ETH Buying and selling Above $3K as World’s third Largest Asset Supervisor Calls It a ‘Retailer of Worth’

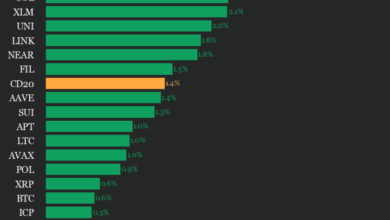

On the time of writing, Ether (ETH) was buying and selling at $3,012, up 8.22% prior to now 24-hour interval, in response to CoinDesk Analysis’s technical evaluation mannequin. The broader crypto market, as gauged by the CoinDesk 20 Index , was up 6.39% throughout the identical interval.

In a recently-released analysis paper titled “Blockchains as Rising Economies”, the world’s third largest asset supervisor defined how “ether can function a medium of change and retailer of worth.”

Additionally, in a weblog put up revealed Thursday, the Etheruem Basis introduced plans to combine zero-knowledge (ZK) proofs all through the Ethereum stack, beginning with a Layer 1 zkEVM. Initially, validators will have the ability to select purchasers that confirm a number of offchain execution proofs from completely different zkVMs, quite than re-executing blocks. This setup leverages Ethereum’s present consumer variety mannequin for added safety, with minimal protocol adjustments wanted to assist pipelined execution within the upcoming Glamsterdam improve.

Though adoption of ZK purchasers will begin small, it’s anticipated to develop as belief builds. When a majority of validators are assured in ZK proofs, Ethereum can improve the gasoline restrict and shift to proof verification because the default.

To allow this shift, the Basis is defining “realtime proving” requirements for zkVM builders. These embody 10-second latency for 99% of blocks, open-source code, minimal 128-bit safety, sub-300KiB proofs with out trusted setups, and {hardware} limits of $100K in value and 10kW in energy use — making dwelling proving possible.

Whereas proving within the cloud is already inexpensive, the emphasis is on optimizing for decentralized, at-home setups. The Basis expects ongoing innovation towards these targets forward of Devconnect Argentina, with zkVMs poised to turn out to be essential infrastructure for Ethereum’s future.

Lastly, yesterday, lockchain analytics platform Glassnode famous a uncommon prevalence within the derivatives market: ether’s 24-hour futures buying and selling quantity briefly surpassed that of Bitcoin. In line with the agency, ETH futures notched $62.1 billion in day by day quantity, edging out Bitcoin’s $61.7 billion.

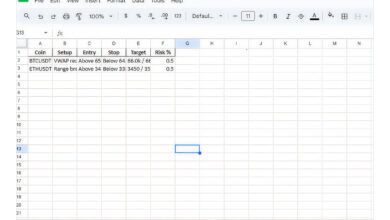

Technical Evaluation Highlights

- ETH exhibited extraordinary bullish momentum through the previous 24 hours from 10 July 09:00 to 11 July 08:00, rocketing from $2,788.96 to $2,976.10, delivering a 7.10% acquire with an total vary of $266.73.

- Essentially the most explosive worth motion materialized at 21:00 on 10 July, the place ETH launched from $2,819.79 to $2,972.56 on distinctive quantity of 1,202,822 items — almost 4 instances the 24-hour common of 308,041 items.

- Essential resistance surfaced at $3,027.83 through the 05:00 hour with heightened quantity of 529,411 items, whereas the asset sustained consolidation above $2,950.00 all through the second half of the interval.

- Sturdy high-volume assist shaped round $2,818.00 indicating continued institutional accumulation and potential for added upside momentum.

Disclaimer: Elements of this text had been generated with the help from AI instruments and reviewed by our editorial group to make sure accuracy and adherence to our requirements. For extra info, see CoinDesk’s full AI Coverage.