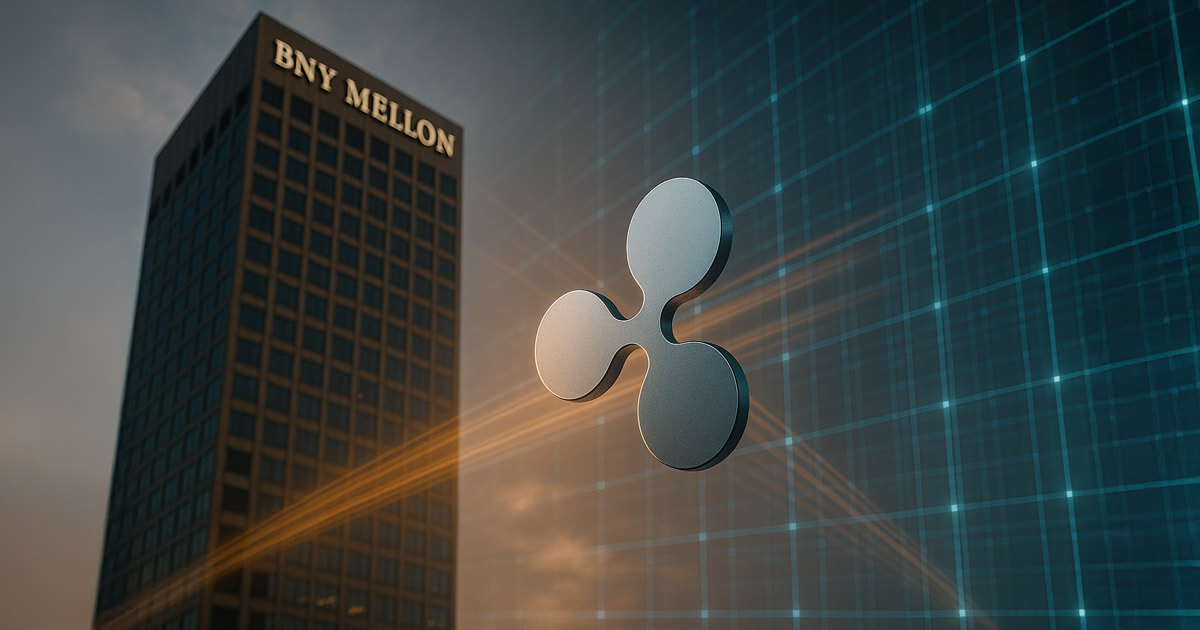

Based on a July 9 announcement, Ripple has appointed BNY Mellon because the official reserve custodian for its enterprise-focused stablecoin, Ripple USD (RLUSD).

Based on a July 9 announcement, BNY Mellon was chosen based mostly on its in depth expertise in digital asset infrastructure and its function as a trusted supplier of transaction banking providers within the US. The financial institution will now handle RLUSD’s money reserves and assist Ripple’s operational wants by way of built-in banking options.

Jack McDonald, the Senior Vice President of Stablecoins at Ripple, described RLUSD as addressing a major hole in enterprise-grade monetary instruments. He praised BNY Mellon’s experience and dedication to innovation, calling the financial institution a ‘forward-thinking companion’ able to bridging conventional and decentralized finance.

Emily Portney, the International Head of Asset Servicing at BNY, additionally echoed this sentiment, whereas including that:

“As main custodian for RLUSD, we’re proud to assist the expansion of digital property by offering a differentiated platform, designed to fulfill the evolving wants of establishments within the digital property ecosystem.”

This transfer follows Ripple’s earlier partnership with Switzerland-based AMINA Financial institution, which now gives custody and buying and selling providers for RLUSD in Europe. That integration introduced the stablecoin right into a regulated banking setting, increasing its footprint amongst institutional and personal shoppers.

RLUSD provide surpasses $500 million

The collaboration with main monetary establishments seems to be fueling RLUSD’s momentum.

Information from CryptoSlate exhibits that RLUSD’s circulating provide has now exceeded $501 million, lower than a yr after its launch.

Round $435 million is presently on the Ethereum community, whereas $65 million resides on Ripple’s XRP Ledger.

This progress exhibits the stablecoin’s growing relevance, particularly in regulated environments. RLUSD is pegged 1:1 to the US greenback and backed by a segregated reserve consisting of money and money equivalents.

The New York Division of Monetary Companies authorized it in December 2024, whereas the Dubai Monetary Companies Authority cleared it to be used this yr.

Not like many stablecoins constructed for retail utilization, RLUSD is designed for enterprise-level cross-border transactions, providing quicker settlement, decrease prices, and improved effectivity.