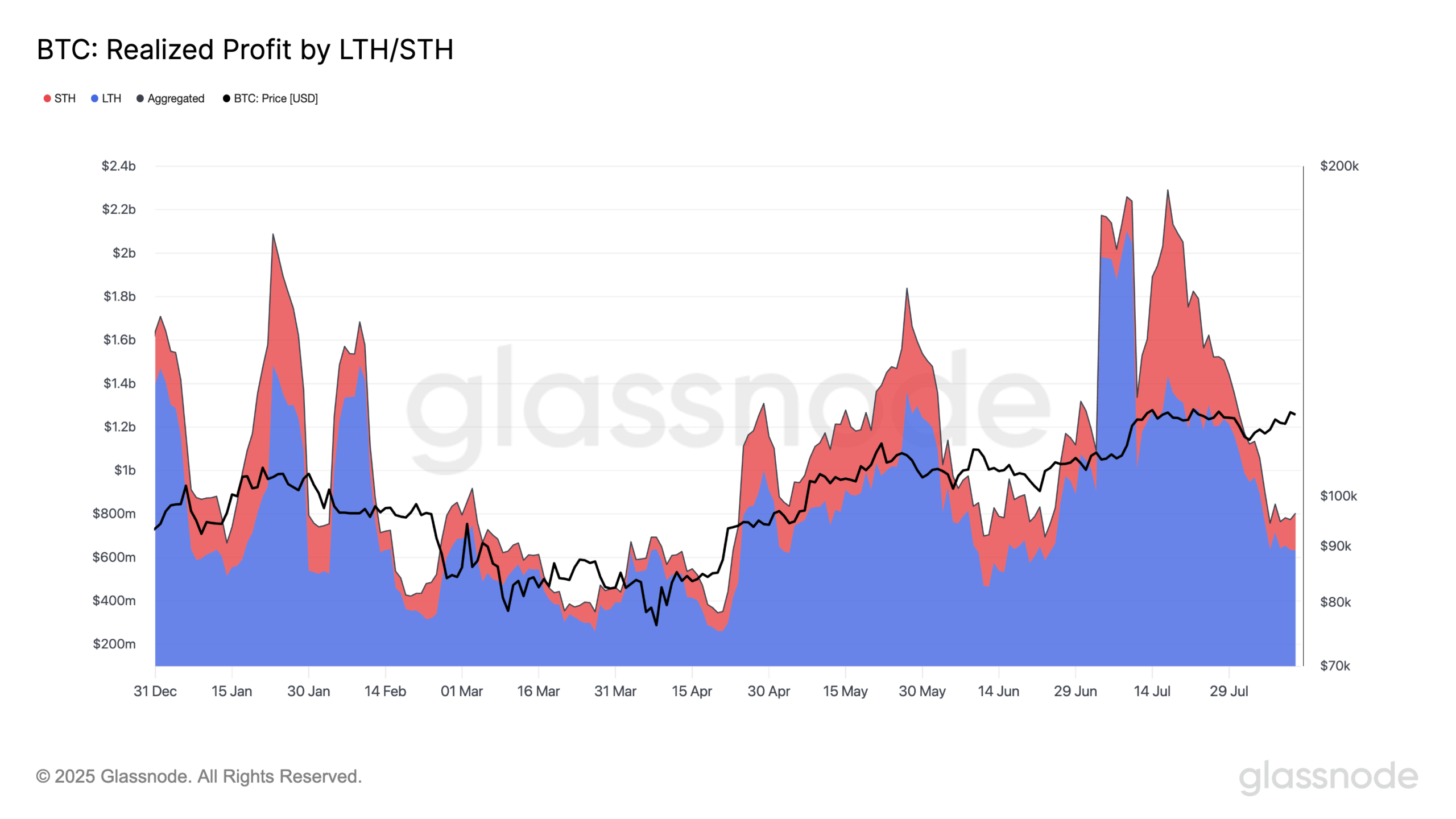

Over the previous 5 days, bitcoin (BTC) has surged from $116,000 to only above $122,000 earlier than retreating to the present $119,000. Regardless of this worth motion, profit-taking has remained muted, averaging underneath $750 million per day on a year-to-date foundation.

For perspective, Glassnode information reveals that in January every day realized income have been round $2 billion, with comparable spikes in July when bitcoin reached its all-time excessive of $123,000.

Glassnode’s Realized Revenue metric measures the entire revenue from all spent cash the place the sale worth exceeded the acquisition worth. When damaged down by Lengthy-Time period Holders (LTH) and Quick-Time period Holders (STH), it presents a extra granular view of market habits. This classification is predicated on the weighted common acquisition date, with LTH provide outlined as holdings aged greater than roughly 155 days.

The info reveals that LTHs have persistently realized way more revenue than STHs. An exception occurred in July, when STH realized income spiked as bitcoin hit its all-time excessive. Many of those short-term features seemingly got here from traders who purchased throughout the March “tariff tantrum” sell-off, when bitcoin fell to $76,000.

The present low degree of realized profit-taking, notably in contrast with prior market peaks, is encouraging for bitcoin’s bullish outlook. It means that holders, each lengthy and brief time period, are largely refraining from locking in features regardless of latest worth will increase. If this pattern persists, it might present the market with the soundness and momentum wanted to push towards new all-time highs.