Today news

2025-02-13 12:00:00

By James Van Straten (All times ET unless indicated otherwise)

After Wednesday’s unexpectedly high consumer price inflation (CPI) figures, all eyes now turn to the produce price report due at 8:30 a.m.

Analysts expect year-over-year PPI to come in at 3.2%, below December’s 3.3%, with a month-on-month reading of 0.3%, up from 0.2%. Core PPI, which strips out volatile food and energy prices, is expected to show underlying inflationary pressure, accelerating to 0.3% from 0% in December. From January last year, it’s seen easing to 3.3%.

Hotter-than-expected data could signal monetary policy remains too loose, potentially delaying or even eliminating Fed rate cuts this year, against President Trump’s wishes. A more restrictive Fed is likely to be bearish for risk assets. On the other hand, softer inflation data could weaken the dollar and lower treasury yields while helping boost risk-assets.

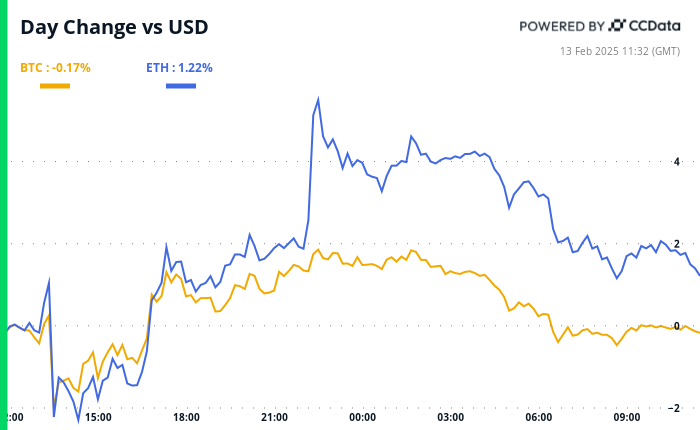

Following the CPI data markets were volatile.

Treasury yields surged to 4.6% before retreating slightly. The Dollar Index (DXY) mirrored this movement, spiking to 108.5 before pulling back below 108.

Despite the initial sell-off, major asset classes rebounded, with bitcoin (BTC), U.S. equities and gold finishing the session in the green.

Also on the agenda, Coinbase (COIN) reports fourth-quarter earnings after the market closes. Following Robinhood’s strong results, expectations are high, and a positive report could provide a boost to the cryptocurrency market. Stay Alert!

What to Watch

- Crypto:

- Macro

- Feb. 13, 8:30 a.m.: The U.S. Bureau of Labor Statistics (BLS) releases January’s Producer Price Index (PPI) report.

- Core PPI MoM Est. 0.3% vs. Prev. 0%

- Core PPI YoY Est. 3.3% vs. Prev. 3.5%

- PPI MoM Est. 0.3% vs. Prev. 0.2%

- PPI YoY Prev. 3.3%

- Feb. 13, 8:30 a.m.: The U.S. Department of Labor releases the Unemployment Insurance Weekly Claims report for the week ended Feb. 8.

- Initial Jobless Claims Est. 215K vs. Prev. 219K

- Feb. 14, 8:30 a.m.: The U.S. Census Bureau releases January’s Retail Sales data.

- Retail Sales MoM Est. -0.1% vs. Prev. 0.4%

- Retail Sales YoY Prev. 3.9%

- Feb. 13, 8:30 a.m.: The U.S. Bureau of Labor Statistics (BLS) releases January’s Producer Price Index (PPI) report.

- Earnings

Token Events

- Governance votes & calls

- Curve DAO is voting on increasing 3pool’s amplification coefficient to 8,000 over 30 days and raise admin fees to 100%. To optimize liquidity, as part of an experiment, 3pool will have higher fees while Strategic Reserves will offer lower fees.

- Aave DAO is discussing using GHO as a gas token across various networks. The framework proposes using the canonical network bridge to mint GHO directly as a gas token.

- Unlocks

- Feb. 14: The Sandbox (SAND) to unlock 8.4% of circulating supply worth $80.5 million.

- Feb. 16: Arbitrum (ARB) to unlock 2.13% of circulating supply worth $45.1 million.

- Feb. 16: Avalanche (AVAX) to unlock 0.4% of circulating supply worth $42.8 million.

- Feb. 21: Fast Token (FTN) to unlock 4.66% of circulating supply worth $79 million.

- Feb. 28: Optimism (OP) to unlock 2.32% of circulating supply worth $34.8 million.

- Token Launches

- Feb. 13: EthereumPoW (ETHW) and Polygon (MATIC) to no longer be supported at Deribit.

- Feb. 13: Story (IP) to be listed on Bybit, Bitrue, Bitget, MEXC, KuCoin, and OKX, among others.

- Feb. 14: Pudgy Penguins (PENGU) to be listed on Coinbase, according to a post shared by the Pudgy Penguins account.

