Key takeaways:

-

China’s central financial institution stimulus may redirect liquidity into cryptocurrencies.

-

Rising US Treasury yields recommend decrease danger aversion, supporting potential restoration in altcoin markets.

Central banks stimulate development by decreasing rates of interest or enabling particular financing circumstances, successfully growing the cash provide. This dynamic advantages danger belongings corresponding to shares and cryptocurrencies.

Merchants now query if the Chinese language central financial institution’s subsequent transfer will present the liquidity increase that lastly drives altcoins past their earlier all-time highs.

Financial stimulus is useful for the cryptocurrency market

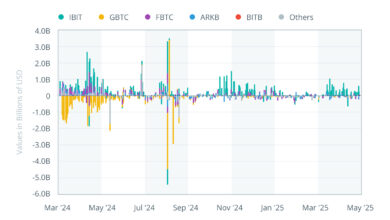

A March 2025 21Shares report highlighted a putting 94% correlation between Bitcoin’s (BTC) value and world liquidity, surpassing each the S&P 500 and gold.

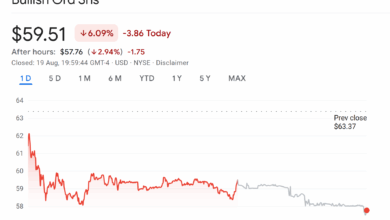

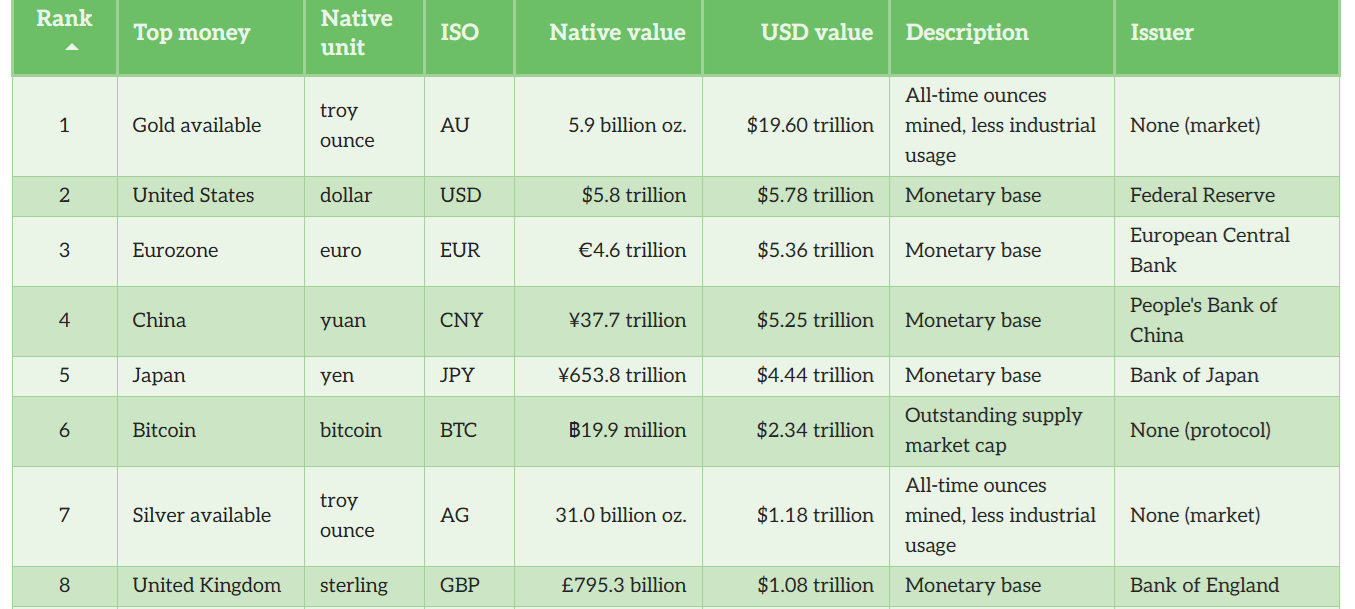

At the moment, the US M0 financial base is $5.8 trillion, adopted by $5.4 trillion within the eurozone, $5.2 trillion in China, and $4.4 trillion in Japan, in line with Porkopolis Economics. With China accounting for 19.5% of worldwide home product, its financial coverage choices stay essential, even when the US Federal Reserve dominates headlines.

On Thursday, China reported a 0.1% decline in July retail gross sales in contrast with the prior month. Goldman Sachs estimates present that in July alone, investments in fastened belongings fell 5.3% year-over-year, the steepest contraction since March 2020. In the meantime, industrial manufacturing rose by simply 0.4% throughout the month. China’s survey-based city unemployment price additionally climbed to five.2% in July, up from 5% in June.

Bloomberg Economics analysts Chang Shu and Eric Zhu famous that the Folks’s Financial institution of China (PBOC) may introduce stimulus measures “as quickly as September.” Equally, economists at Nomura and Commerzbank argued that it’s only a matter of time earlier than stronger assist insurance policies arrive.

Nonetheless, even when the PBOC adopts a extra expansionist stance, cryptocurrency traders could hesitate if world recession fears intensify.

US client sentiment deteriorates, however merchants usually are not fearful

The College of Michigan’s client survey, launched on Friday, confirmed that 60% of People anticipate unemployment to worsen over the subsequent yr, a sentiment final recorded throughout the 2008–09 monetary disaster. But markets have remained resilient. The S&P 500 closed at a brand new all-time excessive, whereas yields on 5-year Treasurys additionally moved larger, suggesting traders nonetheless lean towards optimism.

Associated: Bitcoin’s all-time excessive beneficial properties vanished hours later: Right here’s why

When recession fears rise, demand usually will increase for belongings backed by the US authorities, permitting traders to simply accept decrease yields. After dropping to three.74% on Aug. 4, the bottom degree in additional than three months, 5-year Treasury yields rebounded to three.83% on Friday. The transfer signifies merchants have gotten much less risk-averse, opening house for a rebound in altcoin market capitalization.

If China follows by with stronger stimulus, that added liquidity could possibly be the catalyst for a broad rotation into danger belongings. In such a state of affairs, the push from the PBOC could also be sufficient to propel cryptocurrencies to contemporary all-time highs.

This text is for basic data functions and isn’t supposed to be and shouldn’t be taken as authorized or funding recommendation. The views, ideas, and opinions expressed listed below are the writer’s alone and don’t essentially mirror or characterize the views and opinions of Cointelegraph.