Key takeaways:

-

Institutional investor inflows are altering Bitcoin’s character, lowering its volatility and growing accessibility for on a regular basis buyers.

-

Spot Bitcoin ETFs now maintain over $138 billion in property, with RIAs, hedge funds, and pensions driving a rising share.

-

Decrease volatility improves Bitcoin’s possibilities of functioning as a medium of alternate, not simply digital gold.

Bitcoin (BTC) has come a great distance from a grassroots financial experiment to a maturing monetary asset. It took time for Wall Road to open the door to an unbiased disruptor, however now that Bitcoin has confirmed its endurance, establishments aren’t trying away. The approval of US spot Bitcoin ETFs in January 2024 marked a transparent tipping level. Not confined to crypto-native platforms, Bitcoin can now be held by way of brokerages, pension funds, and even insurance coverage merchandise.

This rising wave of institutional adoption is doing greater than boosting Bitcoin worth—it anchors it in our economies. Decrease volatility, stronger infrastructure, and simpler entry are permitting Bitcoin to evolve from an underground financial savings device right into a useful retailer of worth, and ultimately, a usable medium of alternate.

Huge cash brings stability

Institutional capital behaves in another way from retail. Whereas particular person buyers usually react emotionally—promoting into dips or piling in throughout rallies—massive establishments are likely to act with longer time horizons. This conduct has begun to stabilize Bitcoin’s market cycles.

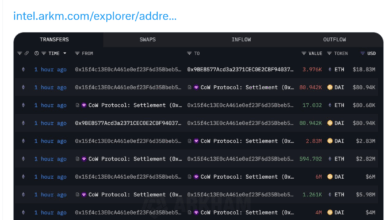

Spot ETF flows reveal the shift. Since their launch in early 2024, US Bitcoin ETFs have often registered internet inflows throughout worth corrections, with funds like BlackRock’s IBIT absorbing capital whereas retail sentiment turned cautious. That mentioned, February–March 2025 was an exception: political uncertainty and tariff fears drove widespread outflows throughout asset courses, Bitcoin included. However general, establishments usually tend to common into dips than panic-sell.

Volatility knowledge confirms the pattern: Bitcoin’s 30-day rolling volatility has dropped markedly over the 2023–2026 cycle, seemingly aided by the stabilizing impact of spot BTC ETFs. Whereas the 2019–2022 cycle noticed repeated spikes above 100%, peaking as excessive as 158%, the present cycle has been markedly calmer. Since early 2024, volatility has hovered round 50% and lately dropped to simply 35%, a degree similar to the S&P 500 (22%) and gold (16%).

Decrease volatility doesn’t simply soothe investor nerves—it improves Bitcoin’s viability as a medium of alternate. Retailers, fee processors, and customers all profit from predictable pricing. Whereas onchain knowledge nonetheless exhibits that almost all Bitcoin exercise is pushed by storage and hypothesis, a extra secure worth might encourage broader transactional use.

Will large cash speed up Bitcoin adoption?

Institutionalization can be accelerating adoption by making Bitcoin extra accessible to the general public. Retail and company buyers who can’t or received’t self-custody BTC can now acquire publicity by acquainted TradFi funding merchandise.

In 18 months, US spot Bitcoin ETFs have amassed over $143 billion in property underneath administration (AUM). Whereas a lot of this AUM is held by retail buyers, institutional participation is rising quick by funding advisers, hedge funds, pensions, and different skilled asset managers. As these entities start providing Bitcoin publicity to their purchasers and shareholders, adoption spreads.

Ric Edelman, co-founder of Edelman Monetary Engines—a $293 billion RIA (registered funding adviser) ranked No. 1 within the US by Barron’s—lately made waves together with his up to date crypto allocation steerage. In what Bloomberg’s Eric Balchunas known as “crucial full-throated endorsement of crypto from the TradFi world since Larry Fink,” Edelman suggested conservative buyers to carry a minimum of 10% in crypto, reasonable 25%, and aggressive buyers as much as 40%. His reasoning was easy:

“Proudly owning crypto is not a speculative place; failing to take action is.”

With funding advisers at the moment managing over $146 trillion in AUM, in accordance with the SEC, the potential for Bitcoin demand is big. Even a ten% “reasonable” allocation would symbolize $14.6 trillion in potential inflows—a 330% improve over Bitcoin’s present market cap of $3.4 trillion. A much more conservative 1% shift would nonetheless inject over $1.4 trillion—sufficient to structurally reprice the market.

Associated: SEC acknowledges Trump’s Reality Social Bitcoin and Ethereum ETF

Pension funds, which collectively handle $34 trillion, are additionally slowly shifting in. Pension funds within the US states of Wisconsin and Indiana have already disclosed direct investments in spot ETFs. These strikes are important: as soon as Bitcoin turns into a checkbox in a retirement portfolio, the psychological and procedural obstacles to entry collapse.

Bitcoin’s institutionalization isn’t only a story of Wall Road buy-in. It’s a shift in Bitcoin’s position—from speculative insurgent to another monetary system.

In fact, this evolution comes with trade-offs. Focus, custodial danger, and creeping regulatory affect might compromise the very independence that gave Bitcoin its worth within the first place. The identical forces fueling adoption might ultimately take a look at the boundaries of Bitcoin’s decentralization.

This text doesn’t comprise funding recommendation or suggestions. Each funding and buying and selling transfer entails danger, and readers ought to conduct their very own analysis when making a call.