Conferences:

CoinDesk’s Consensus to take place in Hong Kong on Feb. 18-20 and in Toronto on May 14-16. Use code DAYBOOK and save 15% on passes.

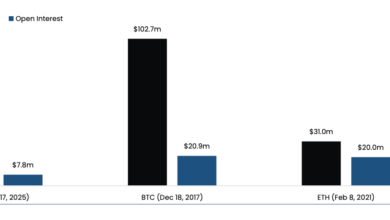

Derivatives Positioning

- Funding rates in perpetual futures tied to SOL, TRS, TRON and DOT remain negative, indicating a bias for shorts, data from Coinglass and Velo Data show.

- Annualized funding rates in BTC and ETH hover near 5%.

- Most major coins, excluding BNB, have seen negative open-interest-adjusted cumulative volume deltas, a sign of net selling pressure, which raises a question mark on the sustainability of Wednesday’s post-U.S. CPI recovery.

- BTC and ETH options skews are positive across the board, reflecting a bull bias.

- Flows, however, have been muted, with some demand for out-of-the-money higher strike ETH calls, according to data sources Deribit and Paradigm.

Market Movements:

- BTC is down 1.53% from 4 p.m. ET Wednesday to $96,206.67 (24hrs: -0.02%)

- ETH is down 0.23% at $2,677.69 (24hrs: +1.79%)

- CoinDesk 20 is down 0.71% to 3,201.06 (24hrs: +0.66%)

- Ether CESR Composite Staking Rate is down 5 bps to 3.05%

- BTC funding rate is at 0.0005% (0.5606% annualized) on Binance

- DXY is down 0.34% at 107.58

- Gold is up 1.26% at $2945.7/oz

- Silver is up 0.49% to $32.85/oz

- Nikkei 225 closed up 1.28% at 39,461.47

- Hang Seng closed -0.20% at 21,814.37

- FTSE is down 0.74% at 8,742.63

- Euro Stoxx 50 is up 1.23% to 5,471.99

- DJIA closed Wednesday -0.50% at 44,368.56

- S&P 500 closed -0.24% at 6,051.97

- Nasdaq closed 0.03% at 19,649.95

- S&P/TSX Composite Index closed -0.27% at 25,563.1

- S&P 40 Latin America closed -0.93% at 2,421.78

- U.S. 10-year Treasury rate was down 2 bps at 4.61%

- E-mini S&P 500 futures are unchanged at 6,073

- E-mini Nasdaq-100 futures are up 0.17% at 21,842.75

- E-mini Dow Jones Industrial Average Index futures are unchanged at 44,480

Bitcoin Stats:

- BTC Dominance: 60.91 (-0.14%)

- Ethereum to bitcoin ratio: 0.02784 (-0.50)

- Hashrate (seven-day moving average): 802 EH/s

- Hashprice (spot): $53.2

- Total Fees: 4.63 BTC / $446,657

- CME Futures Open Interest: 166,680 BTC

- BTC priced in gold: 33.1 oz

- BTC vs gold market cap: 9.40 oz

Technical Analysis

- Since the Jan. 3 crash, bitcoin has remained below the widely-tracked 50-day simple moving average (SMA).

- It now appears the price has also dipped below the Ichimoku cloud, suggesting a potential bearish momentum shift.

- This twin breakdown could embolden bears. Immediate support is seen at around $90,000.

Crypto Equities

- MicroStrategy (MSTR): closed on Wednesday at $326.82 (+2.3%), down 0.56% at $325 in pre-market.

- Coinbase Global (COIN): closed at $274.90 (+3%), up 3.24% at $283.8 in pre-market.

- Galaxy Digital Holdings (GLXY): closed at C$26.87 (+1.24%)

- MARA Holdings (MARA): closed at $16.24 (+1.37%), down 0.55% at $16.16 in pre-market.

- Riot Platforms (RIOT): closed at $11.16 (+0.18%), down 0.54% at $11.10 in pre-market.

- Core Scientific (CORZ): closed at $12.09 (-1.39%), unchanged in pre-market.

- CleanSpark (CLSK): closed at $10.52 (+2.33%), down 0.67% at $10.45 in pre-market.

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $22.73 (+1.75%), unchanged in pre-market.

- Semler Scientific (SMLR): closed at $47.69 (+1.51%), unchanged in pre-market.

- Exodus Movement (EXOD): closed at $48.85 (-0.63%), up 2.48% at $50.06 in pre-market.

ETF Flows

Spot BTC ETFs:

- Daily net flow: -$251 million

- Cumulative net flows: $40.21 billion

- Total BTC holdings ~ 1.174 million.

Spot ETH ETFs

- Daily net flow: -$40.9 million

- Cumulative net flows: $3.13 billion

- Total ETH holdings ~ 3.788 million.

Source: Farside Investors

Overnight Flows

Chart of the Day

- Daily trading volumes in decentralized exchanges based on PancakeSwap have surged to the highest since early December.

- The renewed activity partly explains CAKE token’s jump to a two-month high of $3.4.

While You Were Sleeping

In the Ether