The value of gold is nearing its all-time excessive as tensions within the Center East escalate, however analysts say they’re uncertain Bitcoin will do the identical as buyers prioritize different safe-haven belongings.

The value of gold rose to $3,450 per ounce on Monday, simply $50 shy of its all-time excessive of just under $3,500 in April, in line with TradingView.

The often slow-to-move asset has gained a whopping 30% for the reason that starting of the 12 months, catalyzed by US President Donald Trump’s commerce tariffs and, extra just lately, an escalation of navy motion within the Center East following an Israeli missile strike on Iran on June 13, which precipitated Bitcoin costs to fall.

Gold costs have additionally been linked with inflationary pressures, as it’s thought of a protected haven and an inflation hedge by buyers.

“Ought to extra information or feedback made by financial officers point out wider concern over inflation or rate of interest coverage, this worth might very simply tip into new, document territory,” CBS Information reported over the weekend.

Will Bitcoin observe swimsuit?

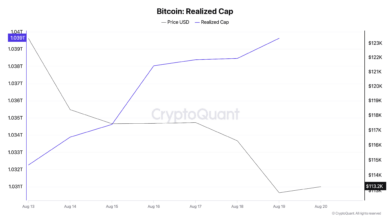

Comparatively, Bitcoin (BTC) has gained simply 13% year-to-date. It is usually flirting with its all-time excessive, buying and selling 5.3% under the $111,800 peak it reached on Might 22.

Nevertheless, IG Markets analyst Tony Sycamore advised Cointelegraph that Bitcoin nonetheless trades extra as a danger asset akin to US equities somewhat than as a protected haven like gold.

“In that sense, with US fairness futures rebounding strongly immediately from Friday’s sell-off, there may be room for Bitcoin to maneuver greater and play some catch-up to US fairness futures.”

He added that, offering Bitcoin holds above assist at $95,000 to $100,000, “I count on a retest of the $112,000 document excessive earlier than a transfer towards the $116,000 and $120,000 area.”

Brief-term positive aspects for oil and gold

Apollo Crypto analyst Henrik Andersson echoed the sentiment, telling Cointelegraph that “we’re seeing a restoration in fairness futures in addition to in Bitcoin after an preliminary sell-off on Friday associated to the information out of the Center East.”

Associated: What’s going to Bitcoin worth be if gold hits $5K?

Nevertheless, he added that within the quick time period, “oil and gold are more likely to proceed to maneuver in the wrong way to equities and Bitcoin.”

LVRG Analysis director Nick Ruck was of an identical opinion. Bitcoin’s “digital gold” narrative is “slowly fading” because it struggles to reflect gold’s rally, “with merchants as an alternative specializing in short-term volatility and liquidity situations, making BTC extra correlated to danger belongings than protected havens,” he advised Cointelegraph.

Looking forward to Fed assembly

“If danger sentiment shifts and buyers search for different shops of worth, Bitcoin might see renewed momentum within the coming weeks if this week’s Fed assembly is available in as anticipated for buyers,” mentioned Eugene Cheung, chief industrial officer at digital asset platform OSL.

Markets are looking forward to the US Federal Reserve’s coverage assembly and price determination on Wednesday, however futures markets nonetheless predict no change in charges on the coming assembly, with a 96.7% chance of them remaining at 4.25-4.50%.

Journal: Will Bitcoin faucet $119K if oil holds? SharpLink buys $463M ETH: Hodler’s Digest