World oil markets are on excessive alert following U.S. airstrikes on three of Iran’s nuclear services, Fordow, Isfahan, and Natanz, with fears mounting over a possible closure of the essential Strait of Hormuz. The army motion, introduced by President Donald Trump final evening, has intensified geopolitical tensions within the Center East and raised issues a couple of sharp spike in oil costs.

The Strait of Hormuz is a slim sea passage between the Persian Gulf and the Gulf of Oman. It supplies the one water entry from the Persian Gulf to the open ocean and has traditionally been one of the vital strategically necessary transport bottlenecks.

Roughly 20% of the world’s oil provide flows by way of the Strait. Any disruption to it might ship crude costs hovering to $120–$130 per barrel, threatening international financial stability and stoking inflation, since hovering oil costs translate into larger prices of on a regular basis items for customers.

Regardless of the U.S. becoming a member of forces with Israel final evening to assault Iran’s nuclear program, the worldwide benchmark Brent crude stays comparatively steady for now, buying and selling at round $72 per barrel. The scenario stays extremely risky as markets await additional readability on Iran’s response and the standing of the Strait.

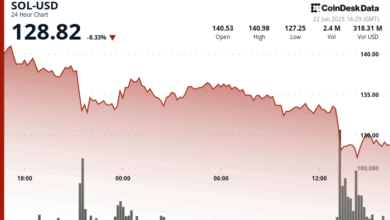

Since information of the strikes, the worth of Bitcoin has proven resilience, at the moment buying and selling above $102,600 and remaining regular whilst conventional markets brace for potential shocks. This stability reinforces the rising notion amongst buyers that Bitcoin is not only a speculative asset however is more and more being acknowledged as a safe-haven choice in occasions of geopolitical turmoil.

Bitcoin’s fastened provide, decentralized nature, and rising adoption have contributed to its new position as a hedge towards inflation and international instability. As oil costs and conventional property face turbulence, Bitcoin’s calm efficiency means that it’s more and more being considered as a complementary risk-off alongside gold. It is a pattern that can seemingly strengthen as the worldwide financial system turns into more and more digital and interconnected.

Furthermore, because the Bitcoin and crypto markets are open to commerce 24/7, they’re usually the primary to be bought off over the weekends as buyers flee to security. Bitcoin’s value barely flinching amid the information of the U.S. airstrikes demonstrates the simple maturation of the market.

Bitcoin Market Knowledge

On the time of press 2:10 pm UTC on Jun. 22, 2025, Bitcoin is ranked #1 by market cap and the worth is down 1.15% over the previous 24 hours. Bitcoin has a market capitalization of $2.04 trillion with a 24-hour buying and selling quantity of $48.7 billion. Be taught extra about Bitcoin ›

Crypto Market Abstract

On the time of press 2:10 pm UTC on Jun. 22, 2025, the whole crypto market is valued at at $3.14 trillion with a 24-hour quantity of $116.1 billion. Bitcoin dominance is at the moment at 65.02%. Be taught extra in regards to the crypto market ›