Blockchain infrastructure platform Centrifuge has teamed up with S&P Dow Jones Indices (S&P DJI) to deliver the S&P 500 Index onchain for the primary time, based on a press launch shared with Cointelegraph.

The collaboration introduces proof-of-index infrastructure for tokenized index merchandise and can see the debut of the primary tokenized S&P 500 Index fund, per the announcement.

Constructed on Centrifuge’s blockchain-native platform, the fund makes use of official S&P DJI index information to supply programmable index-tracking funds through good contracts.

“At the moment is the beginning of an thrilling chapter that extends The five hundred™ into new use circumstances and customers throughout the globe,” stated Cameron Drinkwater, chief product officer at S&P Dow Jones Indices.

Associated: Aptos sees surge in tokenization as asset managers go onchain

Licensed managers cleared to launch onchain funds

The initiative clears the best way for S&P DJI-licensed asset managers to launch onchain funds that align with institutional requirements whereas harnessing the pliability and transparency of decentralized finance.

Web3 native asset supervisor Anemoy Capital has secured the primary license to construct the Janus Henderson Anemoy S&P 500 Index Fund Segregated Portfolio. S&P DJI index information and Centrifuge energy the index publicity and good contract infrastructure.

Nick Cherney, Janus Henderson’s head of innovation, stated their earlier tokenized funds with Centrifuge have gained notable traction, with one technique reaching $1 billion in belongings below administration sooner than any earlier tokenized fund.

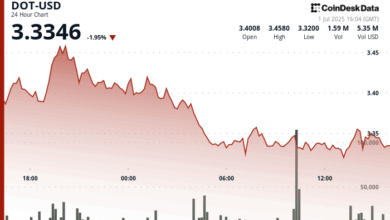

The S&P 500 is central to international markets, with over $1 trillion traded day by day in ETFs, derivatives and different merchandise. Bringing the index onchain would permit buyers to purchase, maintain, commerce, use it as collateral or automate portfolio methods.

“It’s about taking every little thing we realized in conventional markets and reimagining it with programmability, transparency, and international, 24/7 accessibility,” Centrifuge’s Anil Sood stated.

The tokenized S&P 500 fund will formally launch on July 1 on the Centrifuge RWA Summit in Cannes, alongside Centrifuge’s proof-of-index infrastructure, which goals to standardize tokenized index merchandise.

Associated: ‘Every part is lining up’ — Tokenization is having its breakout second

Utility stays key

Centrifuge’s transfer to deliver the S&P 500 onchain comes as trade leaders warn that tokenization alone isn’t sufficient. Kevin de Patoul, CEO of Keyrock, informed Cointelegraph that tokenization “wants precise utility” to thrive.

“If there isn’t one thing I can do with the asset in a tokenized type that I couldn’t do earlier than, then it’s simply friction and value,” he stated.

De Patoul added that liquidity can also be essential for tokenized markets, noting that constant market-making turns tokenized belongings into usable monetary instruments.

Journal: Secrets and techniques of crypto founders below 25 who’re making financial institution