Gold stays on monitor for its third consecutive day of features as commerce tensions weigh on USD

- Gold value advantages as commerce tensions improve its safe-haven enchantment.

- President Trump threatens 35% tariffs on Canadian imports that are not lined by the USMCA (US-Mexico-Canada) settlement.

- XAU/USD features close to 1% with $3,400 in sight.

Gold (XAU/USD) value surged on Friday, buying and selling above $3,340 on the time of writing, as commerce tensions and safe-haven demand have overshadowed rising US yields.

US President Donald Trump introduced on Friday a sweeping 35% tariff on Canadian imports, efficient from August 1, in a transfer that rattled world markets.

The choice is especially vital provided that the United States is Canada’s largest buying and selling associate, accounting for 76% of Canadian exports in 2024, in response to Statistics Canada.

Trump additionally warned of broader motion, stating: “We’re simply going to say all the remaining international locations are going to pay, whether or not it’s 20% or 15%. We’ll work that out now.”

His remarks fueled fears of a brand new wave of blanket tariffs, boosting demand for Gold as a tariff threat hedge.

Gold day by day digest: XAU/USD advantages from safe-haven demand on broader tariff dangers

- The discharge of the Federal Reserve’s (Fed) June assembly Minutes on Wednesday revealed rising concern amongst policymakers in regards to the inflationary affect of escalating tariffs. The minutes famous that “most members highlighted the danger that tariffs might have extra persistent results on inflation.” Officers additionally reiterated they’re “well-positioned to attend for extra readability on the outlook for inflation and financial exercise.”

- In response to the CME FedWatch Software, markets now see a 62.9% chance of a 25 foundation level rate of interest lower in September. To this point this 12 months, the Fed has saved rates of interest unchanged throughout the 4.25%–4.50% vary.

- In the meantime, President Donald Trump escalated commerce tensions this week by saying a 50% tariff on Copper, efficient August 1, citing nationwide safety considerations. “I’m saying a 50% TARIFF on Copper, efficient August 1, 2025, after receiving a sturdy NATIONAL SECURITY ASSESSMENT. America will, as soon as once more, construct a DOMINANT Copper Trade,” Trump declared on Reality Social on Wednesday.

- Brazil was additionally hit with a 50% tariff, with Trump immediately linking the transfer to what he referred to as the political persecution of former President Jair Bolsonaro, describing the proceedings as a “witch hunt”. He additional ordered a Part 301 investigation into Brazil’s digital commerce practices, signaling the potential for extra tariffs.

- At a Cupboard Assembly on Tuesday, Trump confirmed that the August 1 tariff deadline wouldn’t be prolonged, stating that “Everyone has to pay. And the inducement is that they’ve the proper to deal in america.” Reinforcing this stance, he later wrote: “TARIFFS WILL START BEING PAID ON AUGUST 1, 2025. There was no change to this date, and there will probably be no change.”

- For Gold, these developments might proceed to assist the metallic’s safe-haven enchantment.

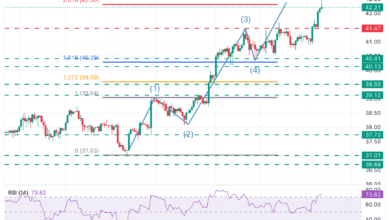

Gold technical evaluation: XAU/USD breaks triangle resistance, heads towards $3,400

Gold day by day chart

Gold has damaged via the symmetrical triangle resistance, permitting XAU/USD to reclaim the 20-day Easy Shifting Common (SMA) at $3,340.

The Relative Power Index (RSI) rises, pointing upwards close to 53 on the day by day chart, signalling a slight bullish momentum in Gold.

However upside dangers stay agency. The 23.6% Fibonacci retracement of the April uptrend stands at round $3,372, which might restrict further features. Additional up, the $3,400 psychological degree and the June excessive close to $3,452 are the subsequent targets.

In the meantime, if the US Greenback (USD) manages to achieve traction and threat sentiment improves, then the 50-day SMA might come into focus at $3,325 as assist. Beneath that degree, focus turns to the $3,300 psychological degree and the 38.2% Fibonacci retracement at $3,292.

Tariffs FAQs

Tariffs are customs duties levied on sure merchandise imports or a class of merchandise. Tariffs are designed to assist native producers and producers be extra aggressive out there by offering a value benefit over related items that may be imported. Tariffs are broadly used as instruments of protectionism, together with commerce boundaries and import quotas.

Though tariffs and taxes each generate authorities income to fund public items and providers, they’ve a number of distinctions. Tariffs are pay as you go on the port of entry, whereas taxes are paid on the time of buy. Taxes are imposed on particular person taxpayers and companies, whereas tariffs are paid by importers.

There are two faculties of thought amongst economists concerning the utilization of tariffs. Whereas some argue that tariffs are essential to guard home industries and tackle commerce imbalances, others see them as a dangerous device that would probably drive costs increased over the long run and result in a harmful commerce warfare by encouraging tit-for-tat tariffs.

In the course of the run-up to the presidential election in November 2024, Donald Trump made it clear that he intends to make use of tariffs to assist the US economic system and American producers. In 2024, Mexico, China and Canada accounted for 42% of whole US imports. On this interval, Mexico stood out as the highest exporter with $466.6 billion, in response to the US Census Bureau. Therefore, Trump desires to give attention to these three nations when imposing tariffs. He additionally plans to make use of the income generated via tariffs to decrease private revenue taxes.