What to know:

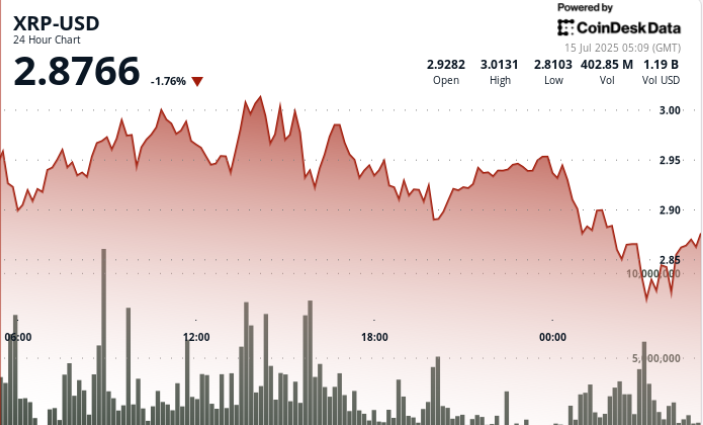

- XRP fell 8% from $3.02 to $2.78 between July 14 06:00 and July 15 05:00, posting a 7% intraday vary between $2.80 and $3.02.

- Morning quantity peaked at 216.12M throughout a coordinated push to $3.02, earlier than systematic profit-taking set in.

- A late-session restoration from $2.82 to $2.87 (+2%) occurred throughout the 04:09–05:08 window, with 112.75M in quantity — indicating company re-entry into assist.

- The drawdown aligns with institutional de-risking forward of the July 18 ProShares XRP Futures ETF launch.

Information Background

The SEC’s still-unresolved digital asset framework continues to dominate institutional danger fashions, forcing treasuries to stability early publicity with compliance optics.

The upcoming ProShares XRP Futures ETF — set for launch on July 18 — has launched a brand new capital allocation vector, significantly for pension and endowment portfolios.

Amid that setup, company flows spiked in each instructions: shopping for early at $2.95–$3.02, and promoting closely in a single day as danger administration protocols kicked in.

Value Motion Abstract

- Vary: $3.02 → $2.80 | Volatility: 7%

- Peak Time: 13:00 — quantity hit 216.12M as XRP touched $3.02

- Breakdown Zone: $2.95–$2.90 failed to carry throughout 00:00–03:00 session

- Last Hour Restoration: XRP rose from $2.82 → $2.87 (+2%) from 04:09–05:08

- Quantity Help: 112.75M confirms company reallocation close to $2.87

Technical Evaluation

- Value failed at $3.02 on heavy quantity; construction turned bearish on decrease highs

- In a single day breakdown noticed algorithmic promoting from $2.95 to $2.80

- Restoration into shut suggests company treasury accumulation at $2.82–$2.87

- $3.00 stays the psychological resistance that bulls should reclaim

- Key ranges: Help = $2.80 / Resistance = $2.95–$3.02

What Merchants Are Watching

- Can XRP maintain above $2.87 forward of the ProShares launch and ETF-related flows?

- Reclaiming $3.00 would validate bullish institutional theses tied to fee utility

- Ongoing regulatory noise might suppress upside till ETF movement readability emerges

- Treasury desks stay cautious however energetic — favoring low-exposure accumulation round volatility bands

Takeaway

XRP’s 8% drop displays greater than volatility — it’s company positioning in real-time.

Whereas whales and treasuries bought into energy above $3.00, the closing bounce and ETF timeline counsel re-entry setups are forming.

If regulatory readability corporations and the ProShares car positive aspects traction, XRP may even see renewed inflows — however till then, anticipate tight risk-managed buying and selling from establishments.

Disclaimer: Elements of this text had been generated with the help from AI instruments and reviewed by our editorial group to make sure accuracy and adherence to our requirements. For extra data, see CoinDesk's full AI Coverage.