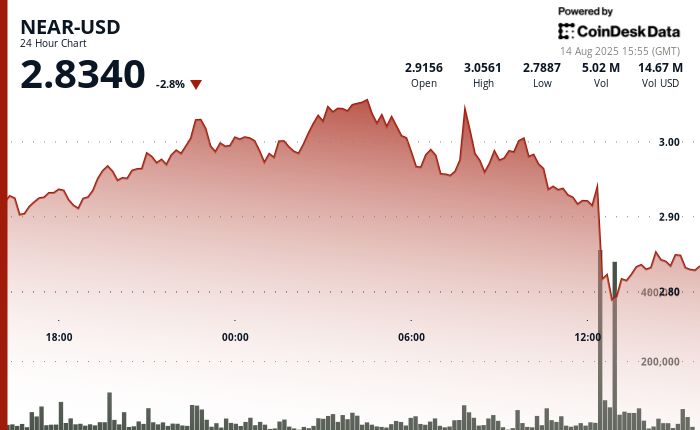

NEAR Protocol noticed heightened volatility within the 24 hours ending August 14 at 14:00 UTC, with costs fluctuating between $2.78 and $3.05 earlier than settling at $2.82.

The decline from the $3.05 resistance to $2.75 help was pushed by heavy institutional promoting, totaling almost 20 million tokens throughout peak strain. Regardless of this, the asset’s fundamentals stay sturdy, supported by a large energetic consumer base of 16 million weekly members.

Within the hour following the selloff, NEAR gained 0.35% to $2.83, buying and selling inside a managed $0.07 vary between $2.81 and $2.85. Key institutional shopping for appeared at a number of intervals, serving to the token breach short-term resistance at $2.83–$2.84 and attain session highs of $2.85.

Buying and selling quantity eased to roughly 100,000 tokens per minute, suggesting accumulation quite than speculative retail exercise, with preliminary help forming close to $2.81–$2.82.

Market Efficiency Indicators Mirror Combined Company Outlook

- NEAR Protocol recorded substantial worth volatility with a $0.26 buying and selling vary representing 8.53% motion between the session excessive of $3.05 and low of $2.78.

- The cryptocurrency initially demonstrated upward momentum from $2.90 to succeed in $3.05 throughout night buying and selling hours, establishing technical resistance on the $3.04-$3.05 stage.

- Important institutional promoting occurred throughout August 14 between 12:00-13:00 UTC with distinctive buying and selling volumes of 19.99 million and 12.22 million tokens respectively.

- Day by day buying and selling exercise considerably exceeded the 24-hour common of 5.47 million tokens, reflecting heightened institutional promoting strain.

- Market worth declined to $2.75 earlier than company shopping for curiosity supported a restoration to $2.82 at session shut.

- Excessive-volume institutional promoting patterns counsel potential continued draw back danger regardless of modest restoration makes an attempt, based on market strategists.

Disclaimer: Components of this text have been generated with the help from AI instruments and reviewed by our editorial workforce to make sure accuracy and adherence to our requirements. For extra data, see CoinDesk’s full AI Coverage.