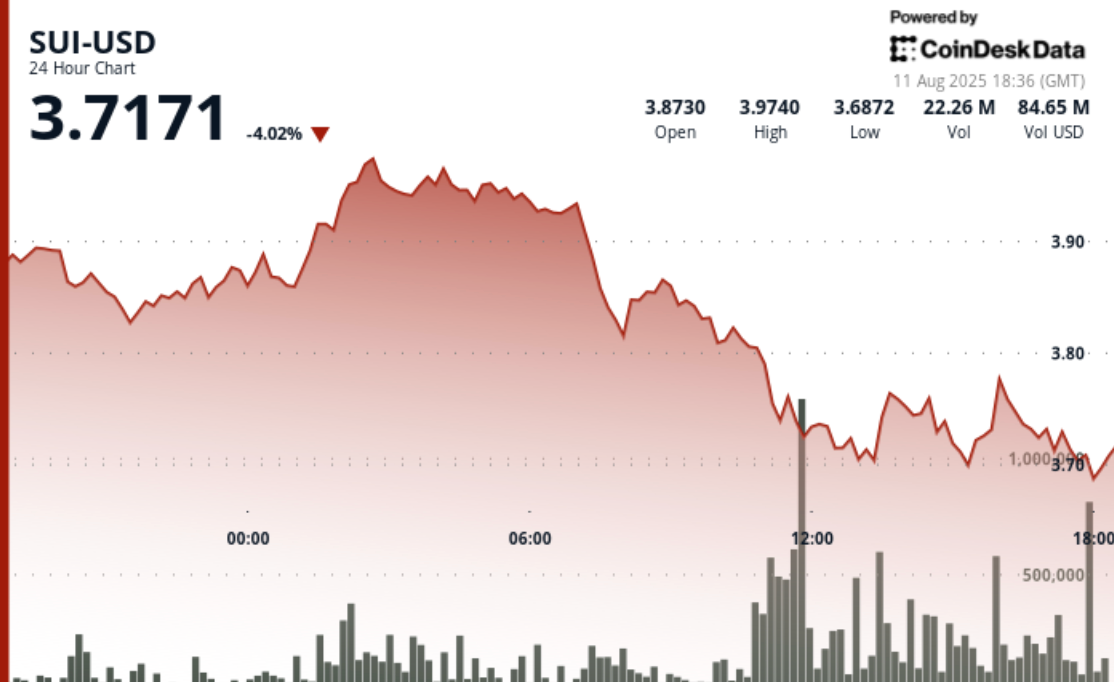

Sui’s (SUI) worth plunged 4% over the previous 24 hours after experiencing substantial market volatility in a single day, CoinDesk Analytics knowledge exhibits.

The token’s worth fluctuated $0.28, or roughly 7%, between session highs of $3.98 and lows of $3.69. The digital asset initially demonstrated energy, advancing from $3.88 to $3.98 with institutional quantity exceeding 18 million items, earlier than encountering important resistance on the $3.97 to $3.98 stage the place company promoting strain intensified.

Buying and selling quantity then noticed a dramatic reversal, characterised by distinctive buying and selling quantity of 35.3 million items, establishing a vital assist threshold close to $3.71 to $3.72 the place institutional patrons tried to defend valuations.

The session concluded at $3.69, representing a 5% decline from opening ranges, suggesting continued bearish sentiment amongst company traders regardless of established assist mechanisms.

SUI’s derivatives market additionally noticed a wave of lengthy positions unwind, with open curiosity falling 15% to $1.79 billion, in accordance with CoinMarketCap. Funding charges — which affect the price of holding leveraged lengthy positions — dropped to 0.0083%, down sharply from their July peak of 0.075%. The decline in charges decreased the inducement for merchants to keep up bullish leveraged bets, signaling a cooling in market sentiment.

SUI is underperforming the broader crypto market as measured by the CoinDesk 20 Index, which is flat over the previous 24 hours.

Regardless of a tough previous 24 hours, the token continues to be up about 5% over the previous seven days and 9% over the previous month as a number of constructive developments caught investor’s eyes final week.

Swiss digital asset financial institution Sygnum expanded its choices to incorporate custody, buying and selling and lending merchandise tied to the blockchain for its institutional purchasers on Friday. Earlier that week, one other Swiss establishment, Amina Financial institution, stated it had began providing each buying and selling and custodial providers for SUI.

SUI’s month-long rally could also be prompting some traders to lock in positive aspects, including to promoting strain out there.

Disclaimer: Components of this text had been generated with the help from AI instruments and reviewed by our editorial staff to make sure accuracy and adherence to our requirements. For extra data, see CoinDesk’s full AI Coverage.