Binance co-founder Changpeng “CZ” Zhao has proposed making a darkish pool perpetual swap decentralized trade (DEX) to stop market manipulation.

In a June 1 X publish, Zhao stated that he has “all the time been puzzled with the truth that everybody can see your orders in real-time on a DEX.”

“The issue is worse on a perp DEX the place there are liquidations,” he stated.

Zhao added that “in the event you’re trying to buy $1 billion price of a coin, you typically wouldn’t need others to note your order till it’s accomplished.” That is to stop front-running and most extractable worth (MEV) bot assaults, which lead to elevated slippage, worse costs and better prices.

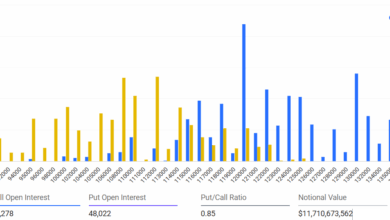

His feedback observe the liquidation of almost $100 million in Bitcoin lengthy positions on Hyperliquid, reportedly held by a dealer referred to as James Wynn. The occasion, which occurred after Bitcoin fell beneath $105,000, sparked claims on X that some customers had coordinated to “hunt” Wynn’s liquidation.

One X consumer claimed that Tron co-founder Justin Solar confirmed curiosity in collaborating, however the declare stays unconfirmed. He additionally went as far as to ask Eric Trump, the son of the USA’ President Donald Trump, to the group.

Associated: Monetary freedom means stopping crypto MEV assaults — Shutter Community contributor

What are darkish swimming pools?

Zhao stated that “massive merchants in TradFi use darkish swimming pools, which are sometimes 10 instances greater” than conventional, clear swimming pools. Darkish swimming pools are personal buying and selling venues the place massive orders are hidden from public view till after they’re executed.

This prevents front-running, slippage and MEV assaults by concealing order dimension, worth and intent. Nonetheless, implementing decentralized darkish swimming pools requires complicated techniques, corresponding to zero-knowledge proofs (ZK-proofs) or delayed settlement mechanisms.

Associated: Defending Web3 consumer’s integrity by stopping malicious MEV — Right here’s how

Commerce privateness is vital to derivatives

Zhao argued that privateness is especially essential in derivatives markets. He stated public visibility of liquidation ranges exposes massive merchants to coordinated assaults that might drive untimely liquidation:

“If others can see your liquidation level, they might attempt to push the market to liquidate you. Even in the event you received a billion {dollars}, others can gang up on you.“

The Binance co-founder admitted that there are counter-arguments to such designs, with the added transparency probably permitting market makers to soak up massive orders. He stated that that is “probably true.”

“I received’t get into an argument on which is correct or improper. Completely different merchants might choose several types of markets,“ he stated.

Zhao concluded by encouraging builders to launch an onchain darkish pool decentralized trade with perpetual swaps. He stated that this could possibly be achieved “both by not exhibiting the orderbook, and even higher not exhibiting deposits into sensible contracts in any respect, or till a lot later.”

Journal: How crypto bots are ruining crypto — together with auto memecoin rug pulls