HBAR Beneficial properties 2.1% With Give attention to ETF Evaluation, Sustainability Push, and AI Developer Instruments

Hedera’s native token HBAR

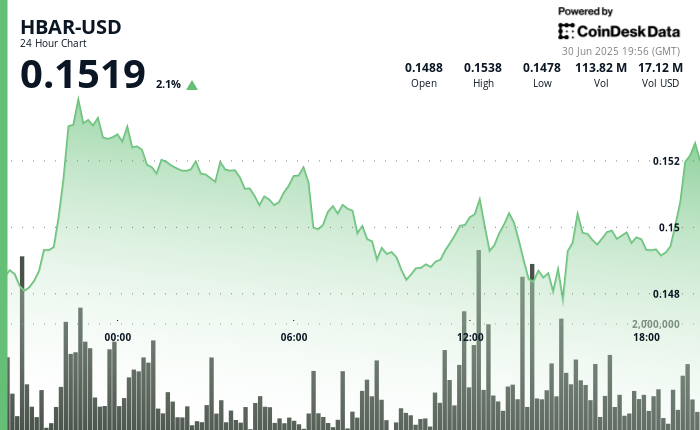

prolonged its rally on Sunday, buying and selling up 2.1% to $0.1519 as of 19:56 UTC on June 30, in response to CoinDesk Analysis’s technical evaluation mannequin.

The transfer follows a flurry of ecosystem updates that broaden Hedera’s enterprise attain and reinforce its rising footprint in AI, gaming, and sustainability.

On June 24, Blockchain for Vitality (B4E), a nonprofit targeted on sustainability information administration within the vitality sector, formally joined the Hedera Governing Council. B4E already runs its carbon monitoring platform on the Hedera community, and its addition brings area experience in emissions reporting and digital MRV (measurement, reporting, and verification) requirements. As a council member, B4E will run its personal node and contribute to governance choices—significantly these aligned with environmental transparency and enterprise accountability.

Simply two days later, Hedera unveiled its AI Studio, an open-source software program improvement equipment designed to assist builders construct decentralized functions powered by synthetic intelligence. The suite contains an Agent Equipment that integrates with LangChain and allows AI brokers to work together immediately with Hedera’s consensus and token companies utilizing pure language instructions. The aim is to decrease the barrier for AI-native apps whereas sustaining onchain auditability, transparency, and regulatory alignment.

On the gaming entrance, Hedera Basis introduced on June 19 a partnership with The Binary Holdings (TBH), a Web3 infrastructure agency. The collaboration goals to carry Hedera-based gaming apps to cell customers in Southeast Asia by way of OneWave, TBH’s decentralized app retailer. Built-in into native telecom platforms throughout Indonesia and the Philippines, OneWave is predicted to onboard over 169 million customers with built-in Web3 rewards and onchain verification.

In the meantime, in mid-June, the U.S. Securities and Trade Fee started a proper overview of the Canary HBAR ETF, which might provide direct publicity to HBAR by way of a regulated funding car. A public remark interval is now open forward of the SEC’s July 7 deadline. If accepted, the ETF may catalyze broader institutional entry and additional legitimize HBAR’s function in capital markets—although regulatory scrutiny stays excessive, and analysts stay divided on long-term token utility.

Technical Evaluation Highlights

- HBAR traded in a 4.1% vary from $0.1478 to $0.1538 between June 29 19:00 UTC and June 30 18:59 UTC.

- A powerful breakout occurred through the 22:00 hour on June 29, with value surging to $0.154 on quantity of 104.5M models.

- Main assist fashioned at $0.148 between 14:00–15:00 UTC on June 30, with 80.6M models traded.

- From 18:00–18:59 UTC on June 30, HBAR confirmed a V-shaped restoration, dipping to $0.149 earlier than rebounding.

- Through the 18:20–18:21 UTC window on June 30, value stabilized with 1.3M in quantity, forming short-term assist at $0.149.

- As of 19:56 UTC on June 30, HBAR traded at $0.1519, up 2.1% for the day with resistance seen at $0.1538.

Disclaimer: Components of this text had been generated with the help from AI instruments and reviewed by our editorial crew to make sure accuracy and adherence to our requirements. For extra data, see CoinDesk’s full AI Coverage.