Europe is pulling forward within the world crypto race below its Markets in Crypto-Belongings (MiCA) framework, outpacing even President Donald Trump’s crypto-friendly America.

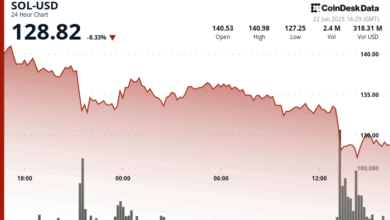

In response to Konstantins Vasilenko, co-founder and chief enterprise growth officer at Paybis, buying and selling volumes from EU prospects jumped 70% quarter-on-quarter in Q1 2025, proper after the MiCA regulation took impact.

Throughout the identical interval, Paybis exercise within the US began trending in the wrong way. Vasilenko advised Cointelegraph that whereas US retail exercise was declining, European customers have been putting bigger, extra deliberate trades.

Different platforms have reported comparable shifts in consumer habits. Kaiko estimates that solely 18% of Coinbase’s spot buying and selling quantity now comes from retail prospects, down from 40% in 2021. On Robinhood, crypto buying and selling quantity fell by 35% within the first quarter of 2025.

“The timing is tough to disregard,” stated Vasilenko. “MiCA’s licensing window opened on January 1, 2025; in that very quarter, our EU volumes jumped 70% whereas the variety of trades hardly moved, which tells me the brand new cash was bigger and extra deliberate.”

Associated: ‘Coverage procrastination’ leaves UK trailing EU, US in crypto regulation: Specialists

Crypto corporations safe MiCA licneses

A number of crypto corporations have already tailored their methods to align with MiCA. OKX, Crypto.com and Bybit have obtained licenses below the brand new framework, with Coinbase turning into the newest to achieve the license from the Luxembourg Fee de Surveillance du Secteur Financier.

The renewed investor confidence in Europe is pushed by key options of MiCA, in keeping with Vasilenko. For one, the MiCA framework launched a single licensing regime throughout all EU member states. As soon as licensed in a single nation, crypto corporations can function all through the bloc.

“As soon as a crypto-asset service supplier is allowed in any member state, it may well “passport” the identical license throughout the remainder of the states, so retail purchasers know their authorized protections journey with them,” Vasilenko stated.

Moreover, MiCA enforces strict guidelines on stablecoins, requiring full 1:1 reserves, audits, and asset segregation. It additionally introduces MiFID-style protections like clear disclosures, cooling-off durations, and clear charges, decreasing uncertainty for buyers.

Alternatively, within the US, persistent regulatory confusion continues to carry the market again. Regardless of favorable rhetoric from President Trump and members of his administration, no sweeping federal crypto laws has materialized.

“State-by-state money-service licenses, unresolved SEC lawsuits, and sudden delistings imply strange customers nonetheless can’t inform which cash, and even which staking merchandise, shall be accessible subsequent month,” Vasilenko stated.

Associated: EU to ban nameless crypto accounts and privateness cash by 2027

France emerges as standout

France, specifically, has emerged as a standout in Europe. Vasilenko stated Paybis noticed a 175% spike in crypto exercise within the nation, thanks partly to its head begin below the 2019 PACTE legislation, which already required AML registration for exchanges.

The presence of high fintech hubs like Station F and the AMF’s proactive regulatory stance have helped make France one among Europe’s most crypto-engaged nations, with penetration anticipated to succeed in 24% of the inhabitants this 12 months.

Germany leads in institutional infrastructure, with Deutsche Boerse’s Clearstream set to supply crypto settlement providers. The Netherlands, in the meantime, continues to punch above its weight with robust cost connectivity.

In response to Vasilenko, the thought of a single “hub” might turn out to be outdated. “Liquidity swimming pools in Frankfurt or Paris, buyer assist in Dublin, and compliance ops in Vilnius — all below the only MiCA umbrella,” he stated.

The US might nonetheless see a comeback. The GENIUS Act, at the moment making its means by means of Congress, might introduce a unified licensing regime and clear definitions for dollar-backed stablecoins. If handed by year-end, Vasilenko believes it “would do for US retail what MiCA simply did for Europeans.”

Journal: Historical past suggests Bitcoin faucets $330K, crypto ETF odds hit 90%: Hodler’s Digest, June 15 – 21