Spain’s second-largest financial institution, BBVA (Banco Bilbao Vizcaya Argentaria), has suggested its prosperous purchasers to allocate a few of their funding portfolio to put money into crypto.

BBVA advised its rich purchasers to speculate between 3% to 7% of their portfolio into crypto and Bitcoin (BTC), relying on their desired threat publicity, Reuters reported on Tuesday, citing an organization government.

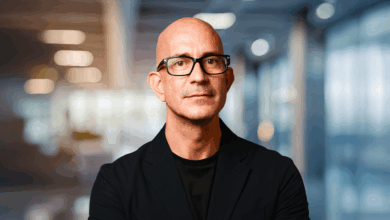

“With personal prospects, since September final yr, we began advising on Bitcoin,” Philippe Meyer, head of digital and blockchain options at BBVA Switzerland, mentioned at a convention in London. He added that the portfolio allocation has now been elevated for riskier profiles.

Meyer mentioned purchasers had been receptive to the financial institution’s recommendation and dismissed considerations that the asset was too dangerous. “In case you take a look at a balanced portfolio, should you introduce 3%, you already enhance the efficiency. At 3%, you aren’t taking an enormous threat,” he mentioned.

BBVA’s transfer comes amid continued warnings from European Union regulators and the bloc’s central financial institution on crypto dangers, and whereas 95% of EU banks are avoiding crypto actions in response to the European Securities and Markets Authority (ESMA).

BBVA will get regulatory nod in Spain for crypto

BBVA has been executing crypto trades since 2021 and moved to lively advisory in late 2024, positioning itself forward of most conventional banks.

In March, Spain’s securities regulator allowed the financial institution to supply Bitcoin (BTC) and Ether (ETH) buying and selling within the nation.

BBVA’s crypto choices had been launched in a phased rollout to pick purchasers first, and can allow customers to purchase, promote, and handle digital property by means of its cell app within the coming months.

Affect of MiCA

BBVA’s growth into crypto got here because the European Markets in Crypto-Property Regulation (MiCA) reached full implementation on the finish of 2024.

Associated: Europe gears as much as regulate DeFi in 2026 as MiCA leaves sector in limbo

EU crypto corporations have till July 2026 to totally adjust to its stringent necessities beneath an 18-month transitional section.

Santander eyes stableoins

Different banks which are providing choose crypto buying and selling embrace Santander, which is mulling the issuance of its personal stablecoin and increasing retail crypto companies.

The financial institution is contemplating providing each greenback and euro-pegged stablecoins, in response to a Could report.

Journal: Will Bitcoin faucet $119K if oil holds? SharpLink buys $463M ETH: Hodler’s Digest