Galaxy Digital wallets have routed over 17,000 BTC to main exchanges inside the previous 24 hours, in accordance with information from Arkham Intelligence.

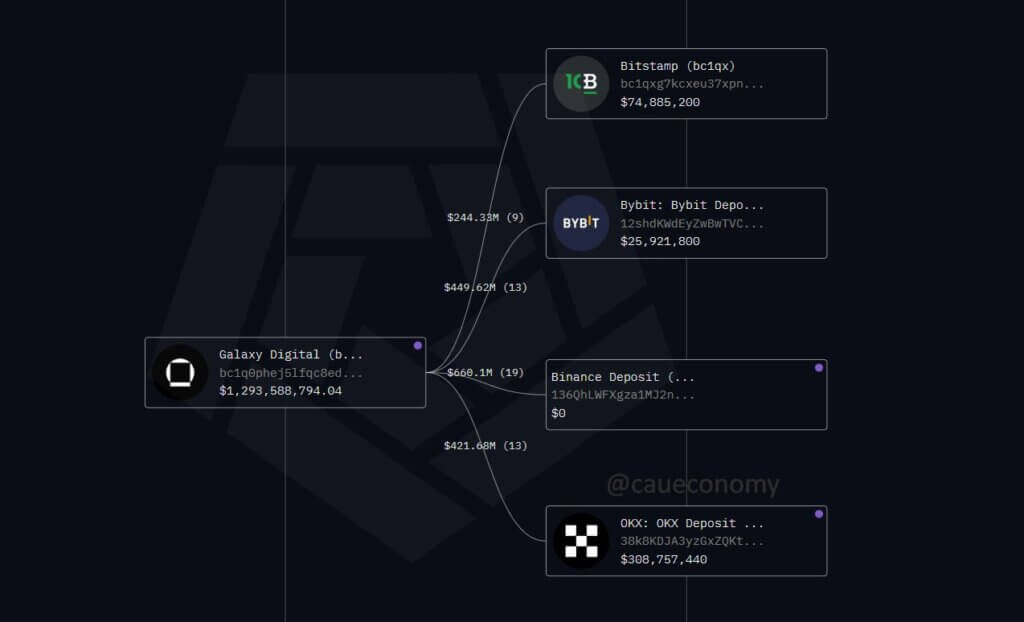

The transactions, totaling greater than $1.7 billion at present costs, concerned deposits to Binance, OKX, Bybit, and Bitstamp, following a wave of inner transfers from the agency’s main custodian deal with.

Between July 15 and 17, Galaxy Digital’s Bitcoin holdings rose from roughly $850 million to over $6 billion. This improve adopted the consolidation of 80,000 BTC from legacy wallets inactive since 2011.

On-chain information signifies the majority of the funds arrived in a handful of high-volume transactions, together with a single 10,000 BTC deposit, which analysts affiliate with a custodial association. Arkham information exhibits that the newly obtained Bitcoin remained static for a number of days earlier than Galaxy started transferring it to change wallets.

Per Cauê Oliveira of BlockTrends, institutional promoting exercise turned detectable as early as Thursday morning. Their evaluation pointed to a internet outflow of 40,000 BTC from massive participant wallets over seven days, accompanied by minimal ebook liquidity. The agency warned of potential downward strain ought to additional distribution happen in skinny order books.

Bitcoin’s value has fallen roughly 2.5% within the final 24 hours, buying and selling round $115,600 at time of writing. CryptoSlate information exhibits each day quantity above $94 billion, suggesting merchants are responding to elevated sell-side strain.

On-chain analysts famous {that a} portion of Galaxy’s outgoing Bitcoin is reaching change scorching wallets in staggered batches, sometimes a sample related to distribution reasonably than custody migration.

The origin wallets, lively previous to 2012 and dormant till this month, started transferring the 80,000 BTC on July 4. The ultimate tranche, over 40,000 BTC, arrived on July 18. Whereas the receiving addresses level to Galaxy, the agency has but to substantiate the beneficiary or the transaction’s objective.

Galaxy Digital often handles property on behalf of institutional shoppers. The character of the latest flows suggests a strategic unwind is underway. Nonetheless holding greater than 60,000 BTC, the agency has the choice to proceed offloading property or return them to chilly storage. Analysts stay targeted on on-chain indicators to find out whether or not the present promoting pattern will persist.