Key takeaways:

-

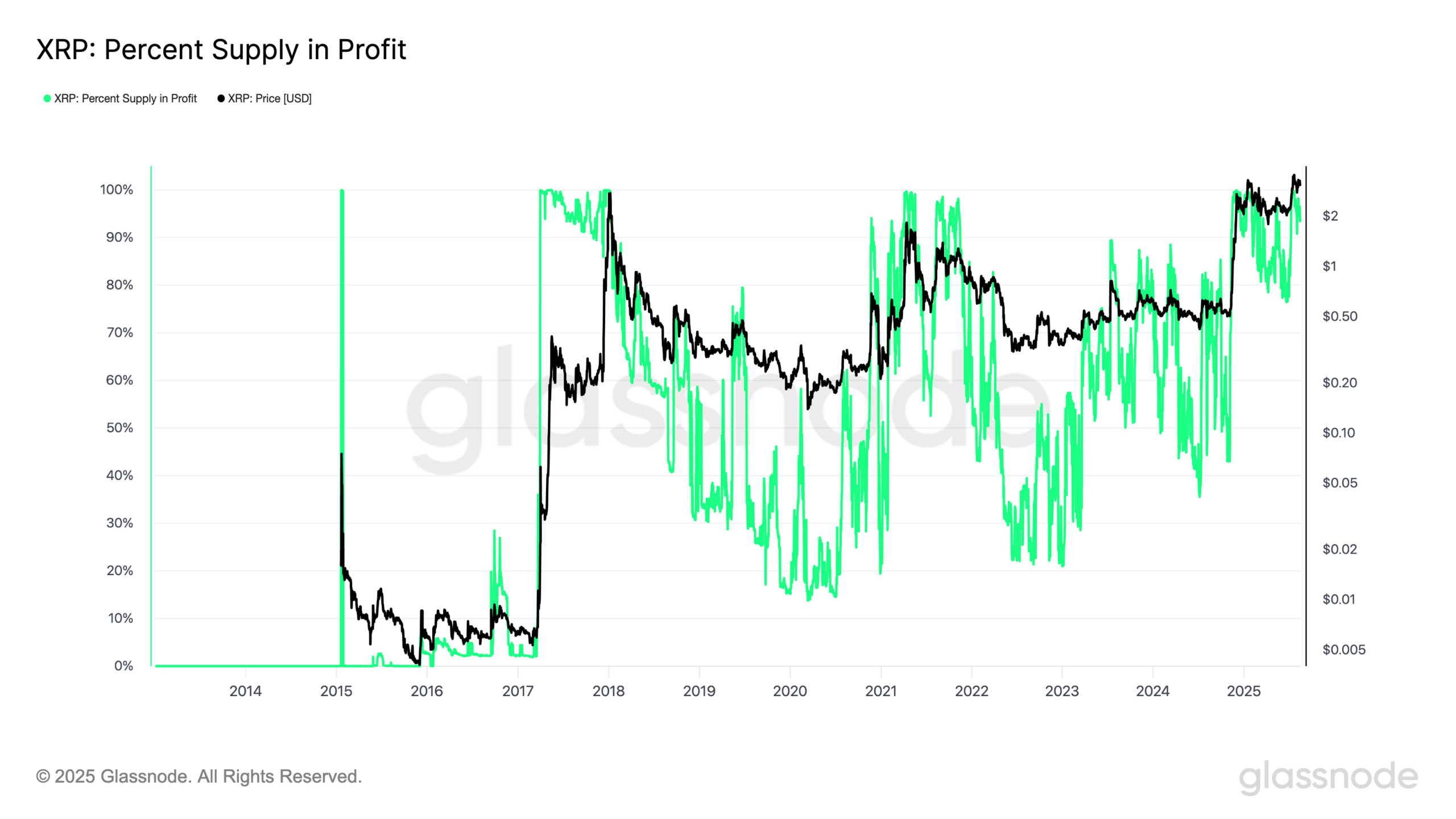

XRP’s rally to $3 has pushed 94% of provide into revenue, a stage that traditionally marked macro tops.

-

XRP is within the “perception–denial” zone, onchain metrics present, echoing peaks in 2017 and 2021.

XRP’s (XRP) rally to over $3 has pushed almost 94% of its circulating provide into revenue, Glassnode information reveals.

As of Sunday, XRP’s % provide in revenue was 93.92%, underscoring robust investor positive aspects because the cryptocurrency rallied by greater than 500% previously 9 months to $3.11 from underneath $0.40.

90%> provide in revenue is normally an XRP macro high

Such excessive profitability has traditionally signaled overheated situations.

In early 2018, over 90% of holders have been in revenue simply as XRP peaked close to $3.30 earlier than a 95% value reversal. The same setup appeared in April 2021, when profitability ranges above 90% preceded an 85% crash from the highest close to $1.95.

