The next is a visitor publish and opinion from Armando Aguilar, Head of Capital Formation and Development at TeraHash.

ETFs might dominate the headlines, however the true architects of Bitcoin’s liquidity are the miners quietly constructing stability sheets. Because the April 2024 halving, the position of miners as a complete has shifted from pure producers to systemic stabilizers. Whereas establishments rejoice inflows, miners are doing the onerous work of anchoring Bitcoin-native finance (BTCFi).

On this article, I discover the best way miners are rising as monetary actors, how they’re deploying balance-sheet methods, and what BTCFi infrastructure nonetheless lacks to ensure that this evolution to succeed.

From Hashrate to Stability Sheets: The Put up-Halving Pivot

The 2024 halving slashed block rewards, tightening margins throughout the trade. Because of this, many miners needed to restructure their operations not simply to outlive, however to handle capital with higher precision. Not content material with promoting block rewards at market, miners started behaving extra like company treasuries: timing BTC gross sales, collateralizing reserves, and constructing monetary buffers.

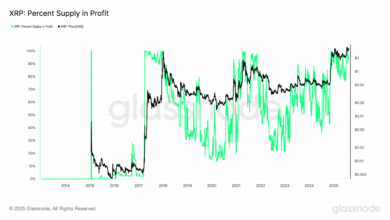

As of mid-2025, statistics present that Bitcoin miners collectively maintain over 104,500 BTC (roughly $12.7 billion), whereas company treasuries added 159,107 BTC in Q2 alone. What seems to be passive “HODLing” is, in actual fact, a deliberate liquidity technique—one which reduces publicity to short-term volatility whereas preserving long-term upside.

This shift coincides with aggressive development in community scale: by mid-2025 Bitcoin’s hashrate surged previous 970 million TH/s, reaching nearly 60 % YoY development. As miners scale up operations, they’re additionally increasing monetary publicity, treating balance-sheet administration as strategically as hashrate optimization.

We’re witnessing a full-cycle pivot. Moderately than merely producing Bitcoin, miners are actively shaping its capital markets.

Treasury-Pushed Mining: Three Pillars of Technique

- Collateralization: Moderately than diluting fairness, miners are borrowing towards BTC holdings to fund operations. This strategy permits for tactical spending with out giving up long-term publicity.

- Timing: Some corporations now deal with BTC gross sales like macro trades, holding by way of downturns or locking in positive aspects throughout rallies. These should not knee-jerk strikes, however correctly thought-out, structured exit methods based mostly on clear objectives and market alerts.

- Liquidity Buffers: Miners are now not working paycheck-to-paycheck. Many are constructing BTC reserves as cushions for market stress, giving them respiration room when community charges or hash competitors spike. Public miners that preserve clear BTC holdings and keep away from pressured gross sales are sometimes considered as extra secure, strategic, and higher aligned with institutional expectations.

Naturally, the 2024 halving didn’t create this mindset, nevertheless it definitely accelerated it. Put up-2024, these monetary methods grew to become mandatory for survival relatively than merely elective.

Signaling Energy: When Miners Transfer Markets

Miners have begun sending deliberate alerts to the broader ecosystem. Holding BTC is about greater than only a perception within the protocol now. It’s a message: “This asset issues, and we’re managing it accordingly.”

When massive public miners delay gross sales, markets take discover. Their actions now affect sentiment and pricing, very similar to central banks adjusting rates of interest. This dynamic was once the area of exchanges—not anymore.

Some nations at the moment are exploring BTC for strategic reserves. Chainalysis even printed a report on the topic earlier this yr, mentioning the U.S., the Czech Republic, Switzerland, and others among the many distinguished supporters of the thought.

In the meantime, main names like Saylor’s MicroStrategy and Marathon Digital are accumulating and disclosing BTC positions with the identical transparency you’d anticipate from institutional asset managers.

Put merely, when miners act like treasuries, mining itself turns into institutional capital administration, setting the tone for Bitcoin’s monetary maturity as a world asset. Whether or not the headlines mirror this or not, that’s precisely what we’re seeing now.

The BTCFi Hole: Infrastructure Nonetheless Enjoying Catch-Up

But, whereas miners mature, BTCFi stays fragile. The infrastructure meant to assist this monetary layer remains to be underdeveloped.

Settlements stay sluggish, with affirmation delays limiting composability. Liquidity is siloed throughout fragmented protocols with minimal coordination. Devices are sometimes trust-based, missing the neutrality BTC-native programs demand.

Initiatives are constantly experimenting—custody-free lending protocols, BTC-backed stablecoins, hash-rate forwards—however most of those instruments are nonetheless within the early levels, removed from broader adoption.

This hole between maturing miner conduct and underdeveloped protocol infrastructure is harmful. Left unresolved, it might flip a stabilizing pressure into a degree of failure. If BTCFi stalls, miners might stand to lose credibility simply as their position turns into important.

That’s why actual infrastructure is important right here:

- Cross-protocol interoperability so miners can allocate capital effectively throughout platforms.

- Sturdy oracles that mirror true market costs and mining inputs with out manipulation threat.

- Incentive fashions that reward transparency and penalize extractive conduct.

With out these, reserves meant to stabilize the system might develop into systemic liabilities…

Conclusion: Acknowledge the Position or Put together to Fail

Miners didn’t ask for this position, however they’ve stepped into it. In a system with out a central financial institution, somebody should set the ground. At the moment, it’s miners who’re holding reserves, managing threat, and performing with systemic foresight.

If BTCFi fails to mature, it received’t be as a result of miners fell brief. Will probably be as a result of the ecosystem refused to acknowledge the monetary infrastructure they had been already constructing and assist the actors holding all of it collectively.

Pull-quote:

“Bitcoin turns institutional when miners act like treasuries. And that’s precisely what’s taking place—whether or not the headlines catch up or not.”