Tether is discontinuing redemptions for USDt (USDT) on 5 legacy blockchains beginning Sept. 1, the corporate introduced on Friday. The transfer impacts customers of Omni Layer, Bitcoin Money SLP, Kusama, EOS (now Vaulta), and Algorand.

“Sunsetting assist for these legacy chains permits us to give attention to platforms that supply higher scalability, developer exercise, and group engagement,” Paolo Ardoino, CEO of Tether, mentioned in a press release.

Tether’s sunsetting of assist for these explicit blockchains has been within the works for a while. In August 2023, the corporate introduced it could now not be issuing USDt on the Omni Layer, Kusama, and Bitcoin Money SLP. In June 2024, Tether halted minting on EOS and Algorand.

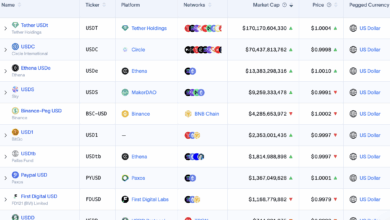

USDt is the biggest stablecoin in circulation with a market capitalization of $139.4 billion based on Cointelegraph indexes. A evaluation of USDt balances throughout the affected blockchains reveals that Omni Layer holds a internet circulation of $82.9 million USDt, whereas different networks have a smaller participation: Bitcoin Money SLP with $986,500, Kusama with $240,000, EOS with $4.2 million, and Algorand with$841,600.

Associated: Many see stablecoins hovering to $2T in ‘handful’ of years: Ripple CEO

Customers on Algorand ‘ought to expertise no disruption’

In keeping with DefiLlama, USDt is the third-most-popular stablecoin on the Algorand blockchain. USD Coin (USDC), issued by Tether’s predominant competitor Circle, is the preferred stablecoin, accounting for almost $73 million extra in market cap on the Algorand community.

“Our customers ought to expertise no disruption, given Tether made the choice to cease providing Tether on Algorand final yr,” a consultant for the Algorand Basis advised Cointelegraph. “On the time, they gave clients one yr to finish redemptions. On this identical yr, we’ve solely seen our stablecoin volumes develop.”

In keeping with knowledge from the Token Terminal, Algorand’s income amounted to $42,300 over the previous 30 days. Blockchain corporations usually generate income via transaction charges.

Tether mentioned that the discontinuance, for at the least the Omni Layer, was as a result of lack of USDt utilization on the community.

Journal: Authorized Panel: Crypto needed to overthrow banks, now it’s changing into them in stablecoin combat