Tokyo-based vitality firm Remixpoint raised 31.5 billion yen (round $215 million) to develop its Bitcoin treasury, in keeping with a Wednesday announcement.

Remixpoint will allocate the newly raised funds totally to Bitcoin (BTC) acquisition, the corporate mentioned in an X submit. The funds had been raised by way of Remixpoint’s twenty fifth collection of inventory acquisition rights and fourth collection of unsecured bonds, in keeping with native media outlet CoinPost.

This collection of inventory acquisition rights will create 55 million new shares, representing a 39.9% dilution. The issuance is made with none low cost and is performed at market worth.

The submit additionally states that the agency goals for its reserve to achieve 3,000 BTC within the close to time period. Remixpoint is at present the thirtieth largest company Bitcoin treasury with a steadiness of 1,051 BTC, price greater than $113.8 million, in keeping with BitcoinTreasuries.NET knowledge.

The information follows a Tuesday announcement that Remixpoint CEO Takashi Tashiro shall be paid in Bitcoin as a part of acknowledged efforts to be “in the identical boat” as shareholders. The corporate is a Tokyo-listed vitality and fintech agency that pivoted to accumulating Bitcoin.

“Now we have turn out to be much more satisfied of Bitcoin’s future, and this resolution is the results of in depth discussions,” the corporate mentioned on Tuesday.

Associated: Few Bitcoin treasury firms will survive ‘dying spiral’: VC Report

The corporate’s board unanimously accredited the funding technique, citing the potential to boost company worth from a risk-return perspective whereas preserving future flexibility:

“We perceive the distinction between seizing alternatives and taking part in it protected, in addition to the excellence between a problem and recklessness.“

Associated: New Bitcoin treasuries might crack below worth stress

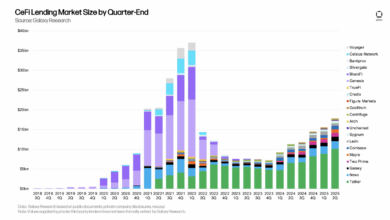

The Bitcoin treasury house is getting crowded

The variety of company Bitcoin treasuries continues to develop, doubtless pushed by the success of early adopters and market dynamics. The world’s first Bitcoin treasury firm, Technique, was anticipated to report greater than $13 billion in unrealized beneficial properties on its Bitcoin holdings for the second quarter of 2025, however reported $14 billion in unrealized beneficial properties on Monday.

Metaplanet, Japan’s high company Bitcoin treasury firm, acquired one other 2,204 Bitcoin for $237 million on Monday. On Tuesday, the agency’s CEO additionally acknowledged that the corporate is exploring the acquisition of a digital financial institution to develop its operations additional.

Additionally on Tuesday, two European firms — France’s The Blockchain Group and the UK’s Smarter Internet Firm — expanded their Bitcoin holdings by 116 BTC and 226.42 BTC, respectively. Regardless of the flurry of exercise, not everyone seems to be satisfied that this can be a profitable guess.

Glassnode lead analyst James Verify instructed final week that the Bitcoin treasury technique might not have the longevity many anticipate. In response to him, the straightforward upside might already be behind new firms coming into the house and highlighted decrease investor curiosity. “No one desires the fiftieth Treasury firm,” he mentioned.

Journal: Bitcoin ‘bull pennant’ eyes $165K, Pomp scoops up $386M BTC: Hodler’s Digest, June 22 – 28