The broad profitability underscores robust investor positive aspects, which usually heightens the chance of distribution as merchants could search to appreciate income. The same situation might be unfolding now.

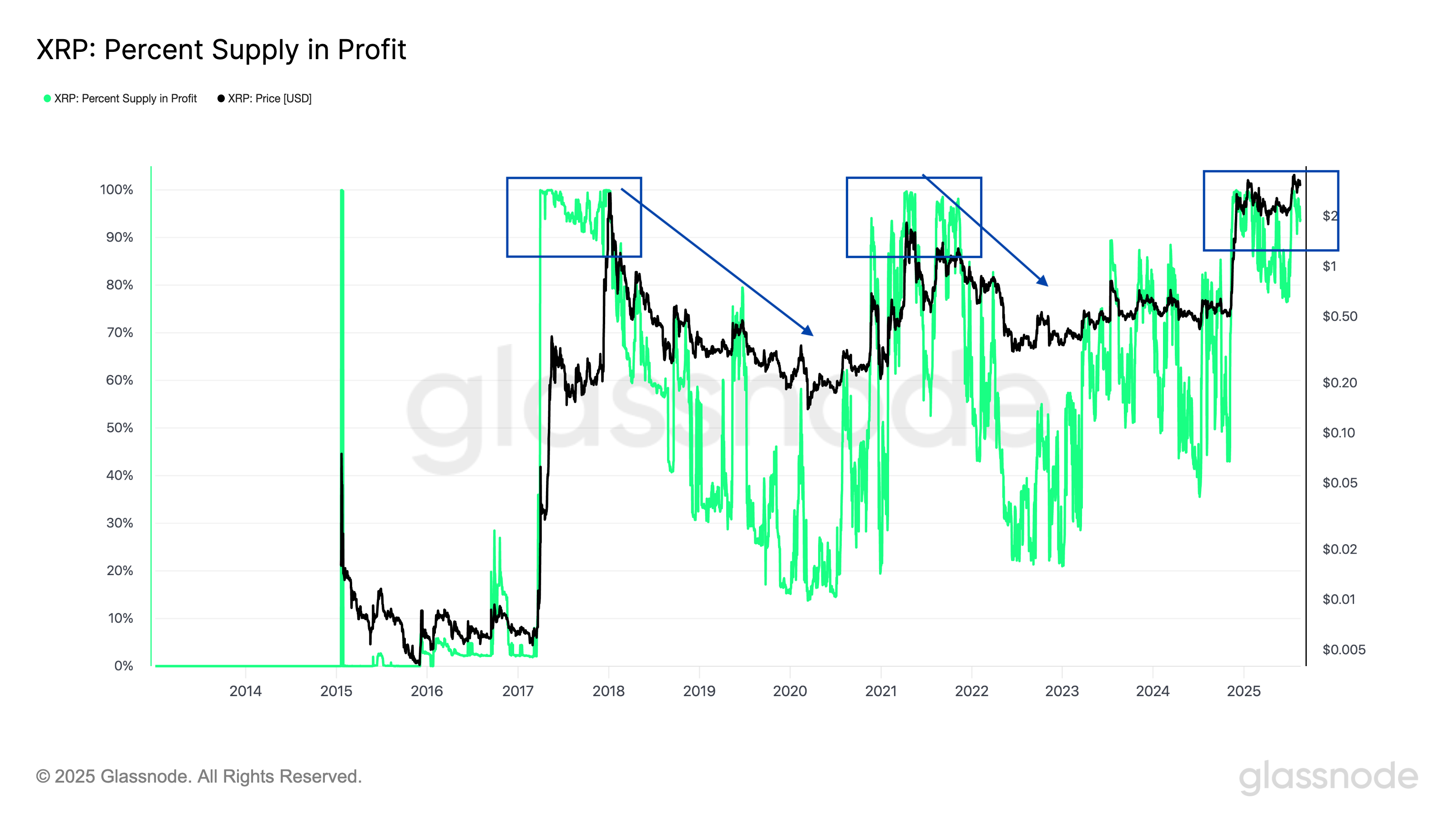

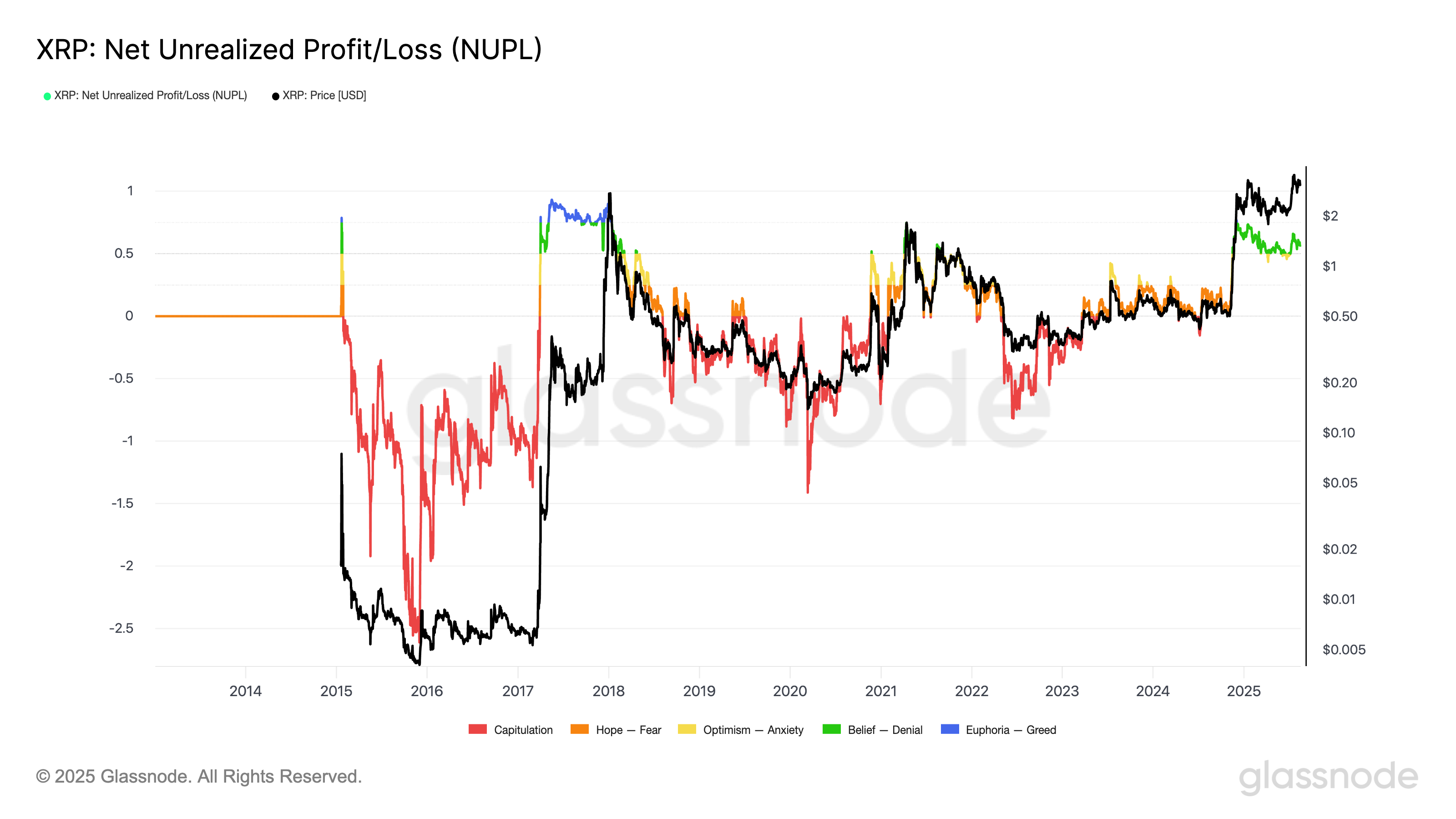

XRP’s NUPL mirros 2017 and 2021 value peaks

XRP’s Web Unrealized Revenue/Loss (NUPL) is additional signaling high dangers.

The indicator, which tracks the distinction between unrealized positive aspects and losses throughout the community, has entered the “perception–denial” zone, a part traditionally noticed earlier than or throughout market tops.

For instance, in late 2017, XRP’s NUPL spiked to related ranges simply as XRP value peaked above $3.30. A comparable sample unfolded in April 2021, when NUPL readings above 0.5 coincided with XRP’s high close to $1.95 earlier than one other sharp downturn.

The present trajectory suggests traders are closely in revenue however not but in full “euphoria.” However the danger of profit-taking and distribution will intensify if NUPL rises towards greed ranges for the primary time since 2018.

XRP may take up potential promoting strain and keep away from a deeper correction under $3 if it will probably appeal to recent inflows, pushed by institutional demand and broader altcoin momentum.

XRP’s traditional bearish setup dangers 20% drop

XRP value is consolidating inside a descending triangle after rising above $3.

The sample, usually bearish, is outlined by decrease highs in opposition to horizontal assist close to $3.05. Earlier this month, XRP briefly broke under the assist in a fakeout, solely to rebound again contained in the construction.

The strain from repeated retests of the decrease trendline raises the chance of a decisive breakdown. A confirmed transfer under $3.05 might set off a sell-off towards $2.39 by September, down about 23.50% from present value ranges.

Associated: Is $30 XRP value an actual chance for this bull cycle?

Alternatively, the bulls should break above the descending resistance line to regain upside momentum and invalidate the bearish setup. Many imagine that the XRP value might rise to $6 on this situation.

This text doesn’t include funding recommendation or suggestions. Each funding and buying and selling transfer entails danger, and readers ought to conduct their very own analysis when making a choice.