Retail traders shopping for long-term drove Bitcoin (BTC) out of its four-month channel between $100,000 and $110,000 to a brand new all-time excessive of $123,120, a 65% rebound from April’s tariff-panic low.

In line with the most recent Bitfinex Alpha report, the transfer to heavy bidding from wallets holding fewer than 100 BTC, whereas long-term holder promoting slowed.

Grassroots demand eclipses issuance

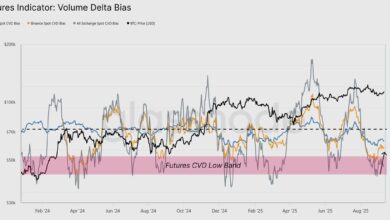

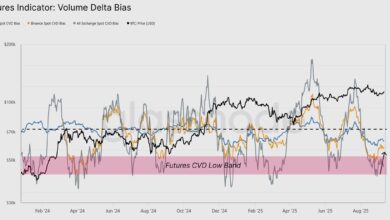

Shrimp, Crab, and Fish wallets, entities with as much as 100 BTC, added about 19,300 BTC monthly by means of early July. New issuance after the April halving runs at roughly 13,400 BTC a month, so the retail cohort alone now absorbs each coin miners create, with room to spare.

The report referred to the imbalance as “crucial structural assist” as a result of it reduces tradable float and tightens the market even earlier than institutional cash arrives.

Alternate-traded fund (ETF) allocations amplified the squeeze. Spot merchandise logged back-to-back day by day creations above $1 billion for the primary time on July 10 and 11. On July 10, issuers minted about 10,000 BTC whereas miners produced 450 BTC.

Cumulative inflows since July 8 reached $2.72 billion, pushing belongings beneath administration throughout the 11 US funds previous $140 billion.

Retail units the stage, establishments drive the spike

Pockets-level information revealed that short-term holders, a lot of whom are new market entrants, triggered the breakout. Nevertheless, retail accumulation laid the groundwork by draining alternate balances for months.

As soon as value cleared $110,000, ETFs and macro-hedge desks accelerated shopping for, locking in two file influx periods whereas Bitcoin’s float sat close to cycle lows. The report famous that BlackRock’s IBIT reached $80 billion in belongings sooner than any ETF in historical past, but grassroots demand “continues to outpace issuance by a large margin.”

The report framed Bitcoin as a “high-beta secure haven.” The token led risk-off recoveries after the April tariff shock, beating gold, equities, and main altcoins within the course of.

With a market capitalization of $2.43 trillion, it now ranks fifth amongst international belongings, forward of silver and Amazon.

Moreover, the report argued that the convergence of bottom-up shopping for and top-down ETF allocations has altered the function of Bitcoin in portfolios.

Retail absorption limits draw back by eradicating stock, whereas regulated funds inject mechanical demand when allocations rebalance.

Collectively, they create what the report known as a “structural bid” that underpins the brand new value vary and will persist so long as issuance stays beneath grassroots consumption.

Bitcoin’s most up-to-date rally rested on on a regular basis holders who gathered sooner than miners may mine new cash, priming the marketplace for file ETF inflows and a recent all-time excessive.

Bitcoin Market Knowledge

On the time of press 11:43 pm UTC on Jul. 14, 2025, Bitcoin is ranked #1 by market cap and the worth is up 1.21% over the previous 24 hours. Bitcoin has a market capitalization of $2.39 trillion with a 24-hour buying and selling quantity of $181.43 billion. Be taught extra about Bitcoin ›

Crypto Market Abstract

On the time of press 11:43 pm UTC on Jul. 14, 2025, the entire crypto market is valued at at $3.75 trillion with a 24-hour quantity of $296.98 billion. Bitcoin dominance is at present at 63.71%. Be taught extra in regards to the crypto market ›