Crypto software program agency Bakkt Holdings Inc. is seeking to elevate as much as $1 billion by way of varied forms of securities choices, which might be used to fund Bitcoin purchases.

The corporate, a subsidiary of The Intercontinental Trade, which owns the New York Inventory Trade, filed a Kind S-3 with the US Securities and Trade Fee on Thursday, revealing its intentions to supply frequent inventory and securities.

The agency stated it may subject as much as $1 billion of any mixture of Class A typical inventory, most popular inventory, debt securities, warrants, or mixtures of those property.

The submitting said that Bakkt up to date its funding coverage earlier this month “to allow us to allocate capital into Bitcoin and different digital property as a part of our broader treasury and company technique,” however it has but to make its first buy.

“We could purchase Bitcoin or different digital property utilizing extra money, proceeds from future fairness or debt financings, or different capital sources,” the submitting added.

The so-called shelf registration permits Bakkt to rapidly entry capital markets when situations are favorable, which is especially essential given their historical past of losses and going concern points.

Bakkt’s going concern points

Bakkt, based in 2018, admitted within the submitting that it had a “restricted working historical past and a historical past of working losses.”

The submitting additionally contained a really particular warning about future operations in that it had “recognized situations and occasions that raised substantial doubt about our capacity to proceed as a going concern.”

Associated: Bakkt names new co-CEO amid re-focus on crypto choices

The agency confirmed that the timing and magnitude of any crypto purchases will rely upon market situations, capital market receptivity, enterprise efficiency, and different strategic issues.

Bakkt share worth woes

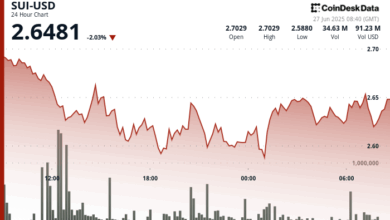

The NYSE-listed Bakkt noticed its share worth rise 3% on Thursday to achieve $13.33, in keeping with Google Finance. Nevertheless, the inventory is down 46% for the reason that begin of the yr.

Bakkt shares tanked 30% in March after the corporate revealed that two of its largest shoppers, Financial institution of America and Webull, weren’t renewing their industrial agreements.

Bakkt bullish on crypto IPOs

The agency commented on X on the current slate of crypto IPO filings, reminiscent of these from Circle, eToro and Gemini, saying they “are simply the most recent in a string of strikes that recommend actual momentum is constructing once more in digital property.”

“These developments convey validation, visibility, and maturity to the market,” they added.

Journal: North Korea crypto hackers faucet ChatGPT, Malaysia street cash siphoned: Asia Specific