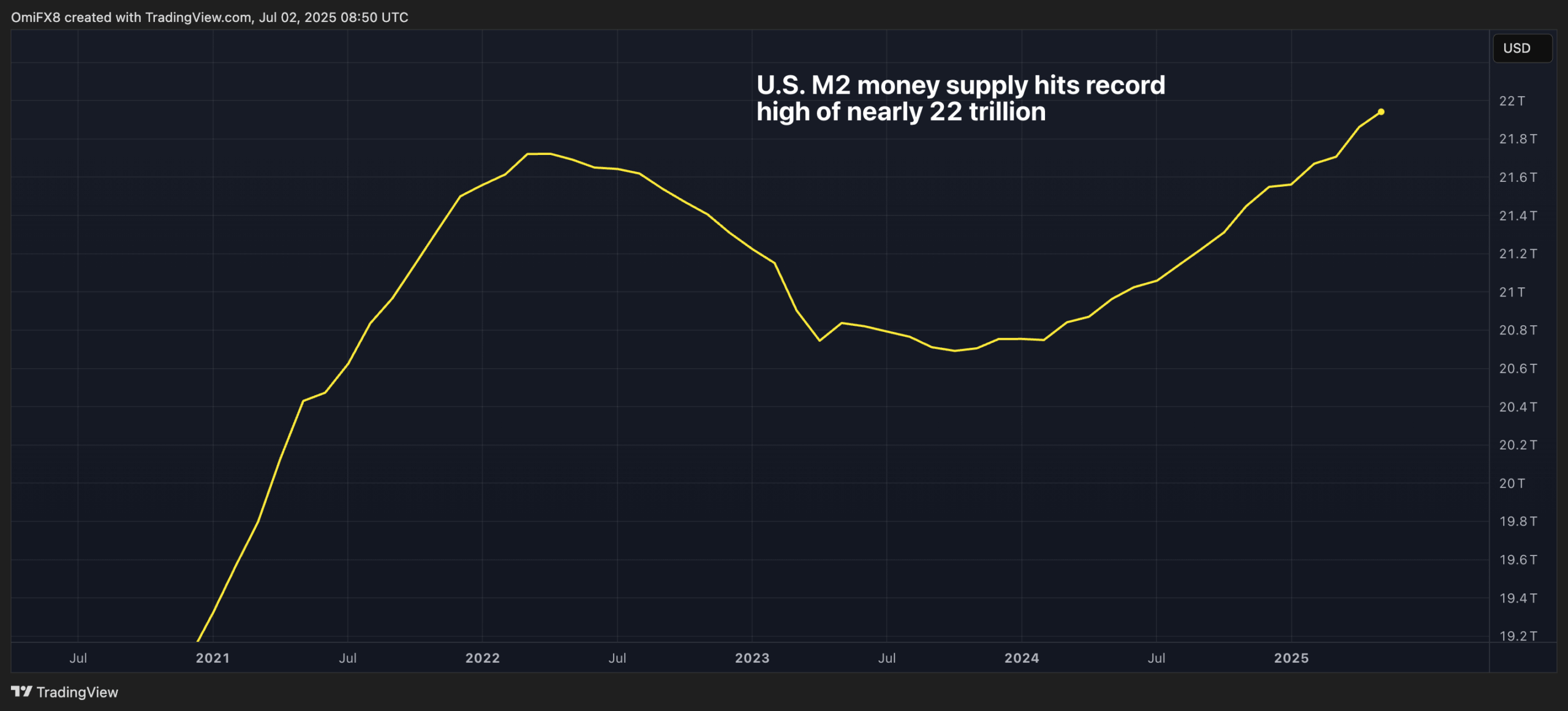

U.S. M2 Cash Provide Hits Report Excessive of Practically $22T. Is It Bullish for BTC or Inflation?

A complete measure of cash circulation within the U.S. has risen to new highs, a sign of financial development that posts contradictory messages for the trail of bitcoin

.

The M2 cash provide, which incorporates laborious forex and financial institution and cash market mutual fund deposits which are comparatively liquid, rose to a document $21.94 trillion on the finish of Could, topping the earlier peak of $21.72 trillion in March 2022, in keeping with knowledge supply barchart.com. Yr-on-year development fee matched April’s 4.5%, which can also be the best in almost three years, in keeping with knowledge supply Yahoo Finance.

For cryptocurrencies, the message is muddled. Usually, a rising cash provide is taken as a sign of looser monetary situations and a rising financial system that promotes larger investor publicity to riskier property.

Then again, cash provide development can result in inflation if it outpaces the financial system, in keeping with Cyprus-based TIOmarkets. Inflation considerations might scale back investor risk-taking and stress the Federal Reserve to boost rates of interest.

Lately, a rising M2 has had a lagged affect on the Fed’s most popular inflation measure, the non-public consumption expenditures (PCE) inflation. The PCE started rising in February 2021, a yr after M2 development started hovering in February 2020 and adopted the M2 development decrease in 2023, St. Louis Federal Reserve famous in a weblog put up.

If historical past is a information, the continuing uptick within the M2 development fee might contribute to inflation within the coming months, making it tougher for the Federal Reserve to chop charges to as little as 1%, as lately referred to as for by President Donald Trump.