- WTI stays supported as Houthi insurgent assaults within the Purple Sea escalate.

- The EIA report reveals a shock construct in US stockpiles, however geopolitical dangers offset elevated provide.

- WTI Crude Oil stays supported by $65.00 assist as resistance holds on the 200-day transferring common above $68.00.

WTI Crude Oil is buying and selling larger on Wednesday as assaults within the Purple Sea overshadow studies of rising provide.

The US Power Info Administration (EIA)launched its weekly stock report, which revealed that stockpiles elevated by 7.07 million barrels over the previous week. Expectations had been for the newest report to point out a drawdown of two million barrels.

The sudden surge in inventories led to a slight pullback in West Texas Intermediate (WTI) Crude Oil, earlier than it recovered to commerce above $67.00 on the time of writing.

Over the weekend, the Organisation of the Petroleum Exporting Nations (OPEC) and its allies (OPEC+) introduced that they’d enhance manufacturing by 548,000 barrels per day (bpd) in August.

Between April and July, manufacturing from members of OPEC+ has already elevated by 1.37 million barrels per day. Nonetheless, regardless of the extra provide, geopolitical dangers, particularly within the Center East, have restricted the draw back transfer.

Purple Sea assaults and rising threat premiums assist larger Oil costs

Houthi rebels launched a coordinated assault on the Greek-owned bulk provider Magic Seas on Sunday, forcing the crew to desert the ship earlier than the vessel sank. The assaults intensified on Monday as drones and speedboats focused a Liberian-flagged, Greek-operated ship, the Eternity C. A number of crew members have been killed or went lacking, and the ship sank within the early hours of Wednesday.

Because of this, threat premiums on Oil have elevated, underpinning larger costs.

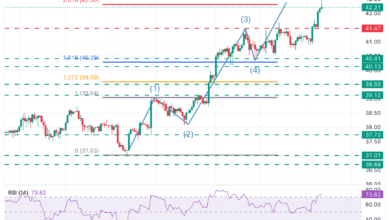

WTI Crude Oil heads towards the 200-day SMA, offering resistance above $68.00

West Texas Intermediate (WTI) crude is buying and selling round $67.54, holding simply above the 50% Fibonacci retracement stage of the January-April decline at $67.08, which is performing as quick assist.

The worth is dealing with resistance close to the 200-day Easy Transferring Common (SMA) at $68.16, with a break above this stage probably paving the best way for a transfer towards the 61.8% Fibonacci stage at $69.98.

On the draw back, assist is bolstered by the 100-day SMA at $65.02 and the 50-day SMA at $64.07, which aligns with the 38.2% retracement at $64.18, creating a powerful technical ground.

WTI Crude Oil each day chart

Momentum indicators are combined. The Relative Power Index (RSI) is studying barely above the impartial stage at 54, whereas the Commodity Channel Index (CCI) is barely adverse, reflecting warning amongst bulls. Regardless of bearish strain from rising inventories and elevated OPEC+ provide, geopolitical dangers within the Center East are serving to to maintain costs supported close to key technical ranges.

WTI Oil FAQs

WTI Oil is a kind of Crude Oil offered on worldwide markets. The WTI stands for West Texas Intermediate, considered one of three main varieties together with Brent and Dubai Crude. WTI can be known as “gentle” and “candy” due to its comparatively low gravity and sulfur content material respectively. It’s thought-about a top quality Oil that’s simply refined. It’s sourced in the US and distributed through the Cushing hub, which is taken into account “The Pipeline Crossroads of the World”. It’s a benchmark for the Oil market and WTI value is steadily quoted within the media.

Like all property, provide and demand are the important thing drivers of WTI Oil value. As such, international development could be a driver of elevated demand and vice versa for weak international development. Political instability, wars, and sanctions can disrupt provide and affect costs. The selections of OPEC, a gaggle of main Oil-producing international locations, is one other key driver of value. The worth of the US Greenback influences the worth of WTI Crude Oil, since Oil is predominantly traded in US {Dollars}, thus a weaker US Greenback could make Oil extra inexpensive and vice versa.

The weekly Oil stock studies printed by the American Petroleum Institute (API) and the Power Info Company (EIA) affect the worth of WTI Oil. Adjustments in inventories replicate fluctuating provide and demand. If the info reveals a drop in inventories it may possibly point out elevated demand, pushing up Oil value. Increased inventories can replicate elevated provide, pushing down costs. API’s report is printed each Tuesday and EIA’s the day after. Their outcomes are often related, falling inside 1% of one another 75% of the time. The EIA knowledge is taken into account extra dependable, since it’s a authorities company.

OPEC (Group of the Petroleum Exporting Nations) is a gaggle of 12 Oil-producing nations who collectively resolve manufacturing quotas for member international locations at twice-yearly conferences. Their selections usually affect WTI Oil costs. When OPEC decides to decrease quotas, it may possibly tighten provide, pushing up Oil costs. When OPEC will increase manufacturing, it has the other impact. OPEC+ refers to an expanded group that features ten further non-OPEC members, probably the most notable of which is Russia.