Key factors:

-

Bitcoin finds assist at decrease ranges, however could face sturdy promoting within the $120,000 to $123,218 zone.

-

Internet Ether ETF inflows of greater than $1 billion on Monday recommend strong institutional demand.

Bitcoin’s (BTC) sturdy rejection close to the all-time excessive of $123,218 indicators that bears are unlikely to give up with out a battle. BTC’s failure to hit a brand new all-time excessive resulted in a pullback in a number of altcoins, however a couple of have bounced again sharply.

Choose analysts have turned cautious on BTC following Monday’s rejection. ZAYK Charts mentioned in a submit on X that the Wyckoff methodology means that BTC could have entered a distribution section, and a affirmation of the identical may sink the worth towards $95,000.

Compared, Ether (ETH) has remained sturdy. Based on Farside Traders’ knowledge, Spot ETH exchange-traded funds (ETFs) recorded their highest-ever internet inflows of $1.01 billion on Monday.

May BTC shock to the upside? Will ETH lead the altcoins larger? Let’s analyze the charts of the highest 5 cryptocurrencies that look sturdy on the charts within the close to time period.

Bitcoin worth prediction

Sellers efficiently thwarted patrons’ makes an attempt to thrust BTC to a brand new all-time excessive above $123,218 on Monday.

The flattish 20-day easy transferring common ($116,779) factors to a stability between provide and demand, however the relative power index (RSI) within the constructive territory suggests the momentum favors the bulls. If the worth stays above the 20-day SMA, the bulls will once more try and drive the BTC/USDT pair above $123,218. If they’ll pull it off, the Bitcoin worth may skyrocket towards $135,000.

Conversely, a drop under the 20-day SMA indicators profit-booking by short-term merchants. That would sink the pair to the 50-day SMA ($114,366), indicating a potential vary formation within the close to time period. Sellers must tug the worth under $110,530 to grab management.

The pair has bounced off the 20-SMA on the 4-hour chart. The upsloping transferring averages and the RSI within the constructive territory point out a bonus to patrons. If the $123,218 resistance is taken out, the pair may soar to $127,735 and later to $135,000.

Sellers are more likely to produce other plans. They may attempt to pull the worth again under the downtrend line. In the event that they do this, Bitcoin’s worth may vary between $123,218 and $111,920 for a while.

Ether worth prediction

Ether began the subsequent leg of the uptrend on Tuesday after patrons pushed the worth above $4,366.

The upsloping transferring averages and the RSI within the overbought zone recommend that the trail of least resistance is to the upside. Consumers will attempt to strengthen their place by pushing the ETH/USDT pair towards $4,868.

The $4,094 stage is the essential assist to be careful for on the draw back. A break and shut under $4,094 signifies profit-booking at larger ranges. Ether’s worth may then plunge to the 20-day SMA ($3,833).

The pullback from $4,366 took assist on the 20-SMA on the 4-hour chart, indicating a constructive sentiment. The pair may rally to $4,500 after which to $4,868, the place the bears are anticipated to pose a considerable problem.

A break and shut under the 20-SMA may pull the pair to $4,094. A strong bounce off $4,094 suggests the bulls try to flip the extent into assist. That will increase the probability of the continuation of the uptrend. A deeper pullback may begin if the $4,094 assist cracks.

BNB worth prediction

BNB (BNB) has been buying and selling in a good vary between $792 and $827 for the previous three days, indicating indecision between the bulls and the bears.

If the worth breaks above $827, the BNB/USDT pair may surge to $861. Sellers are anticipated to fiercely defend the $861 stage, but when the patrons bulldoze their approach by, the BNB worth may soar to $900.

The bears must pull the worth under the 20-day SMA ($787) to point the beginning of a deeper correction to $761 and later to the strong assist at $732. Consumers are anticipated to defend the $732 stage with all their may as a result of a break under it might sign a possible development change.

Each transferring averages are sloping up on the 4-hour chart, however the RSI is exhibiting indicators of forming a bearish divergence within the close to time period. Sellers will achieve the higher hand in the event that they sink the BNB worth under the 50-SMA.

Quite the opposite, a break and shut above $827 indicators the resumption of the up transfer. The pair may then climb to the overhead resistance of $861, the place the bears are anticipated to step in.

Associated: Is $30 XRP worth an actual risk for this bull cycle?

Chainlink worth prediction

Chainlink (LINK) picked up momentum after breaking above the $18 overhead resistance on Thursday, indicating aggressive shopping for by the bulls.

The bears tried to stall the up transfer at $22.70, however the bulls surpassed the resistance on Tuesday. The LINK/USDT pair may surge to $27, the place the bears are anticipated to mount a powerful protection. Nevertheless, if patrons overcome the barrier at $27, the rally may lengthen to $30.

This optimistic view might be negated within the close to time period if the worth turns down sharply and tumbles under $20.83. That would sink the Chainlink worth to $20 and under that to the strong assist at $18.

The pullback bounced off the 20-SMA on the 4-hour chart, indicating shopping for on each minor dip. Each transferring averages are sloping up, and the RSI is within the overbought zone, indicating that patrons stay in management.

The primary assist on the draw back is the breakout stage of $22.70, after which $21. A break and shut under $21 means that the bulls are dashing to the exit. The following cease on the draw back is on the 50-SMA.

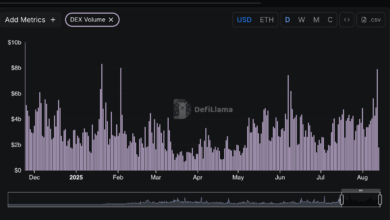

Uniswap worth prediction

Uniswap (UNI) bounced off the 50-day SMA ($9.05) on Aug. 3, indicating strong shopping for at decrease ranges.

The up transfer is dealing with promoting at $12, however a constructive signal is that the bulls haven’t ceded a lot floor to the bears. That implies the bulls anticipate the up transfer to proceed. If patrons drive the worth above $12, the UNI/USDT pair may surge towards $15.

The primary assist on the draw back is on the 20-day SMA ($10.19). If this stage cracks, the Uniswap worth may drop to the 50-day SMA. A brief-term development change might be signaled if the bears tug the pair under the 50-day SMA.

The pair turned down from the $12 overhead resistance, however a constructive signal is that the bulls try to defend the 20-SMA on the 4-hour chart. Consumers will once more attempt to drive the worth above $12. In the event that they succeed, the pair may rally to $14 after which to $15.

Sellers are more likely to produce other plans. They may attempt to pull Uniswap’s worth under the 50-SMA. In the event that they do this, the pair may descend to $10 and later to $9.50. That would sign a spread formation between $8.50 and $12 for a while.

This text doesn’t comprise funding recommendation or suggestions. Each funding and buying and selling transfer includes danger, and readers ought to conduct their very own analysis when making a choice.