- GBP/USD misplaced momentum on Tuesday, churning territory close to the 1.3500 deal with.

- US information helped bolster investor sentiment after job openings got here in increased than anticipated.

- Key US ISM Companies PMI figures from April are slated for Wednesday.

GBP/USD trimmed bullish momentum on Tuesday, settling into slim chart churn simply north of 1.3500. The Financial institution of England’s (BoE) newest Financial Coverage Report hearings earlier than British parliament did little to impress Cable merchants, and market sentiment is pinned within the center as merchants hope for a cooling of US-China commerce tensions.

Traders proceed to financial institution on an eventual commerce deal between President Trump and China’s Xi Jinping, regardless of still-escalating commerce tensions as the 2 sides lob accusations of violating preliminary commerce settlement phrases. Trump administration workers proceed to insist that Trump and Xi might be talking immediately quickly, however particular particulars stay restricted.

JOLTS Job Openings rose to 7.391M in April, flouting the forecast backslide to 7.1M. On the opposite facet of the information coin, US Manufacturing facility Orders contracted greater than anticipated in April, falling 3.7% MoM, their lowest determine in 15 months. The earlier month additionally noticed a pointy downward revision, slipping to three.4% from the preliminary print of 4.3%.

US ISM Companies Buying Managers Index (PMI) survey outcomes are due on Thursday, and traders are hoping for a slight restoration in combination enterprise operator sentiment. Could’s ISM Companies PMI print is forecast to rise to 52.0 from April’s 51.6.

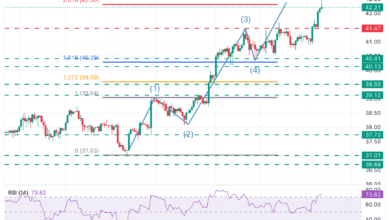

GBP/USD value forecast

GBP/USD discovered intraday technical help from the 1.3500 deal with, serving to to maintain bids bolstered by way of a middling market session. Cable bulls are starting to point out indicators of pressure from retaining value motion elevated, however the quick facet is wanting equally weak because the pair runs nicely forward of key long-term transferring averages.

GBP/USD each day chart

Pound Sterling FAQs

The Pound Sterling (GBP) is the oldest foreign money on the earth (886 AD) and the official foreign money of the UK. It’s the fourth most traded unit for overseas change (FX) on the earth, accounting for 12% of all transactions, averaging $630 billion a day, in line with 2022 information.

Its key buying and selling pairs are GBP/USD, also called ‘Cable’, which accounts for 11% of FX, GBP/JPY, or the ‘Dragon’ as it’s identified by merchants (3%), and EUR/GBP (2%). The Pound Sterling is issued by the Financial institution of England (BoE).

The only most essential issue influencing the worth of the Pound Sterling is financial coverage determined by the Financial institution of England. The BoE bases its selections on whether or not it has achieved its major aim of “value stability” – a gentle inflation fee of round 2%. Its major instrument for attaining that is the adjustment of rates of interest.

When inflation is just too excessive, the BoE will attempt to rein it in by elevating rates of interest, making it dearer for folks and companies to entry credit score. That is typically constructive for GBP, as increased rates of interest make the UK a extra enticing place for world traders to park their cash.

When inflation falls too low it’s a signal financial development is slowing. On this situation, the BoE will take into account reducing rates of interest to cheapen credit score so companies will borrow extra to put money into growth-generating initiatives.

Information releases gauge the well being of the economic system and might influence the worth of the Pound Sterling. Indicators equivalent to GDP, Manufacturing and Companies PMIs, and employment can all affect the path of the GBP.

A powerful economic system is sweet for Sterling. Not solely does it appeal to extra overseas funding however it might encourage the BoE to place up rates of interest, which can immediately strengthen GBP. In any other case, if financial information is weak, the Pound Sterling is more likely to fall.

One other vital information launch for the Pound Sterling is the Commerce Stability. This indicator measures the distinction between what a rustic earns from its exports and what it spends on imports over a given interval.

If a rustic produces extremely sought-after exports, its foreign money will profit purely from the additional demand created from overseas consumers searching for to buy these items. Due to this fact, a constructive internet Commerce Stability strengthens a foreign money and vice versa for a detrimental steadiness.