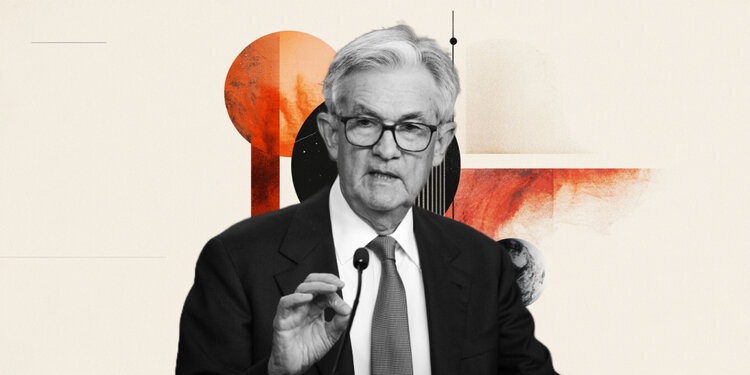

Federal Reserve (Fed) Chair Jerome Powell added additional feedback throughout his testimony earlier than the congressional finances committee on Tuesday, constructing out his case for holding off on price cuts, possible till someday within the fourth quarter.

Key highlights

When the time is correct, count on price cuts to proceed.

Knowledge suggests at the least a few of tariff will hit shopper.

I believe we’ll begin to see extra tariff inflation beginning in June.

We shall be studying as we undergo the summer time.

I am completely open to the concept tariff-inflation move by shall be lower than we predict.

We do not must be in any rush.

If it seems inflation pressures are contained, we are going to get to a spot the place we reduce charges.

I will not level to a selected month.

The Fed simply attempting to watch out and cautious with inflation.

It is uncertainty in regards to the dimension and potential persistence of inflation from tariffs.

The financial system is slowing this 12 months. Immigration is one purpose.

Shock absorber from US oil trade is in query now.

The Fed would have a look at the general state of affairs if oil costs surge.

The greenback goes to be the reserve forex for a very long time.

I do not suppose MBS runoff has a big influence on housing price.

As soon as we get there, we are able to react extra strongly to downturns within the financial system.

I believe the Fed is on proper observe in shrinking stability sheet.

The Fed has some shrinking left to do on stability sheet.

Credit score circumstances for small enterprise a little bit bit tight.

We might count on to see significant tariff inflation results in June, July or August.

If we do not see that, that will result in reducing earlier.

Proper now, we’re in watch and wait mode.

General, the inflation image is definitely fairly constructive.