Bitcoin might be heading to $150,000 after spiking to a brand new all-time excessive of $112,000 on Wednesday, in line with a Bitcoin bull.

“See you at $150k,” Milk Street co-founder Kyle Reidhead mentioned in an X submit on Wednesday, referencing a earlier submit in late June displaying a “bullish cup and deal with” formation that he mentioned will push Bitcoin (BTC) to $150,000.

The optimism follows two weeks of tight consolidation, which noticed many analysts involved Bitcoin might not have the energy to cross its former file excessive in Might.

Bitcoin’s much-needed increase

The brand new all-time excessive seems to have come at good timing.

Simply hours earlier than Bitcoin’s new excessive, economist Timothy Peterson instructed Cointelegraph that if Bitcoin doesn’t hit new highs throughout the subsequent two weeks, the asset probably received’t be capable of come shut till October.

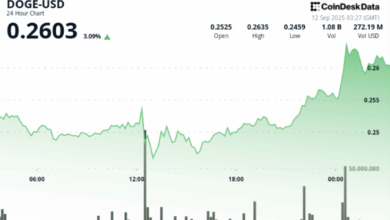

Market sentiment is rising, too. The Crypto Concern & Greed Index, which measures general crypto market sentiment, spiked 5 factors to a “Greed” rating of 71 out of 100.

In the meantime, the CoinMarketCap Altcoin Season Index indicators the market remains to be closely favoring Bitcoin, with a “Bitcoin Season” rating of 26 out of 100.

From a technical standpoint, Bitcoin seems to have damaged out of its current downtrend, in line with crypto analyst Matthew Hyland. “BTC confirms every day higher-high and confirms an finish to the downtrend that began in late Might,” Hyland mentioned in a submit on Wednesday.

“Bulls are in management,” Hyland mentioned.

Bitcoin is at present buying and selling at $111,383, in line with TradingView information.

📈The Cointelegraph Markets Present!

🔥 Burning query: Will Bitcoin hit $150K by year-end or is it simply hopium?@HorusHughes and @bitcoinwallah be part of @rkbaggs to interrupt all of it down in quarter-hour or much less on this week’s episode.https://t.co/YVesqoLwnA

— Cointelegraph (@Cointelegraph) July 9, 2025

In feedback despatched to Cointelegraph, eToro analyst Josh Gilbert mentioned, “That is the primary actual bull market the place institutional participation is entrance and heart.”

Associated: Bitcoin analyst warns time ‘working out’ for an additional BTC value parabolic rally

“Robust ETF inflows and a stable macro backdrop have helped drive market momentum, however maybe essentially the most essential shift is who’s shopping for,” he added. In July alone, there have been roughly $1.04 billion inflows into US-based spot Bitcoin ETFs, in line with Farside information.

Coinstash co-founder Mena Theodorou echoed an identical sentiment. “It’s clear that this momentum is being pushed by establishments, not retail traders,” Theodorou mentioned.

“Even within the face of world uncertainty, from escalating commerce tensions to rising geopolitical dangers, Bitcoin has remained resilient,” he added.

Bitcoin file excessive catches merchants off guard

Not all market contributors had been anticipating a brand new Bitcoin excessive.

Only a day earlier, on Tuesday, Bitfinex analysts mentioned that merchants are cautious about shopping for Bitcoin at its present stage, because the cryptocurrency is struggling to search out the energy to interrupt above its all-time excessive.

Bitcoin merchants’ leveraged positions additionally present an identical story. Over the previous 24 hours, roughly $217.55 million in Bitcoin brief positions had been liquidated, in line with CoinGlass information.

Information additionally exhibits there’s $1.6 billion in brief positions vulnerable to liquidation if Bitcoin strikes one other few thousand {dollars} to $115,000.

In the meantime, Santiment sentiment information on Tuesday confirmed the very best Bitcoin sentiment ratio previously three weeks. Santiment analyst Brian Quinlivan cautioned that related spikes in dealer optimism had been adopted by Bitcoin value drops on June 11 and July 7.

Journal: Excessive conviction that ETH will surge 160%, SOL’s sentiment alternative: Commerce Secrets and techniques

This text doesn’t include funding recommendation or suggestions. Each funding and buying and selling transfer entails danger, and readers ought to conduct their very own analysis when making a choice.