Bitcoin value predictions are coming thick and quick after Monday’s all-time excessive, and one analyst is tipping Bitcoin to achieve $135,000 earlier than a big market correction.

Earlier than this breakout, there have been nearly two months of consolidation, which now looks like “historic historical past,” Fairlead Methods founder and managing accomplice Katie Stockton informed CNBC on Monday.

She stated that the agency creates “measured transfer projections” from the breakouts and assuming the earlier uptrend continues forward of any corrective section:

“That places Bitcoin at round $135,000 as an intermediate-term goal.”

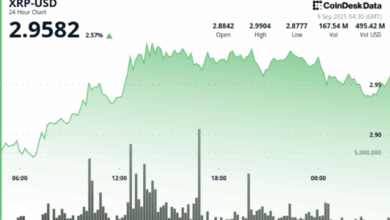

Stockton stated shares that observe Bitcoin (BTC) markets, reminiscent of Coinbase or Technique, are additionally prone to carry out effectively. “There’s constructive motion throughout the universe of cryptocurrencies,” she stated, citing Ether (ETH) and XRP (XRP) actions.

Analysts echo BTC value prediction

Bitcoin broke out from its multi-week sideways channel on Monday to achieve an all-time excessive of $122,871 on Coinbase earlier than retreating again beneath $120,000 throughout early buying and selling on Tuesday morning.

Stockton’s prediction intently mirrors different analysts’ current forecasts.

“Primarily based on the July 10 breakout sign, which has traditionally led to a mean 20% rally over the next two months, we venture Bitcoin may attain $133,000,” 10x Analysis head of analysis Markus Thielen informed Cointelegraph on Tuesday.

“We count on some near-term consolidation, adopted by a push towards $133,000, with our $160,000 year-end goal nonetheless firmly in sight.”

“Traders are nonetheless $150,000 as the subsequent main value stage to achieve throughout this cycle,” LVRG Analysis director Nick Ruck informed Cointelegraph, including:

“We stay optimistic that Bitcoin can proceed, pending no sudden black swan occasions.”

Associated: Bitcoin is rallying on US deficit issues, not hype: Analyst

Cointelegraph technical analysts tagged $132,000 to $138,000 as a “affordable short-term goal” earlier than momentum slows.

Bitcoin’s breakout of what seems to be a “bull flag” sample hints at a $130,000 goal, evaluation recommended.

Retail continues to be absent from crypto

Bitcoin smashed previous the $120,000, breaking above a seven-year trendline that has acted as a powerful resistance stage since 2018.

“That is an extremely bullish sign, particularly given the surroundings that is taking place in,” Nic Puckrin, investor and founding father of The Coin Bureau, stated in a word shared with Cointelegraph.

“However, most significantly, retail patrons are nowhere to be seen but. This rally continues to be pushed by institutional capital, whereas the standard indicators of retail involvement — hovering search visitors and crypto app rankings — are absent,” he added earlier than stating that retail is unlikely to become involved “till we get to round $150,000 and the FOMO kicks in.”

Bitcoin continues to be a tiny asset class

The large transfer elevated Bitcoin’s market capitalization to $2.4 trillion, which enabled BTC to flip Amazon and develop into the world’s fifth-largest international asset.

Nevertheless, when it comes to asset lessons reminiscent of gold, equities, actual property and bonds, it’s nonetheless a minnow, Bitcoin Alternative Fund co-founder James Lavish noticed on Monday.

Journal: Bitcoin vs stablecoins showdown looms as GENIUS Act nears