USD/CAD rises as Fed Powell confirms data-dependent stance, robust US ISM and JOLTS information

- USD/CAD rises as Fed Powell’s feedback on the ECB Discussion board increase expectations of a charge lower in September.

- Fed Chair Powell: “So long as the US financial system is in a strong form, the prudent factor to do is wait.”

- The US ISM Manufacturing PMI and JOLTS job information beat expectations, reflecting a extra resilient US financial system.

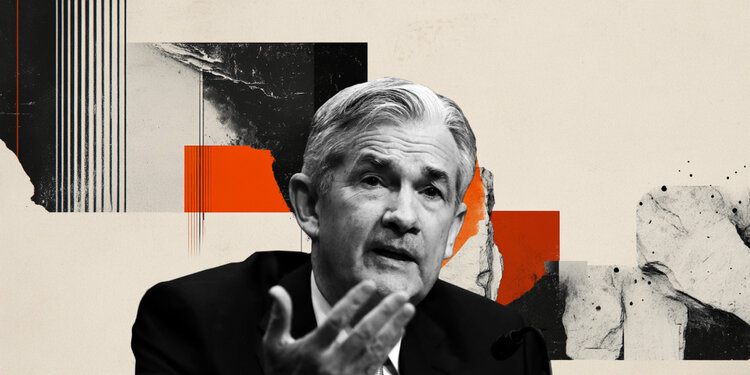

The Canadian Greenback (CAD) is edging decrease in opposition to the US Greenback (USD) on Tuesday, as merchants digest the most recent remarks from Federal Reserve (Fed) Chair Jerome Powell.

Central financial institution audio system collect on the European Central Financial institution (ECB) Discussion board in Sintra, Portugal, offering perception into financial coverage.

As of this writing, USD/CAD is hovering close to 1.3640, as Powell stays dedicated to ready for added indicators of inflation pressures earlier than slicing charges.

“So long as the US financial system is in strong form, we expect that the prudent factor to do is to attend and be taught extra and see what these results is likely to be,” Powell stated.

To date, Powell has adhered to the cautious script, however buyers are conscious that this might shift shortly if the info dictates in any other case.

Moreover, Powell acknowledged that “It’ll depend upon the info, and we’re going assembly by assembly.” “I would not take any assembly off the desk or put it immediately on the desk. It’ll depend upon how the info evolves.”

These feedback recommend that the Fed will not be speeding to chop charges, rising the potential for a September lower. With the US ISM Manufacturing and JOLTS information beating expectations, a resilient US information stays supportive of a extra data-dependent Fed, offering a lift for USD/CAD.

ISM Manufacturing PMI and JOLTS employment numbers replicate a resilient US financial system

Two carefully watched US financial reviews launched in america on Tuesday have helped alleviate issues concerning the US financial system.

First is the Institute for Provide Administration’s Manufacturing Buying Managers’ Index (ISM Manufacturing PMI).The forecast referred to as for a 48.8 print, which falls in contraction territory, hinting at softness within the industrial sector. The June information got here in above expectations at 49, rising from 48.5 in Could.

The second is the Job Openings and Labor Turnover Survey (JOLTS), the place economists had anticipated round 7.3 million open positions as of Could 31. As an alternative, the most recent report revealed that job vacancies rose by 7.769 million, reflecting a resilient US labour market.

Collectively, these two information factors present a strong snapshot of each the demand for items and the demand for labor, two key elements of the US financial system.

USD/CAD technical evaluation: Loonie stays supported above psychological help at 1.3600

The USD/CAD day by day chart exhibits the loonie continues to commerce underneath strain on Tuesday.

Costs at the moment stay under the 20-day Easy Shifting Common (SMA) at 1.3670 and the 50-day SMA round 1.3779.

The pair had not too long ago damaged above a descending channel however has since pulled again, suggesting the downward pattern might proceed.

Key help lies on the 1.3600 psychological degree, a break of which might open the door for the June low of 1.3539. An additional drop might doubtlessly goal the September low at 1.3419.

USD/CAD day by day chart

Key resistance ranges to look at embody the 78.6% Fibonacci degree of the September-February uptrend, situated at 1.3714. The 20-day and 50-day SMAs are located above, adopted by the November low at 1.3823.

The Relative Power Index (RSI) at 40 is reinforcing bearish momentum with out getting into oversold territory.

A sustained transfer above 1.3670, notably past the 50-day SMA, can be wanted to shift the short-term outlook to bullish.

US Greenback FAQs

The US Greenback (USD) is the official forex of america of America, and the ‘de facto’ forex of a big variety of different international locations the place it’s present in circulation alongside native notes. It’s the most closely traded forex on this planet, accounting for over 88% of all world overseas change turnover, or a mean of $6.6 trillion in transactions per day, in response to information from 2022.

Following the second world warfare, the USD took over from the British Pound because the world’s reserve forex. For many of its historical past, the US Greenback was backed by Gold, till the Bretton Woods Settlement in 1971 when the Gold Commonplace went away.

Crucial single issue impacting on the worth of the US Greenback is financial coverage, which is formed by the Federal Reserve (Fed). The Fed has two mandates: to realize value stability (management inflation) and foster full employment. Its major device to realize these two targets is by adjusting rates of interest.

When costs are rising too shortly and inflation is above the Fed’s 2% goal, the Fed will increase charges, which helps the USD worth. When inflation falls under 2% or the Unemployment Fee is simply too excessive, the Fed might decrease rates of interest, which weighs on the Dollar.

In excessive conditions, the Federal Reserve may print extra {Dollars} and enact quantitative easing (QE). QE is the method by which the Fed considerably will increase the stream of credit score in a caught monetary system.

It’s a non-standard coverage measure used when credit score has dried up as a result of banks won’t lend to one another (out of the worry of counterparty default). It’s a final resort when merely decreasing rates of interest is unlikely to realize the required outcome. It was the Fed’s weapon of option to fight the credit score crunch that occurred in the course of the Nice Monetary Disaster in 2008. It includes the Fed printing extra {Dollars} and utilizing them to purchase US authorities bonds predominantly from monetary establishments. QE often results in a weaker US Greenback.

Quantitative tightening (QT) is the reverse course of whereby the Federal Reserve stops shopping for bonds from monetary establishments and doesn’t reinvest the principal from the bonds it holds maturing in new purchases. It’s often constructive for the US Greenback.