Former Bitcoin mining agency Bit Digital fell sharply this week, with its share worth tumbling practically 19% in a five-day interval to shut at $1.99 on June 27, a 15% drop in simply 24 hours.

The plunge follows main bulletins from Bit Digital, together with a $150 million public providing and a strategic pivot to Ethereum staking. On Thursday, the corporate introduced a large public providing, issuing 75 million atypical shares to lift $150 million.

Bit Digital stated it intends to subject 75 million atypical shares priced at $2 every. The proceeds from the gross sales shall be used to buy Ether (ETH), doubling down on its earlier determination to shift to an Ethereum-focused firm.

After the information, the corporate’s inventory dipped to as little as $1.86 earlier than recovering barely throughout after-hours buying and selling.

Bit Digital pivots into an ETH staking and treasury firm

The information follows the corporate’s determination to ditch Bitcoin (BTC) for ETH earlier this week. On Wednesday, the corporate revealed it might transition right into a “pure-play Ethereum staking and treasury firm,” targeted on rising its ETH holdings.

The corporate stated it had amassed ETH for its treasury reserves and had began its staking infrastructure in 2022. It additionally stated it plans to liquidate its Bitcoin holdings to buy extra ETH.

As of March 31, Bit Digital held 24,434 ETH and 417 BTC, valued at round $44.6 million and $34.5 million, respectively.

When it converts all of its BTC into ETH, the corporate would have roughly 42,000 ETH, value about $103 million at present market costs.

Associated: Bitcoin mining agency Bit Digital stories revenues up practically 40%

Bit Digital inventory dips 19% in 5 days

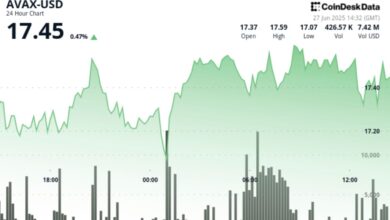

Buyers reacted unfavorably to the shift. Bit Digital shares dropped practically 4% on June 25 following the ETH pivot announcement.

All through the week, the corporate’s inventory costs declined by practically 19%, going from a excessive of $2.40 to a low of $1.86 on Friday. Regardless of the response, the corporate confirmed no indicators of stopping its transfer into ETH.

Bit Digital was the Twelfth-largest Bitcoin mining firm by market capitalization. Nevertheless, since its ETH pivot, CompaniesMarketCap exhibits a drop to the thirteenth spot. The information additionally exhibits that its inventory costs have declined by over 40% this 12 months.

Cointelegraph reached out to Bit Digital for feedback however didn’t get a response by publication.

Journal: New York’s PubKey Bitcoin bar will orange-pill Washington DC subsequent