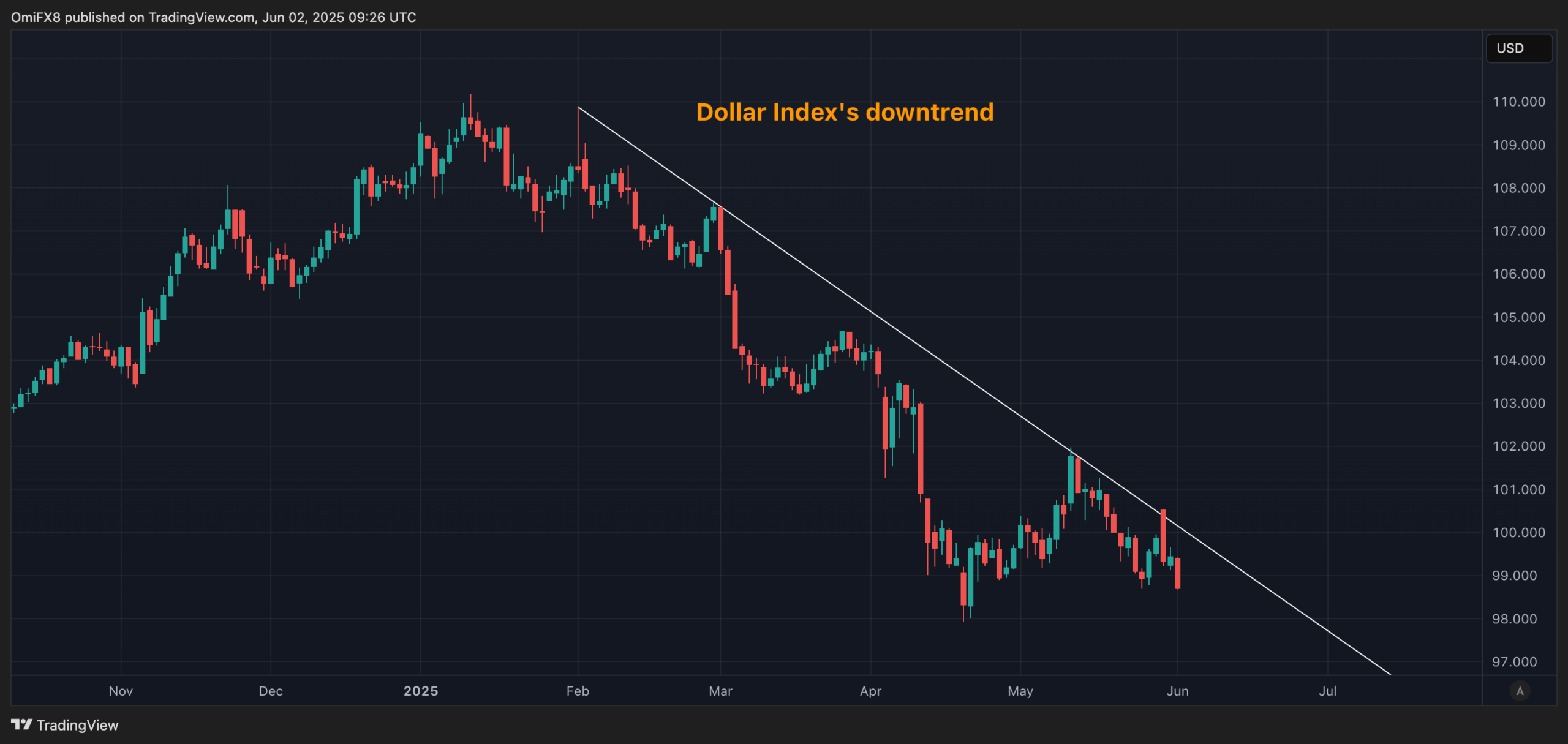

Financial institution of America has warned that the U.S. greenback may very well be in for a tough summer time, having already dropped sharply this yr.

The greenback index, which tracks the worth of the U.S. greenback towards main currencies, has dropped almost 9% to 99.74 this yr, as President Donald Trump’s tariff conflict triggered a shift away from U.S. property.

Financial institution of America expects continued data-driven drubbing over the Summer time. Weak spot within the U.S. greenback is extensively seen as constructive for dollar-denominated property, reminiscent of gold and bitcoin

.

The worldwide FX analysis staff led by Athanasios Vamvakidis acknowledged in a report back to shoppers Friday that tariffs are extra detrimental to the U.S. financial system because the nation trades extra with the remainder of the world than maybe every other nation.

The report acknowledged latest resilience within the U.S. financial system and growth-supportive developments, reminiscent of President Donald Trump’s tax cuts and the abandonment of utmost fiscal spending cuts, however acknowledged that “negatives dominate.”

“Coverage uncertainty on a number of fronts stays. Firms might pause hiring and funding plans till there may be larger readability. In most eventualities, we see tariffs a lot larger than the start line, with present ranges being the minimal,” the report mentioned.

It added that the market is reacting negatively to the loosening of fiscal coverage at a time when debt ranges are at report highs, resulting in larger borrowing prices. In the meantime, the Federal Reserve is unable to take vital motion because of rising inflation expectations.

“Migration flows have collapsed. Demand elevated in Q1 [front running] forward of tariffs however could also be about to fall,” strategists famous, pointing to weak spot in high-frequency indicators such because the ISM information and weekly Dallas Fed financial index.

The weekly Dallas Fed financial index has resumed the downtrend following the transient spike in early April and hit the bottom since December, based on information supply TradingView.

“Such high-frequency indicators are usually very noisy however may nonetheless level to a slowdown of the financial system within the coming months,” strategists mentioned.