The crypto markets skilled a comparatively calm day on Friday regardless of a renewal of the specter of tariffs.

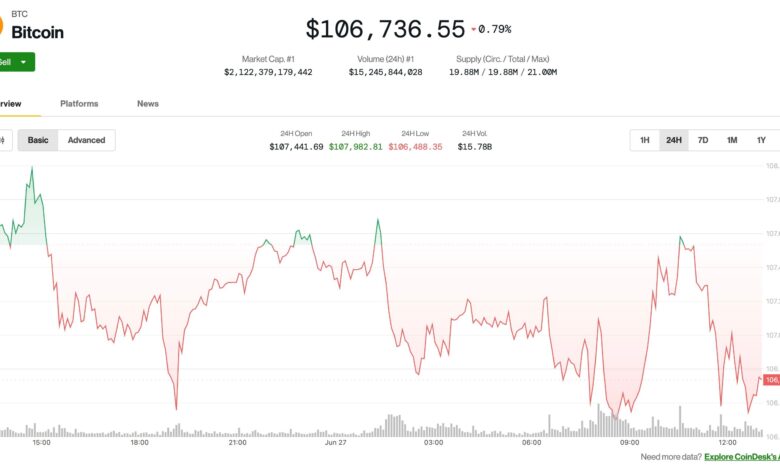

Bitcoin

is down 0.7% within the final 24 hours, now buying and selling for $106,700, in keeping with CoinDesk market knowledge.

The orange coin’s efficiency was broadly in step with the CoinDesk 20’s — an index of the highest 20 cryptocurrencies by market capitalization, aside from stablecoins, memecoins, and alternate cash — which fell 0.7% in the identical time frame. Sui

was the index’s token that skilled the largest worth change both means, and it solely rose 3.3%.

Crypto shares noticed extra important strikes, with Coinbase (COIN) and Circle (CRCL) shedding 6% and 16% respectively. The stablecoin issuer’s inventory is down 40% because it topped at nearly $300 on Monday.

Bitcoin miners remained comparatively flat on the day, together with Core Scientific (CORZ), which rose greater than 30% on Thursday off a report that AI Hyperscaler CoreWeave was wanting into buying the corporate, though Hut 8 (HUT) fell 6.5%.

The gentle worth motion contrasted with the prospect of the White Home’s tariff technique kicking into excessive gear once more. U.S. President Donald Trump introduced that his administration can be terminating all commerce discussions with Canada in gentle of the Digital Companies Tax the nation goals to impose on U.S. tech companies.

“We’ll let Canada know the Tariff that they are going to be paying to do enterprise with the US of America inside the subsequent seven-day interval,” Trump posted.

The pause on reciprocal tariffs can be slated to finish on July 9, however neither conventional markets nor crypto appear significantly involved, Coinbase analysts famous in a analysis report.

“[Markets] have largely disregarded the potential financial dangers stemming from this example… partly as a result of this hasn’t essentially been mirrored within the financial knowledge,” the analysts wrote.

The complacency round tariffs will possible proceed, they mentioned, as a result of they’re unlikely to be as inflationary as beforehand anticipated.