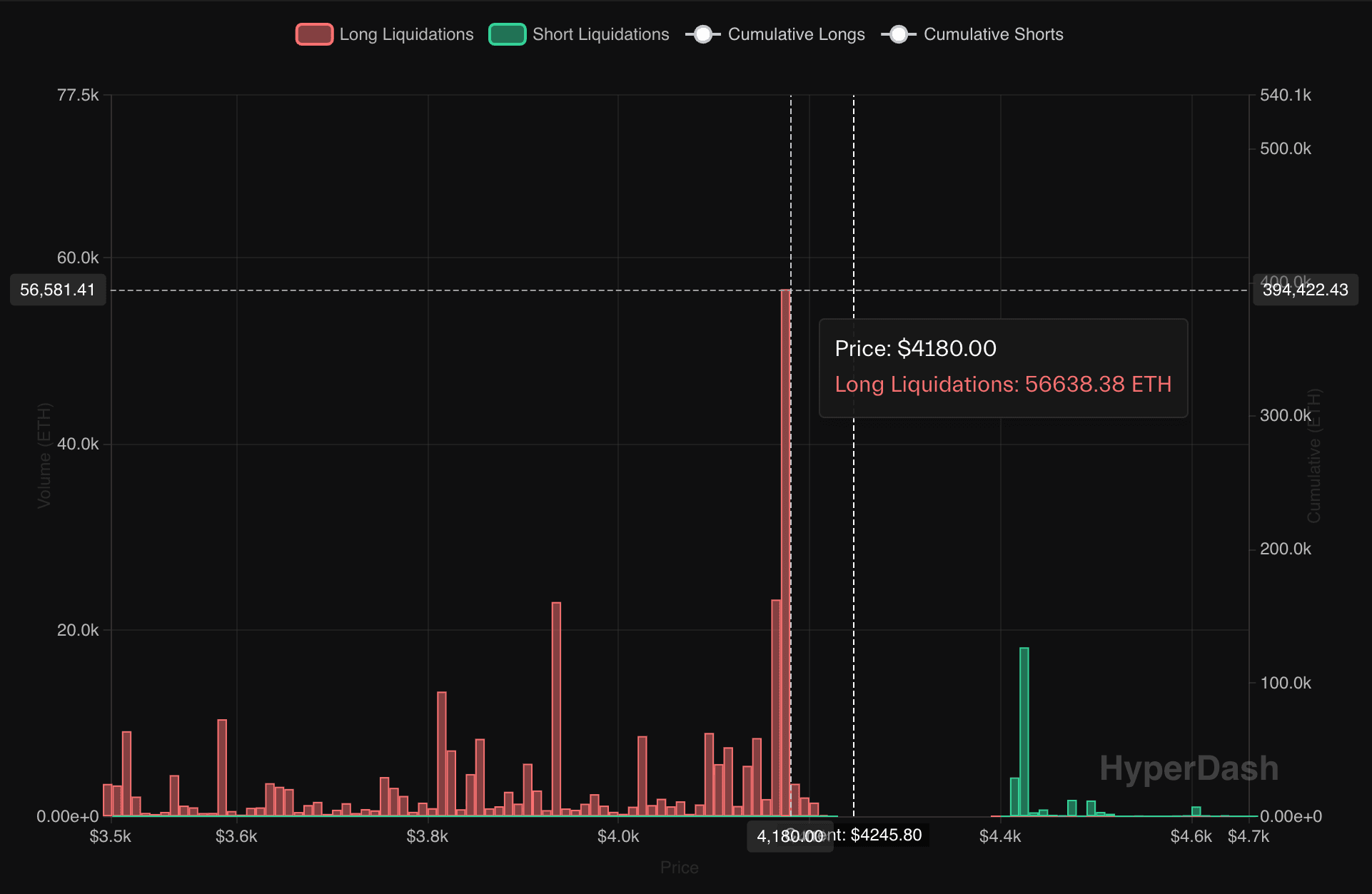

Crypto merchants ought to stay vigilant for an ether (ETH) value drop under $4,200, which may set off tens of millions in lengthy liquidations and improve market volatility.

As of writing, over 56,638 ETH in bullish lengthy positions – valued at $236 million – confronted liquidation danger on the decentralized perpetual change Hyperliquid in case of an ether value drop to $4,170, in line with knowledge from Hyperdash.

The information additionally confirmed a danger of sizable liquidations at $2,150-$2,160 and $3,940. At press time, ether modified arms at $4,260, down almost 5% on the day, in line with CoinDesk knowledge.

Andrew Kang, founding father of the crypto enterprise capital agency Mechanism Capital, acknowledged on X that enormous lengthy liquidations may probably drive ether costs all the way down to $3,600.

“[I] would estimate we’re about to hit $5b in ETH liquidations throughout exchanges, taking us all the way down to $3.2k – $3.6k,” Kang mentioned.

Liquidations, or the pressured closure of leveraged bets, occur when a dealer’s place falls in need of the margin necessities set by the change.

The margin scarcity usually happens when the market strikes in opposition to the dealer’s place, inflicting their account fairness to fall under the minimal upkeep margin. This prompts the change to robotically shut the place to stop additional losses and guarantee borrowed funds are recovered.

Largely lengthy liquidations trigger a sudden surge in promoting stress, which pushes costs even decrease, making a cascading impact that may set off further liquidations. This unfavorable suggestions loop tends to amplify market volatility.

Learn extra: Dogecoin Sellers in Management as Monero Attacker Votes to Goal DOGE; Bitcoin Beneath $116K