- The Unemployment Fee in Canada drops to six.9% in June.

- USD/CAD recedes to the 1.3650 area following the info launch.

Statistics Canada mentioned on Friday that the Unemployment Fee in Canada ticked decrease to six.9% in June, beneath market consensus.

The Web Change in Employment went manner above estimates to 83.1K throughout this era, a considerable improve after the 8.8K acquire in Could. The info additionally mentioned that the Participation Fee rose from 65.3% to 65.4% and that Common Hourly Wages eased to three.2% from a yr earlier, vs. the three.5% enlargement registered within the earlier month.

Market response

The Canadian Greenback (CAD) now trims a part of its earlier losses on Friday, prompting USD/CAD to recede to the mid-1.3600s within the wake of the Canadian labour market report.

Canadian Greenback PRICE Right this moment

The desk beneath reveals the proportion change of Canadian Greenback (CAD) towards listed main currencies at present. Canadian Greenback was the strongest towards the British Pound.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.04% | 0.53% | 0.41% | 0.02% | -0.04% | 0.25% | -0.09% | |

| EUR | -0.04% | 0.48% | 0.38% | -0.04% | -0.01% | 0.20% | -0.13% | |

| GBP | -0.53% | -0.48% | -0.10% | -0.52% | -0.47% | -0.23% | -0.64% | |

| JPY | -0.41% | -0.38% | 0.10% | -0.40% | -0.46% | -0.19% | -0.53% | |

| CAD | -0.02% | 0.04% | 0.52% | 0.40% | -0.01% | 0.22% | -0.13% | |

| AUD | 0.04% | 0.00% | 0.47% | 0.46% | 0.00% | 0.35% | -0.12% | |

| NZD | -0.25% | -0.20% | 0.23% | 0.19% | -0.22% | -0.35% | -0.38% | |

| CHF | 0.09% | 0.13% | 0.64% | 0.53% | 0.13% | 0.12% | 0.38% |

The warmth map reveals proportion adjustments of main currencies towards one another. The bottom forex is picked from the left column, whereas the quote forex is picked from the highest row. For instance, if you happen to choose the Canadian Greenback from the left column and transfer alongside the horizontal line to the US Greenback, the proportion change displayed within the field will characterize CAD (base)/USD (quote).

This part beneath was revealed as a preview of the Canadian labour market report at 05:00 GMT.

- The Unemployment Fee in Canada is anticipated to rise additional in June.

- Additional cooling within the labour market might favour further price cuts.

- The Canadian Greenback stays sidelined round 1.3600 towards the US Greenback.

On Friday, Statistics Canada will launch the outcomes of the Canadian Labour Power Survey. Market buyers predict that the report will are available on the gentle facet, which could encourage the Financial institution of Canada (BoC) to renew its easing cycle.

The BoC saved its coverage price at 2.75% at its June assembly, following the identical transfer in April and the 25-basis-point lower in March. Again to the earlier assembly, the central financial institution justified its resolution to carry charges regular because of the elevated uncertainty surrounding the White Home’s erratic commerce coverage.

The central financial institution additionally prompt that one other price lower might be mandatory in July if tariffs trigger the financial system to weaken. Governor Tiff Macklem reiterated that ongoing uncertainty in regards to the results of tariffs, the outcomes of commerce negotiations, and any new commerce measures would constrain the financial institution’s capability to look far forward.

He noticed that, though first-quarter development had exceeded expectations, enterprise funding and home spending remained largely subdued, and he warned that second-quarter development could be considerably weaker, a view shared by economists who predicted that this subdued development was more likely to persist.

In accordance with Statistics Canada, the Employment Change elevated by 8.8K jobs in Could, constructing on April’s 7.4K acquire, whereas the Unemployment Fee rose for the third consecutive month to 7.0%.

At its most up-to-date assembly, the central financial institution famous that the labour market had weakened, with job losses concentrated in trade-intensive sectors. The BoC added that employment had to this point held up in sectors much less uncovered to commerce however warned that companies had been typically indicating plans to reduce hiring.

What can we anticipate from the subsequent Canadian Unemployment Fee print?

Consensus amongst market members tasks a slight rise in Canada’s Unemployment Fee to 7.1% in June, up from 7.0% in Could. Moreover, buyers forecast the financial system will add no jobs in the identical month, reversing Could’s 8.8K improve. It’s value recalling that Common Hourly Wages, a proxy for wage inflation, held regular at 3.5% YoY for the third time in a row in Could.

In accordance with analysts at TD Securities: “Canadian labour markets will stay below stress in June, with whole employment forecast to carry unchanged because the UE price rises 0.1 pp to 7.1%. Financial uncertainty continues to weigh on hiring sentiment, with PMIs pointing to extra layoffs within the items sector, and our forecast would see the 6m development slip to only 10k/month. Wage development is projected to carry regular at 3.5% y/y.”

When is the Canada Unemployment Fee launched, and the way might it have an effect on USD/CAD?

The Canadian Unemployment Fee for June, accompanied by the Labour Power Survey, can be launched on Friday at 12:30 GMT.

The BoC might doubtlessly decrease its rate of interest at its subsequent assembly because of the additional cooling of the labour market, which might additionally result in some promoting stress on the Canadian Greenback (CAD). This could help the continued rebound in USD/CAD that was sparked final week.

