Bitcoin soared to a different report excessive, pushed by rising international investor demand for danger belongings and a $200 million liquidation of BTC shorts close to a vital overhead resistance degree.

Bitcoin’s (BTC) worth surpassed the $112,000 all-time excessive for the primary time on Wednesday, after rising 5.95% throughout the previous week.

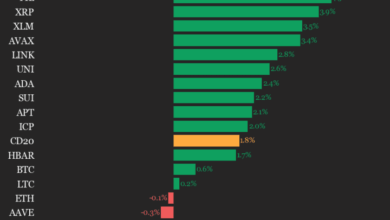

Bitcoin’s worth appreciation helped the entire crypto market capitalization recapture $3.47 trillion, a degree final seen in June 2025.

But, the crypto market’s worth stays beneath the all-time excessive of $3.73 trillion recorded in December 2024.

Bitcoin’s new all-time excessive occurred simply days after President Trump introduced a recent spherical of tariffs of as much as 40% in opposition to Malaysia, Kazakhstan, South Africa, Myanmar and Laos. In the meantime, Japan noticed its tariff charge lifted to 25% and the brand new charges go reside on Aug. 1.

Associated: GENIUS Act ‘legitimizes’ stablecoins for international institutional adoption

Bitcoin’s worth momentum is benefiting from a reset in “over-leveraged contributors” that created a “more healthy basis for continuation,” analysts from Bitfinex change instructed Cointelegraph, including:

“The convergence between on-chain accumulation and off-chain change order stream paints a compelling image: this rally has been constructed on stable floor, supported by actual capital flows relatively than short-lived speculative leverage.”

“To keep up a constructive outlook for the approaching weeks, this sample of spot purchaser dominance should persist,” defined the analysts

Associated: Bitcoin extra of a ‘diversifier’ than safe-haven asset: Report

Bitcoin rally pushed by rising protected haven standing: Sygnum Financial institution analysis lead

Bitcoin’s uptrend since Trump’s Liberation Day announcement on April 2 is pushed by its rising recognition as a safe-haven asset, in line with Katalin Tischhauser, the top of analysis at digital asset banking group Sygnum Financial institution.

Since April 2, Bitcoin has been “outperforming in addition to more and more decoupling on days when the S&P 500 corrected,” she instructed Cointelegraph, including:

“This has been supported by Bitcoin’s rising standing as a protected haven asset within the face of fiat debasement, additionally confirmed by the primary US state signing a Bitcoin reserve invoice into regulation, following the federal Bitcoin reserve established by Government Order.”

Bitcoin change reserves have additionally been in a gentle decline since late April, which is an indication of “long-term confidence” from Bitcoin traders which will result in a provide shock-driven rally, in line with Tischhauser.

Bitcoin reserves throughout all exchanges fell to 2.99 million BTC on Could 21, down from over 3.11 million BTC on March 13, Glassnode knowledge reveals

Journal: Dogecoin set for rebound? Ripple eyes US banking license: Hodler’s Digest, June 29 – July 5