As we speak information

2025-01-30 00:42:00

Getty Photographs

Getty PhotographsChancellor Rachel Reeves mentioned on Wednesday that “financial development is the primary mission of this authorities” as she unveiled a collection of proposals to spice up the UK’s financial system.

However how shortly may the federal government get development from the plans she introduced?

Critics have argued among the tasks – similar to increasing Heathrow – wouldn’t assist in the close to time period.

BBC Confirm has examined among the key numbers and claims.

How gradual is the UK’s development?

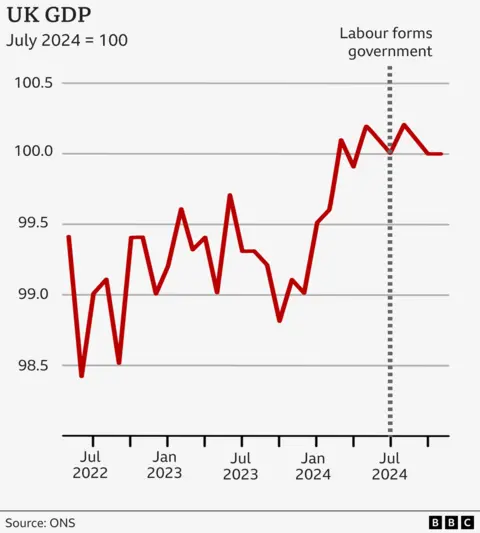

The newest official knowledge reveals there was nearly no development in GDP – the general dimension of the UK financial system – between the July 2024 election and November 2024.

And the newest medium time period official development forecast from the Workplace for Finances Responsiblity, the federal government’s official forecaster, is for 1.6% GDP development in 2029, which might be properly under the pre-2008 monetary disaster common development of two.8% a 12 months.

Nonetheless, the Worldwide Financial Fund has forecast that the UK’s development price for 2025 and 2026 will likely be increased than in France and Germany.

Decrease charges of GDP development would translate into slower development in our wages and incomes and basic residing requirements.

Heathrow enlargement

The chancellor mentioned that permitting Heathrow to construct a 3rd runway would “create 100,000 jobs”, increase funding and exports and “unlock futher development”.

She cited a brand new report by the consultancy Frontier Economics which discovered it may improve the UK’s potential GDP by 2050 by 0.43%, round £17bn.

That’s broadly consistent with the findings of an unbiased fee by Sir Howard Davies in 2015, which concluded a 3rd runway at Heathrow would assist UK commerce and improve productiveness and push up GDP by 0.65-0.75% by 2050 relative to in any other case.

Nonetheless, most analysts consider it could possible take a few years earlier than shovels went into the bottom to start out constructing a brand new runway, even with new reforms to hurry up the planning course of.

And the federal government can have a troublesome balancing act to each broaden Heathrow and meet its local weather targets.

BBC Confirm requested the Treasury for its supply for the 100,000 jobs determine and it pointed to a 2017 report by the Division for Transport estimating {that a} new runway at Heathrow may add between 57,000 and 114,000 extra native jobs. Although that report added that “these jobs will not be extra on the nationwide stage, as some jobs might have been displaced from different airports or different sectors.”

Oxford-Cambridge Progress Hall

The chancellor in her speech claimed an Oxford and Cambridge Progress Hall “may add as much as £78bn to the UK financial system by 2035”.

This hall is a resurrection of the earlier authorities’s plans to affix Oxford and Cambridge with new transport hyperlinks and permit these two college and analysis hubs to broaden.

In assist of the chancellor’s determine, the Treasury has cited analysis by an trade group referred to as the Oxford-Cambridge Supercluster.

This analysis reveals that this £78bn is a “cumulative determine” over 10 years, not the increase in a given 12 months.

The evaluation suggests the venture may add £25bn in Gross Worth Added (GVA) a 12 months to the UK financial system by 2035.

That will represent roughly a everlasting 1% increase to UK GDP by that date.

EPA

EPAEstimates of the impacts of an infrastructure venture on development are inherently unsure and really delicate to the assumptions of researchers about what would have occurred to development if it had by no means been constructed.

But most economists do consider infrastructure tasks, particularly those who permit already productive locations to broaden, will finally assist the UK financial system develop extra quickly than in any other case.

Ben Caswell, a senior economist at The Nationwide Institute of Financial and Social Analysis (Niesr), mentioned: “Massive infrastructure tasks usually ship development over the long run, roughly 10 to twenty years.”

“There could also be a small demand facet increase within the quick time period when shovels are within the floor, however nothing so vital that you’d see it in headline GDP development figures.

“Nonetheless, after the venture is full, the availability capability of the financial system is completely enhanced, and, all different issues equal, that delivers increased sustained GDP development than would have in any other case been.”

Pensions reform

One other reform the chancellor says will likely be pro-growth is enabling UK corporations to entry the funds from their “outlined profit pension” pots, held on behalf of their workforces to fund their retirement.

Outlined profit pension schemes assure an annual pension cost to retired staff, primarily based on their wage whereas they have been in work.

Many of those outlined profit pension pots have moved into surplus lately as a result of rise in rates of interest for the reason that pandemic, that means their monetary property (their investments) are higher than their monetary liabilities (what they must pay out to pensioners).

The Treasury has mentioned that roughly 75% of schemes are actually in surplus and that the full surplus provides as much as £160bn.

The chancellor desires to legislate to permit the corporations to make use of these funds to take a position, whereas preserving safeguards to guard and assure staff’ pension pay-outs.

Measuring the scale of the excess of outlined profit scheme is dependent upon varied advanced assumptions concerning the scheme and its relationship to the employer.

The official Pension Regulator estimates that on one measurement the scale in September 2024 was £207bn, however £137bn on a special measurement.

The Treasury’s estimate is roughly halfway between the 2.

If such sums have been deployed that might, in concept, make a optimistic distinction to total UK enterprise funding, which is regarded by economists as each a brief time period and a long run driver of GDP development.

Whole enterprise funding in 2023, in line with official knowledge, was £258bn.

However the dimension of any increase from this pension reform would rely on corporations being keen to take a position their surpluses, which is topic to nice uncertainty as many corporations have been trying to offload their outlined profit pension schemes to insurance coverage corporations lately.