- Silver reaches new 2025 excessive as tariff tensions carry safe-haven demand.

- Bullish momentum stays sturdy because the white steel rises towards the $38.00 resistance.

- XAG/USD advantages from its twin position as a safe-haven and industrial steel.

Silver (XAG/USD) is buying and selling at a contemporary YTD excessive on Friday as tariff threats and market uncertainty drive demand for safe-haven property.

The Silver worth is buying and selling above $37.60 on the time of writing, as bulls seem keen to check the subsequent psychological resistance degree of $38.00.

Because the white steel continues alongside its upward trajectory, US President Donald Trump’s tariff insurance policies and a weaker US Greenback have confirmed to be outstanding drivers of worth motion.

All year long, a weaker US Greenback and rising prospects that the Federal Reserve (Fed) might want to cut back rates of interest have offered a constructive catalyst for each Gold and Silver.

Since Silver advantages from its enchantment as a safe-haven commodity and an industrial steel, the present surroundings has amplified its enchantment.

With XAG/USD appreciating by greater than 30% this yr, a transfer above $37.00 and above the February 2012 excessive of $37.49, the steel is positioned among the many top-performing commodities this yr.

Silver extends rally towards $38.00 as bullish momentum features

Silver (XAG/USD) has prolonged its bullish momentum, breaking above the June excessive of $37.49 (now serving as assist) and reaching a contemporary YTD excessive of $37.73 on the time of writing.

The transfer displays sturdy shopping for curiosity because the steel approaches the important thing psychological resistance at $38.00.

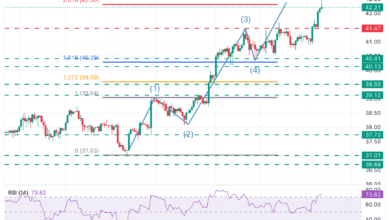

Silver (XAG/USD) day by day chart

The uptrend presently stays intact inside a rising parallel channel, supported by the 20-day and 50-day Easy Transferring Common (SMA), offering extra assist at $36.53 and $34.91, respectively.

Momentum indicators are additionally reinforcing the bullish bias, with the Relative Energy Index (RSI) climbing to 67, approaching overbought territory however just isn’t signaling exhaustion but.

A confirmed breakout above $38.00 may expose the $39.50–$40.00 zone, whereas a failure to carry current features might set off a pullback towards the $36.50 assist.

Silver FAQs

Silver is a valuable steel extremely traded amongst buyers. It has been traditionally used as a retailer of worth and a medium of change. Though much less widespread than Gold, merchants might flip to Silver to diversify their funding portfolio, for its intrinsic worth or as a possible hedge throughout high-inflation durations. Traders can purchase bodily Silver, in cash or in bars, or commerce it by automobiles corresponding to Alternate Traded Funds, which observe its worth on worldwide markets.

Silver costs can transfer because of a variety of things. Geopolitical instability or fears of a deep recession could make Silver worth escalate because of its safe-haven standing, though to a lesser extent than Gold’s. As a yieldless asset, Silver tends to rise with decrease rates of interest. Its strikes additionally rely upon how the US Greenback (USD) behaves because the asset is priced in {dollars} (XAG/USD). A robust Greenback tends to maintain the value of Silver at bay, whereas a weaker Greenback is prone to propel costs up. Different components corresponding to funding demand, mining provide – Silver is far more plentiful than Gold – and recycling charges can even have an effect on costs.

Silver is extensively utilized in trade, notably in sectors corresponding to electronics or photo voltaic power, because it has one of many highest electrical conductivity of all metals – greater than Copper and Gold. A surge in demand can enhance costs, whereas a decline tends to decrease them. Dynamics within the US, Chinese language and Indian economies can even contribute to cost swings: for the US and notably China, their large industrial sectors use Silver in varied processes; in India, customers’ demand for the dear steel for jewelry additionally performs a key position in setting costs.

Silver costs are inclined to comply with Gold’s strikes. When Gold costs rise, Silver sometimes follows go well with, as their standing as safe-haven property is analogous. The Gold/Silver ratio, which reveals the variety of ounces of Silver wanted to equal the worth of 1 ounce of Gold, might assist to find out the relative valuation between each metals. Some buyers might take into account a excessive ratio as an indicator that Silver is undervalued, or Gold is overvalued. Quite the opposite, a low ratio may recommend that Gold is undervalued relative to Silver.