Sluggish laws, concern of lacking out (FOMO) and rising adoption are powering a crypto crime “supercycle,” based on cybersecurity practitioners.

Crypto crime losses hit a brand new report within the first half of 2025, beating the earlier report set in 2022 and almost equal to the overall losses from all of 2024.

Talking to Cointelegraph, Invoice Callahan, a retired DEA agent and cryptocurrency investigator, stated an absence of regulation mixed with hype and FOMO has been taking part in into criminals’ palms, although he stated he would not essentially name it against the law supercycle.

“The fast proliferation of latest crypto belongings, significantly memecoins, mixed with a surge in retail traders and restricted regulatory oversight, creates alternatives for felony exercise, together with theft, bogus funding schemes, scams and frauds.”

Threat vs reward ratio favors crypto criminals

Callahan stated crypto scams seemingly attraction to dangerous actors given the supply of anonymity and ease of organising scams.

“We should bear in mind, the dangerous guys have time, cash and assets on their aspect to excellent felony exercise, they usually don’t must get it proper on a regular basis to nonetheless make a good-looking revenue.”

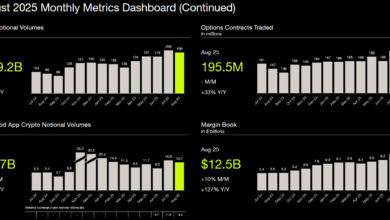

Blockchain safety agency CertiK stated in its H1 Hack3d report launched on July 1 that the common loss per safety incident in 2025 has been $4.3 million, with the median loss being $103,996.

Natalie Newson, a senior blockchain investigator working for CertiK, informed Cointelegraph {that a} “convergence of situations” has emboldened dangerous actors.

“Influencers and key opinion leaders proceed to launch tokens with questionable intent, profiting via techniques like sniping and leaving retail traders uncovered,” Newson stated.

Market surveillance agency Solidus Labs stated in its Could rug pull report that 98.7% of tokens on the token launchpad Pump.enjoyable exhibit traits of pump-and-dump schemes.

On the similar time, Newson stated legislation enforcement businesses around the globe face rising challenges — restricted assets, cross-jurisdictional complexities, and the technical sophistication of cybercriminals.

A July 2024 report from blockchain evaluation agency Chainalysis highlighted cash laundering methods as a specific problem for legislation enforcement businesses and crypto service suppliers.

“The result’s a widening hole between illicit exercise and accountability, creating an more and more hostile atmosphere for reputable customers and builders.”

She speculates that elevated sensible contract safety and consumer schooling might flip the tide, however admitted there isn’t a technique to cease criminals.

Regulators will not be harsh sufficient

In the meantime, Hank Huang, CEO of Kronos Analysis, argued regulators have “swung from overreach to underreaction.”

He stated whereas early enforcement “was typically harsh,” it’s now swinging too far the opposite approach, and we’re “seeing too little accountability.”

“That imbalance creates fertile floor for what looks like a crypto crime supercycle. The repair isn’t extra crackdowns; it’s sensible, focused regulation and discovering stability to proceed driving mass adoption.”

Zero losses is an unimaginable process

On the similar time, legislation enforcement worldwide has been stepping up efforts to drive dangerous actors out of the crypto house, with current enforcement actions focusing on darknet marketplaces worldwide.

Associated: Crypto crime goes industrial as gangs launch cash, launder billions — UN

Nevertheless, Huang stated regardless of the uptick in crackdowns, losses from crypto crime won’t ever hit zero as a result of decentralized markets with nameless contributors will “all the time entice each good and dangerous actors.”

As a substitute of making an attempt to get rid of crypto losses, he stated the main target needs to be on minimizing dangers for customers.

“Different industries are getting hit too, however crypto’s pace and world entry make it particularly susceptible. These assaults are much less about focusing on crypto and extra about testing the bounds of rising techniques,” Huang stated.

Journal: Coinbase hack reveals the legislation in all probability received’t defend you: Right here’s why