Crypto markets traded sideways heading into Monday, with bitcoin

holding close to $115,000 and ether (ETH) above $4,200, as merchants weigh whether or not a possible Fed price lower in September will prolong digital belongings’ risk-on momentum or revive correlations with gold.

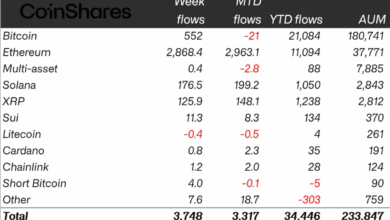

Weekend motion instructed profit-taking throughout the board. Bitcoin ticked decrease by 2.4% in 24 hours, Ether misplaced 4.4% and Solana’s SOL (SOL) and XRP

dropped almost 5% to steer losses amongst majors.

BNB (BNB) hovered round $833 after a modest day by day dip, Dogecoin

eased towards 22 cents and Cardano’s ADA (ADA) held close to 91 cents whilst intraday sellers leaned on liquidity.

The weekend tape mirrored buyers ready for U.S. equities to open, with many anticipating crypto to reflect inventory indices within the absence of latest macro indicators. Nonetheless, the looming September Fed assembly continues to anchor positioning, with price lower expectations now deeply priced into bond and futures markets.

Nick Ruck, director at LVRG Analysis, famous that Bitcoin’s function as “digital gold” may come again into play if financial easing takes maintain.

“The Fed’s potential price cuts in September may reignite Bitcoin’s correlation with gold as a liquidity-driven hedge, however current decoupling reveals gold thriving on central financial institution demand whereas BTC stays tethered to risk-on sentiment,” he stated.

“Traditionally, each belongings converge throughout financial easing, but gold’s file highs amid geopolitical tensions spotlight its enduring safe-haven function, whereas Bitcoin’s narrative hinges on institutional adoption and Fed coverage readability,” Ruck added.

Gold, in the meantime, has surged to all-time highs on file central financial institution shopping for and geopolitical hedging, decoupling from bitcoin’s equity-linked trajectory.

Market contributors say the approaching weeks might present readability. Jeff Mei, COO at BTSE, stated broader equities and retail earnings may function a set off.

“Markets did not see a lot motion over the weekend, so we would count on cryptocurrencies to commerce in step with shares when the US market opens later at this time,” he stated in a Monday observe to CoinDesk.

“Proper now it is troublesome to foretell how merchants will react as soon as the market opens, on condition that there are not any main financial indicators to be introduced this week. There are, nevertheless, a lot of retail corporations set to announce earnings, resembling Wal-Mart, Lowe’s and Goal. Their knowledge and outlook may give a sign as to how tariffs and inflation are affecting the enterprise setting — it would be fascinating to see how markets react,” Mei added.

That leaves crypto tethered to equities within the quick time period, however with September shaping up because the month that would redefine if bitcoin resumes its previous safe-haven commerce alongside bullion or retains driving the liquidity cycle alongside danger belongings.

Learn extra: Dogecoin Sellers in Management as Monero Attacker Votes to Goal DOGE; Bitcoin Beneath $116K