Webus Worldwide revealed a plan on Could 29 to boost as much as $300 million by means of non-equity financing and deploy the capital into an XRP reserve that can assist the corporate’s world chauffeur companies funds community.

The Chinese language AI-powered mobility agency acknowledged that it might make the most of current money, industrial financial institution loans, shareholder ensures, and institutional credit score traces to assemble the reserve with out issuing new shares.

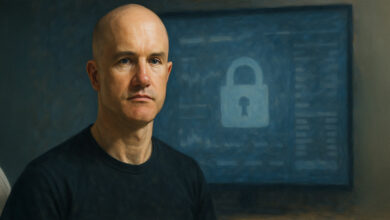

CEO Nan Zheng instructed buyers the technique seeks to protect fairness worth whereas enabling on the spot cross-border settlements, on-chain reserving data, and a Web3 loyalty program.

Broad initiatives

The proposed reserve represents the primary of three initiatives financed by the bundle. The others embody the event of a proprietary blockchain infrastructure and the acceleration of abroad growth.

Administration didn’t specify a timeline for closing the amenities or buying XRP. Nonetheless, it emphasised that non-equity devices give Webus latitude to regulate the reserve measurement in accordance with market circumstances.

Webus indicated it should couple the reserve with in-house wallets that course of passenger fares and quick driver refunds, a mannequin it says aligns with the corporate’s imaginative and prescient of “borderless journey.”

As a part of the identical announcement, Webus renewed a multi-year partnership with Tongcheng Journey Holdings, one among China’s largest on-line journey companies.

The deal extends “Wetour x Tongcheng” inter-city constitution traces throughout China, pairing Tongcheng’s 240 million annual paying customers with Webus’s car community.

Zheng stated the home alliance provides information and route density, whereas XRP-based funds would take away currency-conversion friction for worldwide journeys and driver payouts.

Firm executives described the financing plan as non-binding till definitive agreements are signed and due diligence hurdles cleared.

XRP treasury momentum

Webus’s disclosure arrived at some point after clean-energy group VivoPower Worldwide stated it had secured commitments for a $121 million personal placement to construct its personal XRP treasury.

VivoPower will promote 20 million abnormal shares to institutional digital asset buyers and strategic companions led by Saudi investor Prince Abdulaziz bin Turki Al Saud.

The corporate plans to allocate the proceeds to XRP accumulation, infrastructure for the XRP Ledger, and debt discount.

Though a number of public corporations maintain Bitcoin (BTC), treasuries denominated in XRP stay unusual. Each Webus and VivoPower cited XRP’s low-fee settlement layer and integration with the XRP Ledger as motivation.