Ripple CEO Brad Garlinghouse says there’s a widely-held perception that the stablecoin market may develop nearly ten instances over the following few years.

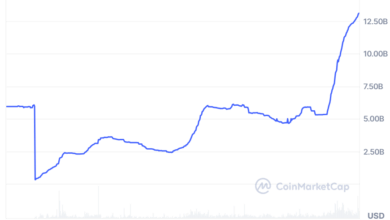

The stablecoin trade is at the moment round $250 billion in market capitalization, and “many individuals assume it should attain $1 to $2 trillion in a handful of years,” stated Garlinghouse on CNBC’s “Squawk Field” on Wednesday.

He added that the expansion behind it has been “profound,” saying that Ripple joined the market late partly as a result of the agency was utilizing stablecoins in its cost flows for its institutional prospects.

“We are able to take part on this [stablecoin] market given our institutional background and regulatory compliance,” he stated, confirming that the expansion forward will serve the agency nicely.

The feedback got here as Garlinghouse introduced that BNY Mellon could be the agency’s stablecoin custodian for its Ripple USD dollar-pegged asset.

Ripple launched its personal enterprise-focused stablecoin, RLUSD, in late 2024. Since then, its market capitalization has grown to $500 million, a milestone it reached on Wednesday.

Enormous development for stablecoins

Apollo Capital’s chief funding officer, Henrik Andersson, agreed with Garlinghouse’s prediction, telling Cointelegraph on Thursday, “The $1-2 trillion market cap for stablecoins is in step with our prediction.”

“We’re seeing fintechs, banks, social networks, and enormous retailers all launch their very own stablecoins.”

Andersson cited Tether’s profitability for instance of how profitable the enterprise might be.

“The subsequent catalyst for stablecoin adoption would be the GENIUS Act within the US, which can make stablecoins authorized tender,” he added.

The stablecoin laws handed a Senate vote in June and is more likely to be made into legislation this month.

“The crypto-friendly SEC, together with the GENIUS Act, can align the crypto trade to quickly develop, with the potential for the stablecoin market to achieve $1-2 trillion in market cap in a number of years,” Nick Ruck, director at LVRG Analysis, advised Cointelegraph.

Ripple banking license

Ripple, which primarily serves institutional shoppers, is aiming to change into totally compliant within the US in order that it might function underneath the identical framework as banks and monetary establishments.

Earlier this month, Ripple utilized for a banking license with the US Workplace of the Comptroller of the Foreign money (OCC).

The agency has additionally utilized for a Federal Reserve Grasp Account, stated Garlinghouse, including, “We expect that the important thing factor for crypto and decentralized finance […] is constructing bridges between conventional finance and DeFi.”

XRP hits seven-week excessive

This week, Ripple additionally introduced that its stablecoin has obtained a big increase by integrating with Transak, a significant cryptocurrency funds platform.

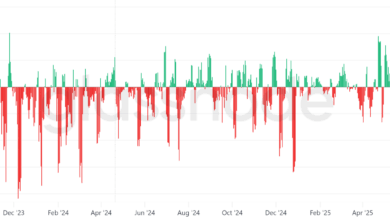

The agency’s cross-border funds token XRP (XRP) has rallied 7% since Monday and was buying and selling at $2.42 on the time of writing, its highest worth for seven weeks.

Journal: Inside a 30,000 telephone bot farm stealing crypto airdrops from actual customers