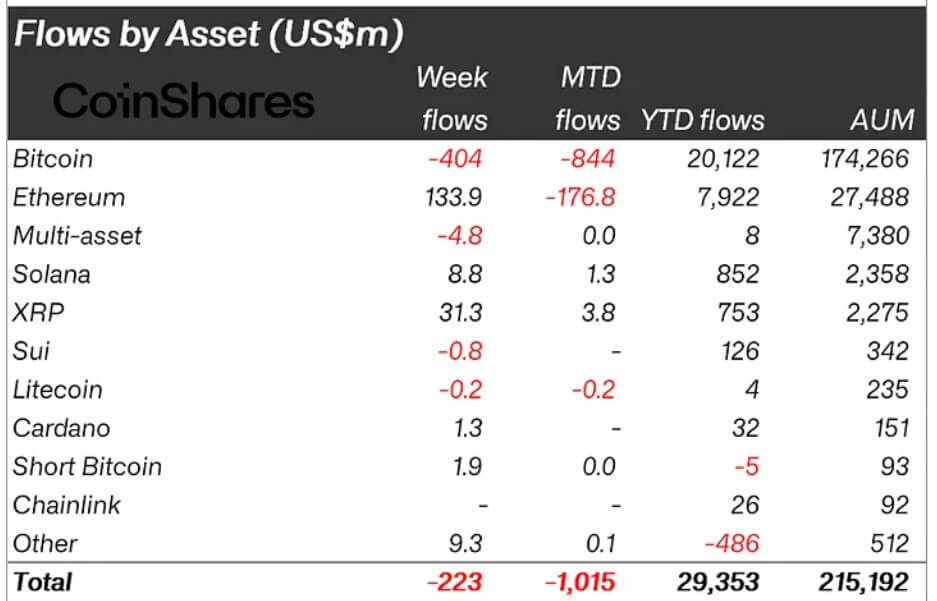

Crypto funding merchandise noticed a $223 million outflow final week, ending a 15-week interval of constant inflows, in accordance with CoinShares’ newest weekly report.

This marked a big shift from the development earlier within the week, which began with $883 million in inflows.

James Butterfill, Head of Analysis at CoinShares, defined that broader macroeconomic situations within the US doubtless triggered the outflow. These embrace hawkish statements from the Federal Open Market Committee (FOMC) and stronger-than-expected financial knowledge, contributing to detrimental market sentiment.

Regardless of weak payroll knowledge later within the week, which hinted at a dovish method by the Fed, general market sentiment remained “risk-off,” resulting in substantial outflows, significantly on Friday, when over $1 billion exited the market.

Butterfill additionally identified that, over the previous 30 days, digital asset investments noticed a web influx of $12.2 billion, which accounts for about 50% of the whole inflows for the 12 months. He famous that the current outflow could possibly be attributed to minor profit-taking.

Ethereum secures one other week of victory over Bitcoin

Bitcoin noticed important outflows, with $404 million leaving the market, ensuing from detrimental sentiment that overshadowed any constructive exercise in different digital property.

Nonetheless, Bitcoin’s year-to-date inflows stay sturdy at round $20 billion. This displays the highest crypto’s continued enchantment regardless of the volatility attributable to shifting financial insurance policies.

In the meantime, Ethereum led the influx chart final week with $133 million, regardless of experiencing notable losses on the finish of the week. This introduced Ethereum’s year-to-date inflows to roughly $8 billion.

ETH’s efficiency illustrates the robust constructive sentiment in the direction of the digital asset, with some Butterfill just lately suggesting the onset of an “altseason.”

That is evident within the efficiency of different altcoins, which additionally recorded important flows in the course of the week.

In line with the CoinShares report, XRP, Solana, and SEI noticed inflows of $31.2 million, $8.8 million, and $5.8 million, respectively. Nonetheless, Litecoin and Sui skilled smaller outflows of $0.2 million and $0.8 million, respectively.

These numbers counsel buyers are shifting capital away from Bitcoin to extra promising property, significantly Ethereum and different altcoins.