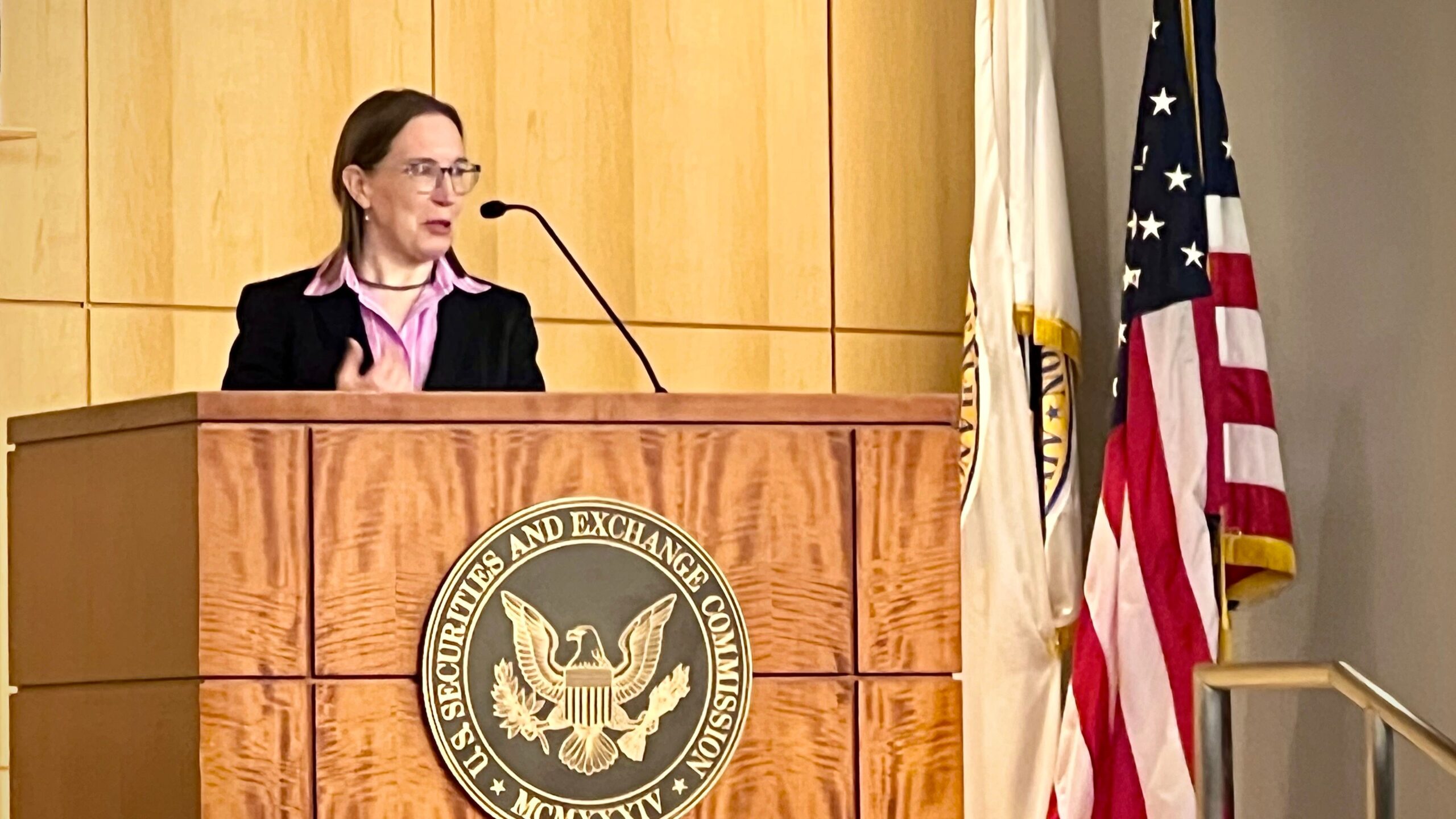

LAS VEGAS, Nevada — You should not be a crypto libertarian that comes crying for presidency assist when issues go badly, in accordance with Hester Peirce, the chief of the crypto job power on the U.S. Securities and Alternate Fee.

“I do suppose that typically, when one thing unhealthy occurs on this area, people who find themselves remarkably free thinkers, libertarian-minded individuals, are available in and say, ‘The place was the federal government? Why weren’t you defending me? Hey, Crypto Mother, the place’s my bailout?'” she informed a crowd at Bitcoin 2025 in Las Vegas, referring to her trade nickname.

“C’mon, let’s have some consistency,” Peirce continued. “Sure, you need to have freedom to make your individual decisions, and when it goes improper, choose your self up, mud your self off, study from it and do higher subsequent time. And that’s the greatest method to transfer ahead.”

Since Republicans took management of the SEC, together with Commissioner Peirce and newly arrived Chairman Paul Atkins, they’ve labored to situation statements and directives to carve out corners of the crypto sector from the company’s jurisdiction, together with memecoins, some crypto mining and sure stablecoins. However there stays a pathway of policymaking the company has began down whereas lawmakers in Congress are additionally engaged on sweeping new legal guidelines that might additional set its agenda.

The SEC has quite a lot of present authority to make clear the character of crypto securities, Peirce mentioned, but when individuals need a U.S. federal regulator for retail buying and selling, they will want Congress to provide laws to make that occur. She put the query to her viewers on Thursday, whether or not they needed a federal crypto regulator.

“NO!” any person shouted.

“There you go, you will have one reply,” she quipped.

Peirce mentioned that almost all crypto tokens aren’t themselves securities, and consequently, buying and selling platforms dealing with them should not must register with the SEC until they’re additionally touching the securities world.

Requested about memecoins, which an company assertion mentioned are outdoors its enforcement pursuits, Peirce provided it for instance of the place buyers must look out for themselves.

“Be an grownup,” she mentioned. “If you wish to have interaction in hypothesis, go for it. But when one thing goes improper, don’t come complaining to the federal government about it.”

And as for the pattern of corporations placing digital property into their very own treasuries, she mentioned public corporations are entitled to do what they like — so long as they’re correctly disclosing it.

“They’ll make their very own choices,” she mentioned. “I am agnostic.”