Bitcoin’s value skilled a pointy pullback on Aug. 14, dropping under $120,000 lower than a day after reaching a brand new all-time excessive above $124,000.

In response to CryptoSlate knowledge, BTC fell to $118,479 at press time, marking a 2.07% decline on the 1-hour candle and 5% from its 24-hour peak.

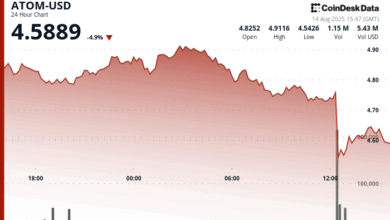

The sudden dip rippled throughout the broader crypto market. Ethereum fell 4% to $4,581, whereas XRP dropped over 3% to $3.11. Different top-ten cash, together with Dogecoin, Solana, and BNB, additionally noticed losses exceeding 3% in the identical timeframe.

This correction follows a interval of sustained bullish momentum that had pushed the broader market to document highs. Whereas the velocity of the decline could have shocked some merchants, market analysts had flagged potential dangers.

On Aug. 13, blockchain analytics agency Glassnode highlighted that open curiosity throughout main altcoins had surged to a document excessive of $47 billion.

In response to the agency, such elevated leverage can enlarge upward rallies and downward corrections, exposing merchants throughout sudden market swings.

Lengthy merchants lose over $500 million in 1 hour

Knowledge from Coinglass reveals that the sharp value actions triggered $577 million in liquidations inside only one hour.

Lengthy merchants, who anticipated costs to climb additional, bore many of the losses, totaling $545 million. Quick positions misplaced $31 million.

Ethereum merchants suffered essentially the most, with liquidations exceeding $177 million. Bitcoin merchants misplaced round $113 million, whereas XRP and Solana positions had been liquidated for $44 million and $39 million, respectively.

When the liquidation window is expanded to the previous 24 hours, complete losses attain $1.05 billion. Lengthy positions account for $778 million of that determine, underlining the heightened dangers in periods of fast value changes.

These figures spotlight the acute volatility inherent in crypto markets. Sudden corrections can erase important unrealized positive factors, particularly when leveraged positions dominate buying and selling exercise.

For merchants, this can be a reminder that robust uptrends are sometimes accompanied by equally sharp pullbacks, emphasizing the significance of threat administration methods in unstable markets.

Bitcoin Market Knowledge

On the time of press 2:54 pm UTC on Aug. 14, 2025, Bitcoin is ranked #1 by market cap and the value is down 2.23% over the previous 24 hours. Bitcoin has a market capitalization of $2.36 trillion with a 24-hour buying and selling quantity of $106.74 billion. Be taught extra about Bitcoin ›

Crypto Market Abstract

On the time of press 2:54 pm UTC on Aug. 14, 2025, the entire crypto market is valued at at $4.03 trillion with a 24-hour quantity of $286.8 billion. Bitcoin dominance is at present at 58.67%. Be taught extra in regards to the crypto market ›