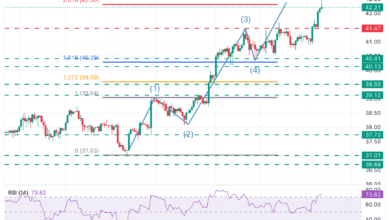

Senior Analyst Pablo Piovano from FXStreet notes that the Canadian Greenback had given up a few of its latest good points, inflicting USD/CAD to rise from ranges final noticed in early October 2024 within the 1.3550-1.3540 band to the neighborhood of 1.3700 the determine initially of the week.

Piovano signifies that the resurgence of the bearish tone might inspire USD/CAD to revisit its 2025 backside at 1.3538, which was marked on June 16. As soon as this degree is cleared, it might be adopted by the September 2024 trough of 1.3418 and the weekly base of 1.3358 that was reached on January 31, 2024.

He mentions that if bulls acquire stronger confidence, it would drive the spot value to its provisional barrier on the 55-day Easy Transferring Common (SMA) of 1.3755, adopted by the month-to-month ceiling of 1.3797 reached on June 23, after which the Could peak of 1.4015 recorded on Could 13.

Piovano notes that, when contemplating the broader image, additional losses within the pair had been possible beneath its key 200-day SMA at 1.4038.

“Moreover, momentum indicators seem blended: the Relative Power Index (RSI) hovers round 50, whereas the Common Directional Index (ADX) is round 17, indicating some lack of impetus within the present development,” he says.

Employment FAQs

Labor market circumstances are a key ingredient to evaluate the well being of an financial system and thus a key driver for forex valuation. Excessive employment, or low unemployment, has constructive implications for client spending and thus financial development, boosting the worth of the native forex. Furthermore, a really tight labor market – a state of affairs in which there’s a scarcity of staff to fill open positions – can even have implications on inflation ranges and thus financial coverage as low labor provide and excessive demand results in increased wages.

The tempo at which salaries are rising in an financial system is vital for policymakers. Excessive wage development signifies that households have more cash to spend, often main to cost will increase in client items. In distinction to extra risky sources of inflation resembling vitality costs, wage development is seen as a key part of underlying and persisting inflation as wage will increase are unlikely to be undone. Central banks all over the world pay shut consideration to wage development information when deciding on financial coverage.

The burden that every central financial institution assigns to labor market circumstances is dependent upon its goals. Some central banks explicitly have mandates associated to the labor market past controlling inflation ranges. The US Federal Reserve (Fed), for instance, has the twin mandate of selling most employment and steady costs. In the meantime, the European Central Financial institution’s (ECB) sole mandate is to maintain inflation below management. Nonetheless, and regardless of no matter mandates they’ve, labor market circumstances are an necessary issue for policymakers given its significance as a gauge of the well being of the financial system and their direct relationship to inflation.

Canadian Greenback FAQs

The important thing components driving the Canadian Greenback (CAD) are the extent of rates of interest set by the Financial institution of Canada (BoC), the worth of Oil, Canada’s largest export, the well being of its financial system, inflation and the Commerce Stability, which is the distinction between the worth of Canada’s exports versus its imports. Different components embody market sentiment – whether or not buyers are taking up extra dangerous property (risk-on) or in search of safe-havens (risk-off) – with risk-on being CAD-positive. As its largest buying and selling accomplice, the well being of the US financial system can be a key issue influencing the Canadian Greenback.

The Financial institution of Canada (BoC) has a big affect on the Canadian Greenback by setting the extent of rates of interest that banks can lend to 1 one other. This influences the extent of rates of interest for everybody. The primary purpose of the BoC is to take care of inflation at 1-3% by adjusting rates of interest up or down. Comparatively increased rates of interest are typically constructive for the CAD. The Financial institution of Canada can even use quantitative easing and tightening to affect credit score circumstances, with the previous CAD-negative and the latter CAD-positive.

The value of Oil is a key issue impacting the worth of the Canadian Greenback. Petroleum is Canada’s greatest export, so Oil value tends to have an instantaneous influence on the CAD worth. Usually, if Oil value rises CAD additionally goes up, as mixture demand for the forex will increase. The other is the case if the worth of Oil falls. Greater Oil costs additionally are inclined to end in a better probability of a constructive Commerce Stability, which can be supportive of the CAD.

Whereas inflation had all the time historically been regarded as a damaging issue for a forex because it lowers the worth of cash, the alternative has truly been the case in trendy instances with the comfort of cross-border capital controls. Greater inflation tends to guide central banks to place up rates of interest which attracts extra capital inflows from world buyers in search of a profitable place to maintain their cash. This will increase demand for the native forex, which in Canada’s case is the Canadian Greenback.

Macroeconomic information releases gauge the well being of the financial system and may have an effect on the Canadian Greenback. Indicators resembling GDP, Manufacturing and Providers PMIs, employment, and client sentiment surveys can all affect the path of the CAD. A robust financial system is nice for the Canadian Greenback. Not solely does it appeal to extra international funding however it might encourage the Financial institution of Canada to place up rates of interest, resulting in a stronger forex. If financial information is weak, nonetheless, the CAD is more likely to fall.