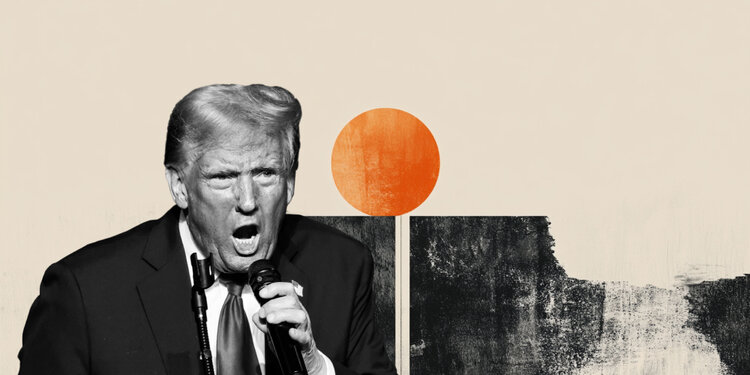

US President Donald Trump referred to as for the evacuation of Iran’s capital Tehran on Monday, hours after urging the nation’s leaders to just accept a deal to curb its nuclear program as Israel hinted that assaults would proceed, per Bloomberg

“Iran ought to have signed the ‘deal’ I instructed them to signal,” Trump wrote in a social media put up from a Group of Seven leaders’ summit in Alberta, Canada. “What a disgrace, and waste of human life. Merely acknowledged, IRAN CAN NOT HAVE A NUCLEAR WEAPON. I mentioned it time and again! Everybody ought to instantly evacuate Tehran!”

Market response

On the time of writing, the Gold value (XAU/USD) is buying and selling 0.13% greater on the day to commerce at $3,438.

Threat sentiment FAQs

On the planet of monetary jargon the 2 broadly used phrases “risk-on” and “threat off” consult with the extent of threat that buyers are prepared to abdomen through the interval referenced. In a “risk-on” market, buyers are optimistic in regards to the future and extra prepared to purchase dangerous belongings. In a “risk-off” market buyers begin to ‘play it secure’ as a result of they’re apprehensive in regards to the future, and due to this fact purchase much less dangerous belongings which might be extra sure of bringing a return, even whether it is comparatively modest.

Usually, during times of “risk-on”, inventory markets will rise, most commodities – besides Gold – will even achieve in worth, since they profit from a optimistic development outlook. The currencies of countries which might be heavy commodity exporters strengthen due to elevated demand, and Cryptocurrencies rise. In a “risk-off” market, Bonds go up – particularly main authorities Bonds – Gold shines, and safe-haven currencies such because the Japanese Yen, Swiss Franc and US Greenback all profit.

The Australian Greenback (AUD), the Canadian Greenback (CAD), the New Zealand Greenback (NZD) and minor FX just like the Ruble (RUB) and the South African Rand (ZAR), all are likely to rise in markets which might be “risk-on”. It’s because the economies of those currencies are closely reliant on commodity exports for development, and commodities are likely to rise in value throughout risk-on durations. It’s because buyers foresee higher demand for uncooked supplies sooner or later as a consequence of heightened financial exercise.

The foremost currencies that are likely to rise during times of “risk-off” are the US Greenback (USD), the Japanese Yen (JPY) and the Swiss Franc (CHF). The US Greenback, as a result of it’s the world’s reserve forex, and since in occasions of disaster buyers purchase US authorities debt, which is seen as secure as a result of the biggest economic system on the earth is unlikely to default. The Yen, from elevated demand for Japanese authorities bonds, as a result of a excessive proportion are held by home buyers who’re unlikely to dump them – even in a disaster. The Swiss Franc, as a result of strict Swiss banking legal guidelines provide buyers enhanced capital safety.