Sui

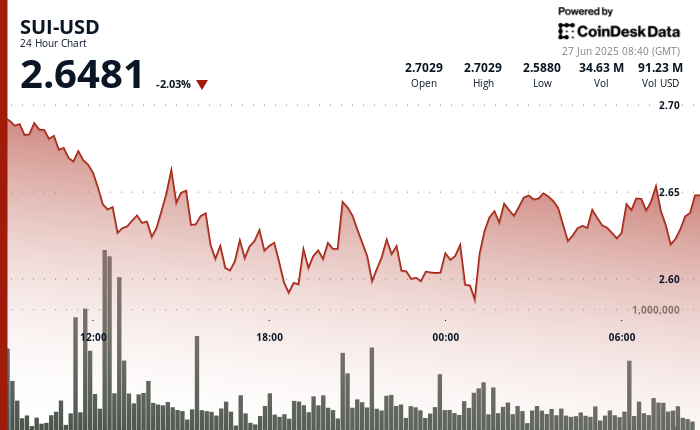

is buying and selling at $2.6481, down 2.03% prior to now 24 hours, after rebounding from the $2.58–$2.60 assist vary throughout the June 26–27 session, in keeping with CoinDesk Analysis’s technical evaluation mannequin.

The bounce adopted a steep intraday decline from $2.70 to $2.58 however was supported by renewed quantity and improved sentiment tied to institutional curiosity.

A key improvement got here by way of Lion Group Holding Ltd. (LGHL), which on June 26 introduced its intention to accumulate SUI tokens as a part of a broader $600 million crypto treasury technique.

In a press launch, the Singapore-based Nasdaq-listed agency confirmed a $2 million acquisition of HYPE tokens at a median worth of $37.30, marking the primary strategic buy underneath this program. The corporate additionally stated it intends to make use of future proceeds from its convertible debenture facility to buy SOLand SUI.

CEO Wilson Wang described HYPE as a “foundational execution-first asset” and stated LGHL views it as core infrastructure for the way forward for capital markets. The agency plans to make use of no less than 75% of the online proceeds from every closing of its convertible facility for token acquisitions, together with SUI, and the remainder for broader crypto operations and dealing capital.

Lion Group operates a multi-asset buying and selling platform providing providers corresponding to whole return swaps (TRS), contracts-for-difference (CFDs), OTC inventory choices, and brokerage for securities and futures. The agency emphasised its rising dedication to layer-1 blockchain ecosystems and stated it would proceed updating the market on additional treasury reserve developments.

This announcement follows heightened exercise within the SUI ecosystem, together with sturdy shopping for on the $2.60 degree and a late-session V-shaped restoration on elevated quantity, which helped push the token towards its present worth. Analysts stay cautious, noting resistance round $2.66, however short-term sentiment seems to have improved.

Technical Evaluation Highlights

- SUI traded inside a 24-hour vary of $2.58 to $2.70, exhibiting a 4.5% decline from peak to trough.

- A brief backside fashioned at $2.58 throughout the 21:00 UTC session on June 26, adopted by accumulation indicators.

- A number of rejection wicks emerged close to $2.66, confirming short-term resistance throughout the 09:00–11:00 UTC window on June 27.

- A minor bullish reversal sample appeared from 07:51 to 08:24 UTC on June 27, with a 0.9% restoration from $2.61 to $2.63.

- A sequence of upper lows developed from 01:00 to 08:00 UTC on June 27, signaling gradual shift in momentum.

- Quantity spiked 18% above the 24-hour common throughout the restoration part beginning 08:00 UTC on June 27, reinforcing assist at $2.60.

Disclaimer: Elements of this text had been generated with the help from AI instruments and reviewed by our editorial crew to make sure accuracy and adherence to our requirements. For extra info, see CoinDesk’s full AI Coverage.