Litecoin

rallied greater than 2% on Monday, gaining floor as traders eye a doable spot exchange-traded fund (ETF) approval and navigate a shaky geopolitical backdrop.

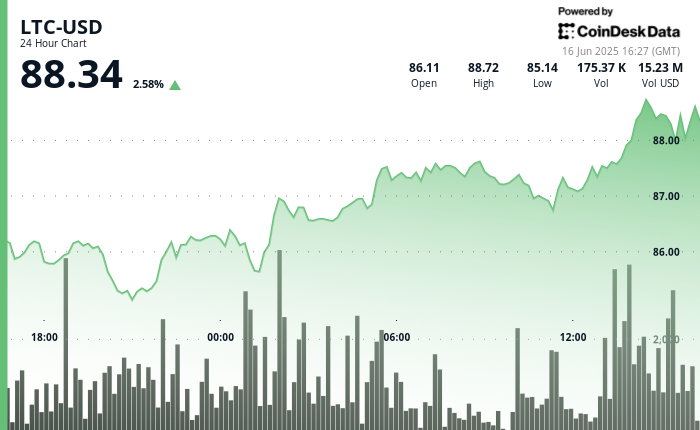

LTC rose from $85.05 to $88 in a 24-hour interval, an uptrend marked by increased lows and heavy quantity. The rise coincides with rising expectations that the U.S. Securities and Change Fee (SEC) may greenlight a spot ETF giving traders publicity to LTC.

In response to Bloomberg ETF analysts Eric Balchunas and James Seyffart, the chances of such an approval now stand at 90%, whereas merchants on Polymarket are weighing a 76% probability.

In the meantime, whales, wallets holding giant sums, have elevated their LTC holdings from 25.8 million to 27.8 million tokens since mid-April, based on blockchain information agency Santiment.

Technical Evaluation Overview

Litecoin’s value motion over the previous 24 hours exhibits a possible bullish reversal, based on CoinDesk Analysis’s technical evaluation information mannequin.

Its rise was marked by a sample of upper lows and better highs, typically related to rising demand, whereas important buying and selling exercise accompanied every leg up. Spikes in quantity, properly above day by day averages, counsel regular institutional curiosity relatively than sporadic retail enthusiasm.

Assist emerged close to the $86.50 vary, the place consumers stepped in repeatedly, and resistance close to $87.80 was finally damaged following a concentrated surge in trades, based on the mannequin.

Three distinct shopping for waves pushed LTC previous resistance ranges. Throughout one burst alone, almost 28,000 tokens modified arms, serving to flip earlier resistance into a brand new help flooring simply above $88.

Promoting stress tapered off following the transfer.

Disclaimer: Components of this text had been generated with the help from AI instruments and reviewed by our editorial group to make sure accuracy and adherence to our requirements. For extra info, see CoinDesk’s full AI Coverage.